Articles by Charles Komanoff

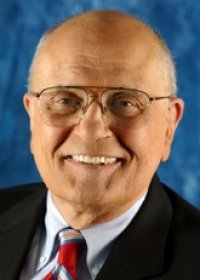

Charles Komanoff is the co-founder of the Carbon Tax Center. For more information, click here.

All Articles

-

Big Green savages Dingell’s carbon tax

"Man always kills the thing he loves," wrote naturalist Aldo Leopold in the environmentalist bible, A Sand County Almanac. Leopold was referring to Americans' destruction of the wilderness, but he could have been describing the green establishment's hostile reaction to the "hybrid carbon tax" proposed by Michigan Rep. John Dingell last month.

Dingell's tax package, combining a carbon-busting tax on fossil fuels, a surtax on gasoline and jet fuel, and a phase-out of subsidies for sprawl homes, should have been greeted by environmentalists like the Second Coming. Extrapolated to 2025, the carbon tax alone would cut annual CO2 emissions by 1.3 billion metric tons (a sixth of current emissions) and curb U.S. oil usage by 2.8 millions barrels a day (mbd). With Dingell's petrol surcharge, the savings swell to nearly 1.6 billion metric tons of CO2 and 4.5 mbd, more than the entire oil output of Iran.

Further savings would come from abolishing the tax-deductibility of mortgage interest on houses larger than 4,200 square feet, a loophole that has underwritten millions of McMansions on America's SUV-crazed exurban fringe. (Smaller houses down to 3,000 square feet would also lose some deductions, on a sliding scale.) Taken as a whole, Dingell's proposal would be a giant step toward what Friends of the Earth terms "decarbonizing the tax code." It would also embody the cardinal sustainability precept that keeps Europe's carbon footprint at half of ours: energy prices must tell the truth, even if it requires taxing fuels.

Alas, with the lone exception of FoE, leading Big Green groups have gone after Dingell's proposed bill like a clear-cutter on crank.

-

Rep. John Dingell introduces his hybrid carbon tax

With a mighty creak of long-rusted hinges, a door is finally opening in Washington. The present Congress will apparently be asked to consider a carbon tax.

The measure -- actually, a hybrid carbon and petroleum tax -- will be introduced by the powerful chairman of the House Committee on Energy and Commerce, Rep. John Dingell (D-Mich.).

Today Dingell posted on his website a summary of the bill, which he began drafting in June. The current version would phase in, each year for five years, a charge of $10 per ton of carbon content of coal, oil, and natural gas -- plus an additional 10 cents/gallon for gasoline and jet fuel (kerosene). By the end of the five-year period the charges would reach $50/ton of carbon plus 50 cents/gallon of gasoline and jet fuel. These equate to 63 cents a gallon of gas and 90 cents for one hundred kilowatt-hours, assuming the nationwide average fuel mix.

Today Dingell posted on his website a summary of the bill, which he began drafting in June. The current version would phase in, each year for five years, a charge of $10 per ton of carbon content of coal, oil, and natural gas -- plus an additional 10 cents/gallon for gasoline and jet fuel (kerosene). By the end of the five-year period the charges would reach $50/ton of carbon plus 50 cents/gallon of gasoline and jet fuel. These equate to 63 cents a gallon of gas and 90 cents for one hundred kilowatt-hours, assuming the nationwide average fuel mix.Dingell is asking the public for comments. Here's ours: we think the bill is terrific. It's in line with what we said when we founded the Carbon Tax Center, and as Dingell himself wrote last month in the Washington Post, "[S]ome form of carbon emissions fee or tax ... would be the most effective way to curb carbon emissions and make alternatives economically viable." Moreover, as we elaborate below, his supplemental tax on gasoline and jet fuel has the look of genius.

-

The connection between congestion pricing and carbon taxes

I wrote this piece linking NYC Mayor Bloomberg's congestion pricing proposal with a carbon tax, in June. I shopped it around but none of the big papers took it. Now, NY Times columnist Tom Friedman -- perhaps the second-most visible supporter of carbon taxes (after Al Gore) -- has written a column backing the Bloomberg pricing plan. "Crunch time" for the plan may come as early as the next day or two. So it's time the piece saw the light of day.

Every so often there arises an environmental controversy that tests the capacity of Americans to face reality. One such case is emerging in New York City, where Mayor Michael R. Bloomberg has proposed a "congestion fee" on cars and trucks driving into Manhattan.

Backers from the mayor on down tout the fee as a cure-all: it will unsnarl traffic, relieve pollution and create a revenue stream to upgrade subways and buses, while also cutting global warming emissions.

These claims are a bit overstated. More probably there will be a single-digit increase in traffic speeds, a one percent drop in emissions citywide, and perhaps a $400 million revenue infusion for a transportation system whose annual costs top $30 billion.

But even though the immediate benefits of the congestion charge are relatively modest, the act of imposing such a charge is transformative in itself.

-

Picking apart an argument against carbon taxes

Yesterday's L.A. Times ran an odd op-ed calling carbon taxes an ineffectual antidote to global warming. Unlike other critiques that brand carbon taxes politically unpalatable, this one argued that they're simply not up to the job of cutting carbon emissions:

Carbon taxes -- taxes on energy sources that emit carbon dioxide (CO2) -- aren't a bad idea. But they only work in some situations. Specifically, they do not work in the transportation sector, the source of a whopping 40% of California's greenhouse gas emissions (and a third of U.S. emissions).

I've known Daniel Sperling, the author of the op-ed, for decades. As the long-time director of the Institute of Transportation Studies at UC Davis, Dan probably knows as much about automotive engineering as anyone in the world. What's more, he's conscientious, tireless, and concerned.

So why do I think he's wrong about carbon taxes? Actually, Dan is part right, but his message is wrong. Let me explain.