By Janet Larsen

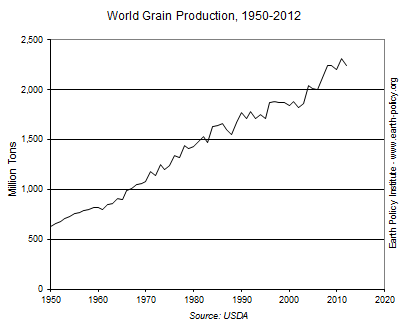

The world produced 2,241 million tons of grain in 2012, down 75 million tons or 3 percent from the 2011 record harvest. The drop was largely because of droughts that devastated several major crops—namely corn in the United States (the world’s largest crop) and wheat in Russia, Kazakhstan, Ukraine, and Australia. Each of these countries also is an important exporter. Global grain consumption fell significantly for the first time since 1995, as high prices dampened use for ethanol production and livestock feed. Still, overall consumption did exceed production. With drought persisting in key producing regions, there is concern that farmers in 2013 will again be unable to produce the surpluses necessary to rebuild lowered global grain reserves.

Corn, wheat, and rice account for most of the world’s grain harvest. Whereas rice and most wheat are consumed directly as food, corn is largely used for livestock and poultry feed and for industrial purposes. Climbing demand for corn-intensive meat, milk, and eggs plus the recent increased production of corn-based ethanol have made corn the world’s leading grain since 1998. In 2012, the global corn harvest came in at 852 million tons, while 654 million tons of wheat and 466 million tons of rice were produced. Wheat takes up the most land because corn yields are typically much higher, averaging close to 5 tons per hectare globally compared with about 3 tons per hectare for wheat and rice. (One hectare = 2.47 acres.) In the United States, corn yields in the top-producing areas exceed 10 tons per hectare when conditions are favorable.

Nearly half the world’s grain is produced in just three countries: China, the United States, and India. China produced an estimated 479 million tons of grain in 2012—its largest harvest ever—compared with 354 million tons in the United States. India harvested 230 million tons. The countries in the European Union together produced 274 million tons. (See data.)

The 2012 U.S. grain harvest was 8 percent smaller than the year before. The heat and drought that gripped nearly two thirds of the contiguous United States during the summer was particularly severe throughout the midwestern Corn Belt. As temperatures soared, so did corn prices, hitting an all-time high of $8.39 a bushel on August 21st. Yields in Iowa, the top corn-producing state, were down 20 percent from 2011. In Illinois, typically the number two producer, yields dropped by 33 percent, ending up at the lowest level since the historic 1988 drought. As of January 2013, each state’s farmers have collected more than $1 billion in crop insurance payments.

The total U.S. corn harvest came in at 274 million tons, down from 314 million tons the year before. The drop would have been far worse were it not for strong production in states less affected by dryness or with ample irrigation; in fact, Minnesota and North Dakota had record high output. The result was that some of the trains and barges that normally transport corn out of the Corn Belt reversed routes to bring corn in for meat and ethanol producers. U.S. corn stocks fell to 15 million tons, enough for just 21 days at current consumption levels. Such a low corn-stocks-to-use ratio—unseen before by farmers working the land today—presages further price volatility.

As high corn prices shrank ethanol’s profit margins, a number of distilleries suspended operations. U.S. corn use for ethanol dropped to 114 million tons, down from 127 million tons in 2011. About a third of the total U.S. grain harvest went to fuel for cars.

The reduction of corn use for ethanol production and wheat use for feed contributed to an abrupt pause in the growth in global grain consumption, which over the past decade averaged close to 40 million more tons per year. January 2013 estimates by the U.S. Department of Agriculture put 2012 global grain consumption at 2,284 million tons, down 27 million tons from 2011. Even with the drop in use, global grain production fell short of consumption by 43 million tons.

