Lindsey GeeA fracking rig in North Dakota.

Remember that massive economic boom in North Dakota? That was so early 2012.

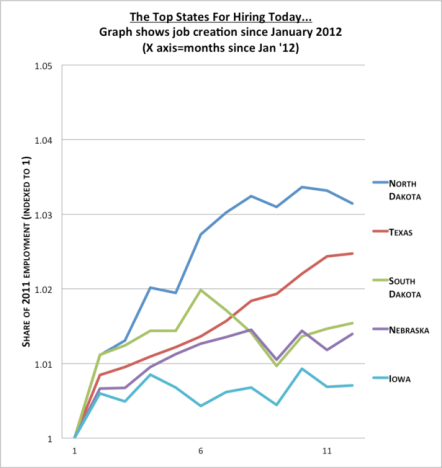

The Atlantic‘s Derek Thompson outlines the state’s slowdown at the end of last year. He starts with this graph:

This chart tells two stories about America’s little petro state. First story: At the beginning of 2012 (much like in 2011 and 2010), North Dakota’s stratospheric job creation numbers made even the next frothiest states look like they’re were suffering a post-Soviet-breakup depression. Second story: Something happened in the second half of 2012. North Dakota’s economy fell back to earth. …

You might say, don’t be unfair, North Dakota never could have kept up its 2011 rate!, and I might respond, you’re right. If the U.S. had experienced Dakotan growth across 2011, we would have added about 400,000 jobs per month, and that’s just absurd.

Why the slowdown? In part, because drilling (and ancillary costs) gets more expensive as it gets more popular. Supply and demand.

The rig count across North Dakota, and particularly in the rich Bakken shale, dropped sharply in September and hiring has slowed since the summer, as drilling companies have turned their focus to efficiency as capital costs (and concerns of regulation) rise in the Bakken. That’s probably had spill-over effects in transportation hiring.

And in housing: A massive spike in new house construction at the beginning of 2012 leveled off as oilfield hiring slowed.

Thompson notes that the state is not seeing a bust, just a slowdown. So if you want to get in on that North Frackota action, you still can. But open a hotel, not an oil well.