You’re an earth-friendly person and want to go solar, but a large tree shades your house; or you’re a renter; or you don’t have $20,000 to drop on a solar power system. Or maybe you just want to get more than 0.5 percent interest on your savings account while getting a piece of the clean energy economy.

You’re an earth-friendly person and want to go solar, but a large tree shades your house; or you’re a renter; or you don’t have $20,000 to drop on a solar power system. Or maybe you just want to get more than 0.5 percent interest on your savings account while getting a piece of the clean energy economy.

If you live in the U.S., you’re probably out of options. Not so in Canada.

Thanks to innovative energy policy, residents of Ontario can invest in local solar power projects by buying SolarShare bonds. The $1,000 bond provides a 5 percent annual return over five years and the money is invested in solar power projects across the province (as the chart below shows, this beats a savings account with 0.8 percent interest or even a 5-year U.S. treasury, with 0.91 percent interest).

Investors also become voting members of the SolarShare cooperative, a project of the TREC Renewable Energy Cooperative that both develops community-owned renewable energy projects and educates Ontarians about renewable energy, energy conservation and the community power model.

The SolarShare cooperative already operates 18 solar projects with a combined capacity of 600 kilowatts (enough power for about 130 homes). The program could grow rapidly, once the bond program gets its regulatory approval and removes the $1,000 cap on investments.

The SolarShare projects have low investment risk, thanks to the provincial feed-in tariff, an awkwardly named but highly successful policy that guarantees solar projects a long-term contract and a favorable price for their electricity output.  While U.S. incentives for solar power are tax-based and generally preclude non-profit and cooperative enterprises, the feed-in tariff is available to anyone who wants to become a renewable energy producer.

While U.S. incentives for solar power are tax-based and generally preclude non-profit and cooperative enterprises, the feed-in tariff is available to anyone who wants to become a renewable energy producer.

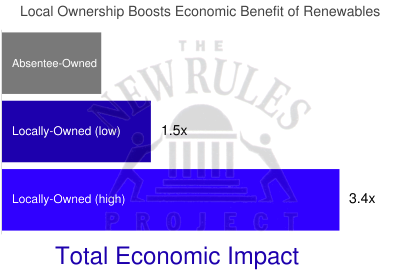

Not only does the SolarShare program help finance more solar energy projects, but by enabling local investment, it helps capture much more of the economic development from solar within the province. As I’ve covered before, locally owned renewable energy projects have an economic impact 1.5 to 3.4 times higher than absentee-owned projects. In the case of SolarShares, this is the direct result of funneling revenues from solar projects back to investors within the province.

The U.S. isn’t without examples of successful community renewable energy projects. One South Dakota community wind project, for example, enabled more than 600 state residents to invest in a local wind project (though only due to a temporary switch of the federal tax credit to a cash grant). But this kind of project is the exception rather than the norm and better energy policy might open the doors to more Americans to become investors in a local clean energy future.

Photo used with permission from the SolarShares photo gallery