It’s been nearly 40 years since the battery world had a major shake up. In 1980, a researcher at England’s University of Oxford made the first breakthrough that would eventually take lithium-ion batteries from theoretical to possible. But the industry was slow to embrace the shiny new design. It would be more than a decade before Sony decided to throw its weight behind lithium ion, and the future where it powers everything from cell phones to laptops to Teslas.

If the next superstar battery is biding its time in a dim university lab right now, it will have an even harder time supplanting lithium ion. But Massachusetts Institute of Technology chemist Donald Sadoway thinks he has a contender.

His lab pioneered a liquid metal battery that’s currently being developed by its spin-off company, Ambri. And in research published in Nature Energy last month, Sadoway announced a new design with even greater potential to be both durable and dirt cheap. He’s calling it a “liquid displacement battery” or metal mesh battery.

“I know what our materials costs are, and they’re below the materials costs of lithium ion,” he says. That’s important. Next to the battery’s performance, price is the biggest indicator of its chances of sticking around.

But like lithium ion after its big unveiling, Sadoway might have to wait a while for a major company to take interest in his new technology. Thanks to the rise of battery-powered electric vehicles, lithium-ion batteries are cheaper than ever, which makes them more attractive to anyone looking to install a lot of energy storage. Plus, all that sustained attention on a single technology feeds a loop of research and development that keeps making lithium-ion batteries faster and more reliable as the price continues to plummet.

All of that means that, today, the field is more tilted against new technologies than ever. Last year, the promising upstart Aquion, a company making large-scale batteries out of little more than salt water, declared bankruptcy. It was a sudden and inauspicious end for a battery that had seemed poised to claim a slice of the market for the first time in a long time.

But according to Sadoway, the reigning battery of the moment has some important shortcomings, too. “It’s good for handheld devices — we can debate whether it’s the right chemistry for an automobile — but at grid level it’s just not adequate,” he told me on a visit to his lab in 2016.

For one thing, he explained, lithium ion relies on a flammable electrolyte — the gel or liquid in the battery that ions flow through. So if you make a lithium battery too powerful or let it get too hot, the whole thing can go up in flames. That’s why the famously pyrotechnic Samsung Galaxy Note 7 smartphone is no longer allowed on airplanes, and why larger versions of lithium ion batteries — such as grid-scale battery farms tethered to renewable energy installations, like this one in Hawaii — always need to use some of their power to keep themselves cool.

But Sadoway’s batteries — both the original liquid metal battery and his new metal mesh battery — operate at temperatures well over 400 degrees F without any danger of combustion. That means they will probably never be portable enough to carry in your pocket or drive around under the hood of your car (maybe not the place you’d want to keep what is essentially a box of molten metal in any case). But at large enough scales, sitting next to a wind or solar farm, they could give lithium ion a run for its money.

And, Sadoway says, the metal mesh battery design from his lab’s January Nature paper is perhaps the most exciting development he’s seen so far.

