Like boiling frogs, it’s the rate of change that matters when it comes to energy efficiency investments. Consumers who have grown accustomed to $4 gasoline are much less likely to buy a hybrid car than ones who just saw their gasoline price double from $1 to $2 between fill-ups.

This is the silver lining of the current spike in energy costs — lots of homes and businesses are finding economic and psychological reasons to invest in efficiency in the current economic environment who might not have before.

The flip side is also true: when energy prices are stable or falling for long periods of time, we tend to get complacent. That’s why 20 years of steadily falling energy prices led to Hummers in 2000. It’s also why energy-intensive industrials build their factories in areas that have historically had stable energy costs.

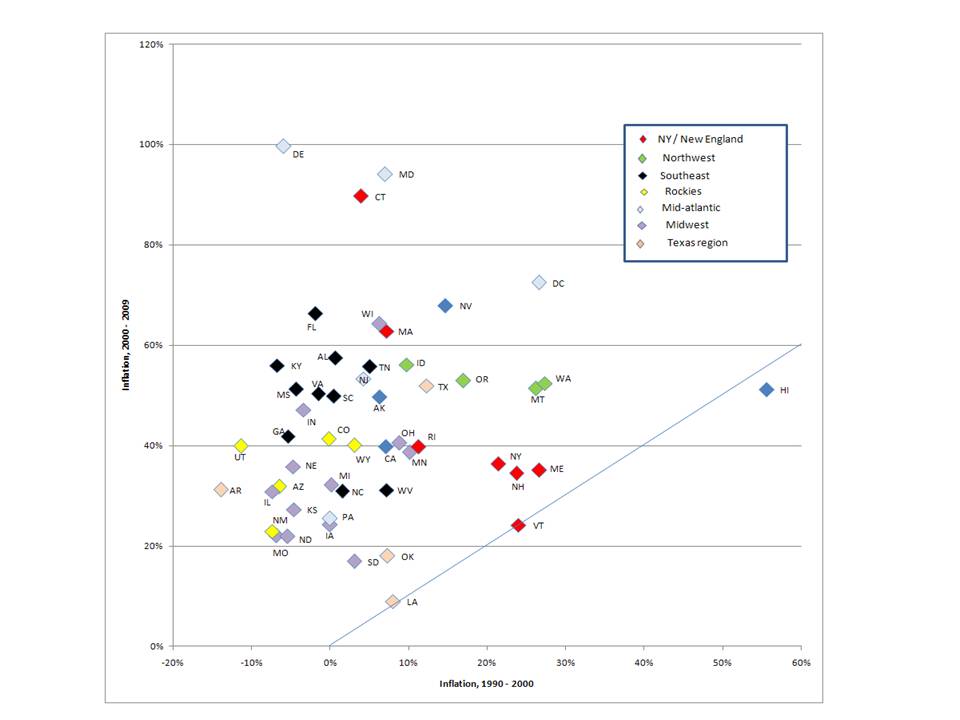

Which brings me to this fun little chart. On the y-axis is the percent increase in nominal electricity costs from 1990 – 2000. On the x-axis, the percent increase in nominal energy costs from 2000 – 2009 (the most recent full year with state-level data available.)

Retail Electric Rate Inflation: 1990s vs 2000s

Source: DOE/EIA

First, let’s state the obvious — electricity rates are rising faster than they used to. With the exception of Hawaii, every state in the country has seen their retail electricity prices rise faster in the last 10 years than they did in the prior 10 years. (And with 50 percent price inflation in Hawaii during the last decade, that “reduction” in inflation is of trivial significance.)

The more interesting insight is on the left side of the chart. For big chunks of Appalachia and the Midwest, electricity prices were falling (even in nominal terms) through the 1990s and have since risen by 20 – 60 percent. The downside is that lots of folks in those parts of the country feel like frogs in rapidly boiling pots. The upside though is that the capital allocation decisions made as recently as 10 years ago are now wildly out of date. My prediction, consistent with some trends we’re seeing in our business is that lots of folks in the middle of the country are going to start looking a lot harder at efficiency and conservation — and in many cases, already are. Since that’s where most of our big energy consumers live, that’s good news.