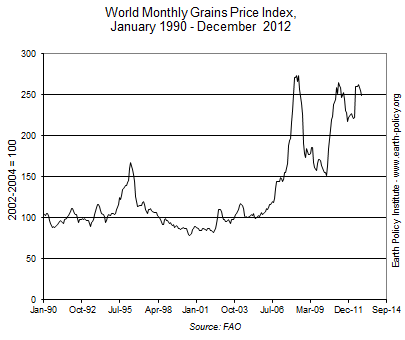

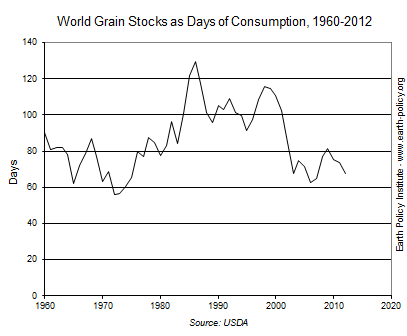

Global grain consumption has exceeded production in 8 of the last 13 years, leading to a drawdown in reserves. Worldwide, carryover grain stocks—the amount left in the bin when the new harvest begins—stand at 423 million tons, enough to cover 68 days of consumption. This is just 6 days more than the low that preceded the 2007–08 grain crisis, when several countries restricted exports and food riots broke out in dozens of countries because of the spike in prices.

Grain prices receded somewhat during the recent recession, only to jump again in 2010 when heat and drought withered wheat in Russia, prompting an export ban. The poor prospects for the 2012 harvest led to the third spike in world market prices in just six years. This time around, even with its 2012 harvest forecast to be smaller than in 2010, Russia announced that it would avoid suspending exports.

Following a record high year in 2011, global grain trade in 2012 dropped back to 2010 levels. The 296 million tons of traded grain made up 13 percent of global consumption. Japan remained the world’s largest importer, taking in a net 24 million tons (mostly corn to feed livestock and poultry), equal to 73 percent of what it used. Densely populated South Korea imported 13 million tons of grain, also amounting to 73 percent of its consumption. Feed corn dominated imports in Mexico—the cradle of corn—as well, with 15 million tons of grain imports accounting for 32 percent of its use. In the arid Middle East, Egypt took in 14 million tons of grain, largely wheat for bread, making up 39 percent of its grain consumption. Saudi Arabia’s 13 million tons of grain imports, mostly barley for feed, accounted for 87 percent of its use.

China made the list of top 10 net importers for the second year in a row, taking in 8 million tons of grain in 2012, down from 11 million tons in 2011. China’s 2012 imports (roughly split between corn, wheat, rice, and barley) amounted to just 2 percent of its domestic consumption, but the country’s recent forays into world grain markets following years of self-sufficiency have captured attention because of China’s enormous potential appetite. (Soybeans are another story; China takes in 60 percent of world soybean exports.)

Although the United States is by far the world’s largest grain exporter, its share of the world market is shrinking. The net 49 million tons of grain the United States shipped out in 2012 was its smallest outflow since 1971. U.S. corn exports of 22 million tons were less than half the quantity of five years prior and just slightly larger than outflows from each of its South American competitors, Argentina and Brazil. For rice, Thailand was edged out of its top exporter position for the first time in three decades when India unloaded stocks accumulated during a four-year ban on non-Basmati exports.

Looking forward, the 2013 winter wheat crop could be in trouble because of droughts in the United States and in the Black Sea region. And while the heart of the Corn Belt has received some precipitation since the baking summer, soil moisture remains low and could possibly hinder spring planting, further tightening the corn situation. This is bad news when strong harvests are needed to rebuild stocks and to help stabilize prices.

Another hindrance to expanding production is the leveling off of yields for a number of key crops, importantly rice in Japan and South Korea and wheat in France, Germany, and the United Kingdom. It appears that farmers in some areas have maximized productivity and are now running into biological constraints. On top of that, climate change is heightening the likelihood of weather extremes, like heat waves, droughts, and flooding, that can so easily decimate harvests. Although 70 days’ worth of grain stocks once was considered enough to provide food security, a world with growing climate instability requires a larger buffer to protect against food price shocks. Skyrocketing prices hit the poorest among us the hardest, and ultimately they can spark instability that affects everyone.

For further discussion of the world food situation, see Full Planet, Empty Plates: The New Geopolitics of Food Scarcity by Lester R. Brown (New York: W.W. Norton & Co.), with data, video, and slideshows at www.earth-policy.org.