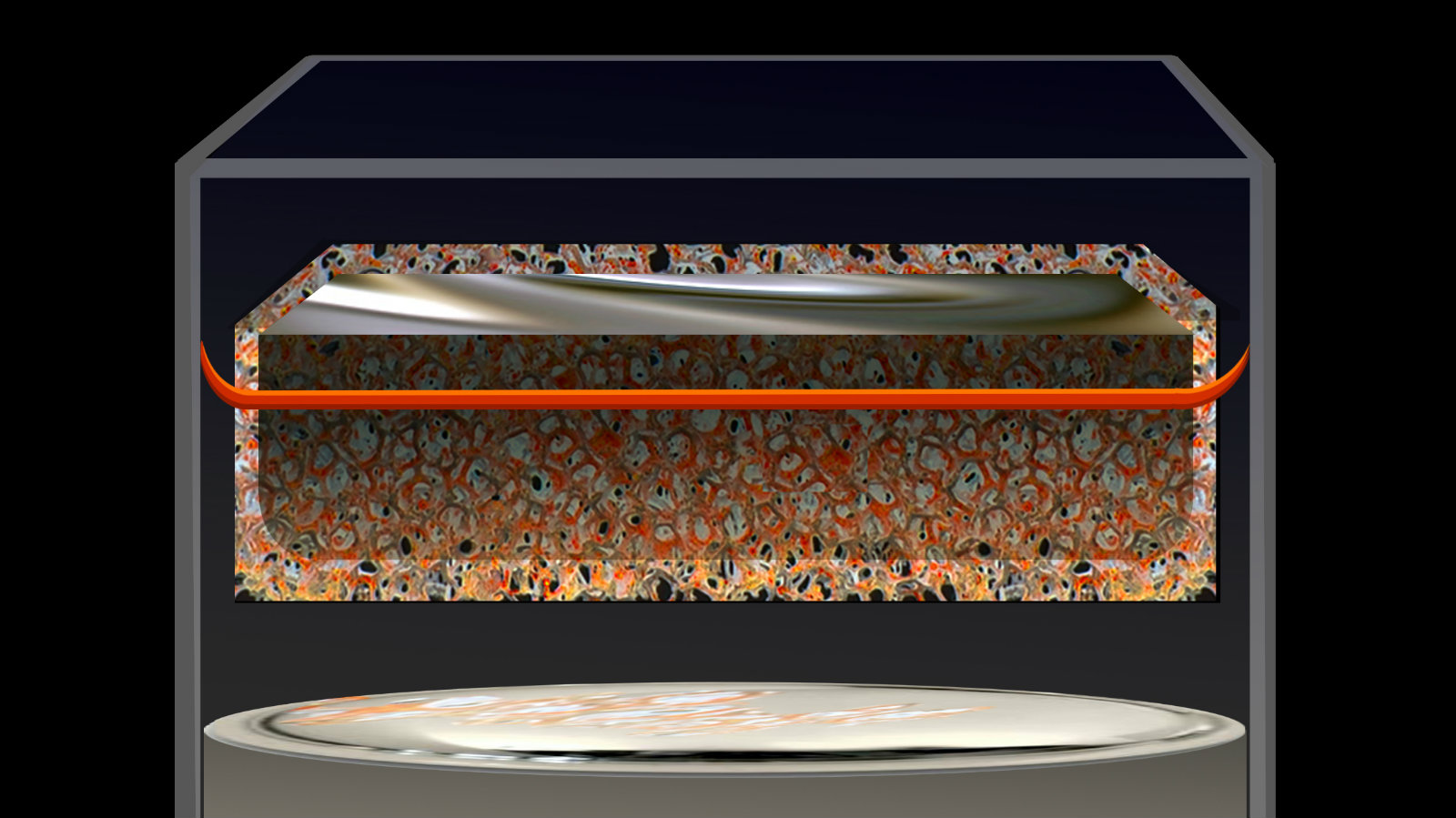

“This is a gigantic improvement over a technology that was invented about 50 years ago,” Sadoway says. That design started with a Ford Motor Company battery that used molten salts to pass electricity across a thin, ceramic mesh barrier. But now, instead of the fragile, ceramic mesh of the original, Sadoway substitutes a metal basket.

With that change, Sadoway believes, a battery that was once too finicky and fragile to use in anything but the most specialized conditions — mostly, Japanese state-run nuclear plants — has a whole new set of possibilities.

“You know the difference between something that’s metal and something that’s ceramic,” he explains. “You drop a metal object on the floor, the worst thing that happens is it gets a little bit dented. You drop your coffee cup on the floor and you’re not going to be able to put it back together.”

Even with its liabilities, the original ceramic mesh battery had potential. In 2005, General Electric poured millions of dollars and years of research trying to bring it to market. The company called it “Durathon” and even went as far as to open a manufacturing facility in Schenectady, New York, in 2011.

But by 2015, after a decade of research and development, GE pulled the plug. The batteries — originally developed for train locomotives and eventually installed in a few cell towers and wind farms — were just too expensive.

Ultimately, the thing that makes lithium ion so tough to topple is something called the “experience curve.” The curve maps how, over time, in many different sectors, increases in scale lead to a reliable and predictable decrease in price. It works for solar panels and semiconductors, even contact lenses and motorcycles, and it definitely works for lithium-ion batteries, says Chris Shelton, chief technical officer at energy company AES. In other words, every time you double the volume of lithium-ion battery production, you reduce the cost by more than 15 percent.

AES regularly does an exhaustive screen for potential new battery technologies, but for the past few years, none have been able to get close to lithium ion. It’s simply the most robust technology out there. And the thing Sadoway points to as a weakness of lithium ion — the fact that it can serve the electronics sector as well as the electricity sector — is in fact a strength, Shelton says, at least as far as the market is concerned.

“Its success does not depend on what happens in the electric industry alone or in the telecom industry or data centers or whatever,” he explains.

Shelton does concede that lithium-ion batteries might have some limitations, such as the fact that the battery’s solid electrodes degrade as they charge and empty over and over again. (That’s why your iPhone battery stops working as well over time, too.) But even with those limitations, Shelton insists, once the technology is on the experience curve, it’s easier for future innovation to improve its performance than it would be for a whole new technology to replace it. As a result of lithium ion’s head start, new battery startups, Shelton points out, “have to work on 5-years-from-now price, not today’s price.”

As for Sadoway, he’s been at the game long enough to know that even the best-laid chemistries can go awry on the open market. But he can’t help but get carried away imagining what a big break might look like. Would GE possibly be interested enough in his update that they’d consider reviving the decommissioned Durathon? Will Ambri finally have a battery to challenge lithium ion on the open market?

He knows the odds are not tilted in his favor, but he is excited by the possibility. At the end of it all, he may be right back where he started.

“I’m glad it’s so complicated,” he reflects. “Otherwise, I’ll be out of the job.”