What happens when a few large buyers dominate a market?

Anyone who keeps up with my posts — still there, mom? — knows what’s coming next: The buyers gain the power to dictate to dictate terms and conditions to sellers.

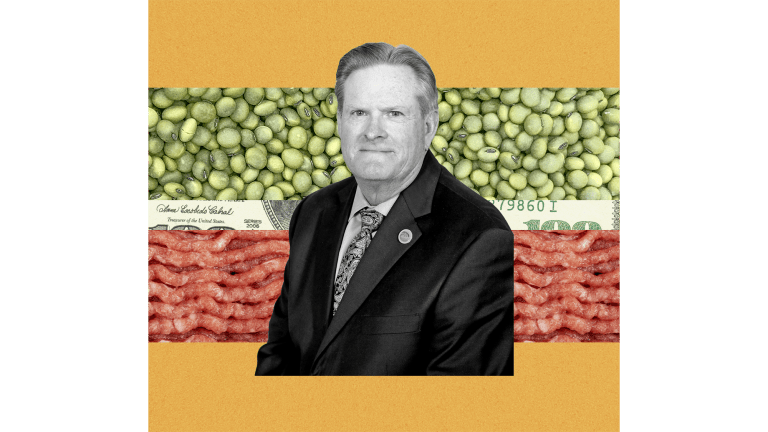

For farmers, the results of concentrated markets are devastating. As a few giant companies like Smithfield and Tyson came to dominate meat packing, they managed to drive down the farmgate price of chickens, pigs, and beef cows.

As a result, hundreds of thousands of farmers were driven out of business. Survivors took on debt and scaled up, in a desperate attempt to make up on volume what they were losing on price. The result: vast animal factories known as CAFOs (concentrated-animal feedlot operations), with their abysmal environmental, social, and animal-welfare records.

I often focus on meat to illustrate the ills of market concentration. But as this post from the Ethicurean’s excellent Mental Masala shows, things are just as bad in produce markets. Riffing off an article in the San Francisco Chronicle, Mental invites us to consider California’s mighty tomato-processing industry.

Here are some highlights.

- Before World War II, California produced 20 percent of the nation’s processing tomatoes. Today, it produces 95 percent. Commercial tomato processing outside of California has essentially disappeared — even though tomatoes can be grown in all 50 states.

- California’s processing tomatoes are machine-harvested, an innovation that developed after the Bracero "guest worker" program ended in 1964, closing off a major source of cheap labor.

- In the 1960s, 4,000 California farmers grew processing tomatoes. By 1973, when investments in mechanical-processing equipment had becmme necessary to remain profitable, there were fewer than 600 growers. Today, 225 farms in California grow nearly all of the processing tomatoes consumed in the United States.

- In tomato-intensive Colusa County, just eight growers have 25,000 acres in production. That farm size — more than 3,000 acres per operation — would not be out of place in Iowa corn country.

- Given these vast monocrops, pests and diseases are a huge problem and require regular application of poisons. Each year, the California Department of Food and Agriculture sprays malathion to limit bug damage on tomato fields. Malathion, an organophosphate, is nasty stuff.

- Growers of processing tomatoes receive 3.5 cents per pound for their goods.

- Three companies — Heinz, Bayer CropScience, and Monsanto — sell 90 percent of the seed for the crop. (Heinz claims to be the "the market share leader in North America and the world.")

- Growing these tomatoes is extraordinarily capital-intensive. "Long before harvest time, growers will have $2,700 dollars per acre invested in diesel, seed, labor, water and chemical costs," the Chronicle reports.

- The industry is extremely water-intensive: each acre needs two-and-a-half feet of water.

- The article contains surprisingly little information about the processors themselves. But according to this source, a single company — Morningstar — owns 30 percent of the tomato-paste market. Heinz claims to own 60 percent of the ketchup market.