This post is by ClimateProgress guest blogger Bill Becker, executive director of the Presidential Climate Action Project.

—–

Hunter Lovins is one of the country’s premier prophets of the prosperity we can achieve if we move quickly to establish a post-carbon economy. Vast new markets and investment opportunities are opening worldwide for clean technologies. “Those who recognize this opportunity will be the first to the future and the billionaires of tomorrow,” Hunter says.

The good news: The race already has begun. It’s producing some new billionaires and attracting some old ones.

The first recorded solar billionaire was identified by The Wall Street Journal in October 2006. He is Shi Zhengrong, founder of Suntech Power Holdings Company in China. Since then, at least two other solar entrepreneurs have joined the club: Frank Asbeck, who founded Germany’s Solar World, and Xiao Peng, head of LDK Solar in China.

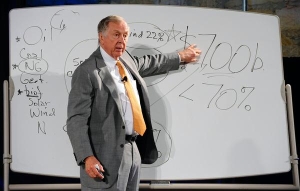

Joining them are two American tycoons who have decided that while their past was in oil, their future — and America’s — will be found in renewable energy: Everyone now knows about T. Boone Pickens’ commitment to build the world’s largest wind farm in Texas, and to spend $5 million of his own money on television commercials to persuade Americans that we can’t drill out way out of the energy crisis. Pickens has been traveling around the Great Plains states lately to make the case for wind power and, judging by the photo, he’s committing so much of his disposable fortune to renewable energy that he can’t afford Powerpoint.

Less publicized is Denver billionaire Philip Anschutz, who is developing a 2,000 megawatt wind project in Wyoming. Anschutz has announced that he’s acquired rights to build a $3 billion, 900-mile transmission line to move his wind power from Wyoming to California, Las Vegas, and Phoenix.

The solar billionaires’ club is small today, but it should grow much larger. Although solar and wind provide just a fraction of the world’s energy today, they are the fastest-growing forms of electric generation, the next cool thing in the opinion of some investors. As The Economist puts it, “There are lots of terawatts to play for and lots of money to be made. And if the planet happens to be saved on the way, that is all to the good.”

Wind energy already is competitive with coal in some parts of the U.S. Now solar energy, still very expensive, is showing significant signs that it will soon be competitive, too. A report just released by McKinsey Quarterly says that solar companies received $3.2 billion in venture capital and private equity last year. Over the last two decades, McKinsey says, the cost of manufacturing and installing solar power systems has dropped by 20 percent. The company predicts that unsubsidized solar energy, even with no radical technical breakthroughs, will compete with conventional electricity within three to five years in California and the Southwest, as well as in Italy, Japan and Spain. By 2020, McKinsey says, the price of solar electricity will drop to 10 cents a kilowatt hour or less, while the cost will increase for “clean coal” and next-generation nuclear power.

“Solar energy is becoming more economically attractive,” McKinsey concludes. “Component manufacturers, utilities and regulators are making decisions now that will determine the scale, structure and performance of this new sector. Technological uncertainty makes the choices difficult, but the opportunities — for companies to profit and for the world to become less dependent on fossil fuels — are significant.”

In this case, the tide that lifts solar entrepreneurs to billionaire status will lift us all. With finite and carbon-intensive fuels destined to become more expensive, consumers will win when solar and wind power (free fuel, no carbon) are widely available. Investors will win, too: Shareholders in Asbeck’s Solar World company reportedly earned an astounding return of more than 10,000 percent over the last five years.

Cash-strapped localities also will benefit. A study issued recently [PDF] by GE Energy Financial Services reports that wind energy projects built in the U.S. in 2007 are generating $6 million annually in local property taxes and $15 million annually in state income taxes. The projects created 17,000 construction jobs and 1,600 long-term jobs. By GE’s calculation, the benefits easily outweigh the cost of the federal Production Tax Credit for wind.

This happy future won’t develop all by itself, however. “During the march to grid parity, well-understood and targeted subsidies will be critical to build the confidence of investors and attract capital,” McKinsey says. That’s why Congress’s repeated failure this year to extend the federal tax credits for solar and wind development is an affront to America’s future. The latest attempt, last week in the Senate, would have allocated $18 billion for wind and solar development. It failed in what The New York Times called “poisonous bickering” between Democrats and Republicans as they postured for the fall election.

The lack of consistent and sustained federal incentives for renewable power hog-ties the United States in the race to capture the huge emerging market for carbon-free energy. Solar energy has boomed in Germany and Japan due to aggressive government support. We already have given up the lead to other nations on manufacturing solar systems, wind turbines, and new-generation batteries for electric vehicles. The practical effect of our sissified federal policy in the United States will be to surrender the post-carbon energy market to countries like Germany, Japan, China, and Denmark.

So, let’s all send a big shout-out to those Senators who repeatedly vote in favor of sustaining the tax breaks for oil, coal, and natural gas, but against tax incentives for renewable energy. By subsidizing America’s past instead of its future, they’re helping to make sure that the solar billionaires of tomorrow will emerge in Europe and Asia rather than in the United States — and that in the race to the new world economy, the U.S. will have given up without a fight.

This post was created for ClimateProgress.org, a project of the Center for American Progress Action Fund.