I spotted a rare critter on the streets of San Francisco this week — a smiling, optimistic businessperson.

I spotted a rare critter on the streets of San Francisco this week — a smiling, optimistic businessperson.

Then again, Ron Kenedi is in the solar panel business.

“The big news as I see it is the demand — demand keeps growing everywhere,” says Kenedi, vice president of Sharp Solar, the renewable energy arm of the Japanese conglomerate. “What really amazes me every day is how much demand has grown throughout the world.”

Kenedi is not one for Pollyannaish optimism — he started in the business around the time Ronald Reagan took down Jimmy Carter’s solar panels from the White House roof.

“I used to have to go out there with a sandwich board on to get people interested in solar,” he says. “Now I can’t even walk down the street without people talking to me about solar and wanting it on their home and businesses.”

That’s because there’s a boom in so-called distributed generation under way — placing solar panels and pint-sized photovoltaic farms at or near where electricity is consumed.

Until very recently, distributed generation just couldn’t compete on cost with Big Solar — massive megawatt solar thermal power plants usually located in the desert.

Big Solar has had the edge by the dint of the gigawatt-size deals utilities have struck with developers like BrightSource Energy, eSolar, and Solar Millennium. Large solar thermal power plants — which use mirrors to heat liquids to create steam that drives a generator — could make electricity cheaper than photovoltaic panels, which produce electrons when the sun strikes semiconducting materials.

Now that’s all changing. Over the past year, a number of Big Solar thermal projects have become mired in disputes over their impact on fragile desert ecosystems and the lack of transmission lines to connect them to cities. In December, California’s powerful Democratic senator, Dianne Feinstein, introduced legislation to ban renewable energy development on more than a million acres of the Mojave Desert she wants to protect as national monument.

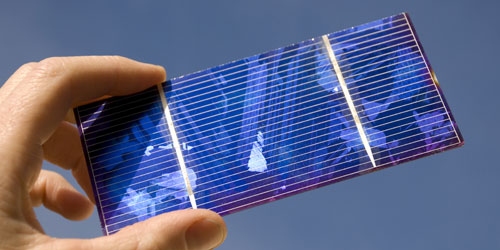

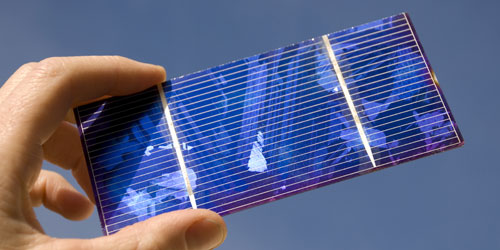

Photovoltaic module prices, meanwhile, have plummeted by about 30 percent over the past year thanks to an oversupply of modules and the rise of low-cost Chinese manufacturers. Thin-film solar companies, which make solar cells that use little or no expensive polysilicon and which layer or print them on glass or metal, began to produce solar modules for less than a one dollar a watt — long considered a key milestone for making solar competitive with fossil fuels. Though less efficient than conventional crystalline solar modules, thin-film solar cells can be manufactured more cheaply, making it particularly suited for use by photovoltaic power plants.

Distributed solar’s new competitiveness can be seen in a spate of deals and initiatives over the past few weeks as utilities turn to small-scale solar to help meet mandates to obtain a growing percentage of their electricity from renewable sources. As of today, 1,300 megawatts’ worth of distributed solar will be installed over the next five years — at peak output those arrays will generate as much electricity as a big nuclear power plant.

California regulators two weeks ago approved Southern California Edison’s five-year program to install 500 megawatts of solar arrays on commercial rooftops. They also recommended that PG&E, the big Northern California utility, be given the go-ahead for its own 500-megawatt distributed solar program to place small solar farms near substations and cities that can plug directly into the grid.

And both utilities revealed additional distributed solar deals this week. Southern California Edison agreed to buy 50 megawatts from three small-scale solar farms to be built by San Francisco’s Recurrent Energy in Kern and San Bernardino Counties in the eastern part of the state.

On Monday, PG&E filed a request that regulators approve a contract with Eurus Energy America, a joint venture between Tokyo Electric Power and Toyota Tsusho, for 50 megawatts of solar electricity from three power plants to be constructed near Fresno.

“We’re seeing the rest of the industry cotton on to what we’ve been saying, distributed solar done at the right size can scale,” says Arno Harris, Recurrent’s chief executive. “Distributed solar is faster on permitting, on environmental issues, and interconnection to the grid.”

For Sharp Solar, the biggest demand for its thin-film panels comes from utilities. “That’s what’s opening up the utility sector for Sharp — it’s a very robust market,” says Kenedi.

(And lest you think this is just a California phenomenon, the New York Power Authority last week announced a program to install 100 megawatts of photovoltaic panels on rooftops and at ground stations over the next four years.)

The Sacramento Municipal Utility District showed, just last month, how fast the distributed generation market is growing when it put up 100 megawatts of photovoltaic projects up for bid and sold out the allotment in one week.

But the shocker of the SMUD deal is that the utility is not paying a premium for solar electricity, according to Adam Browning, executive director of Vote Solar, a San Francisco nonprofit that promotes renewable energy (and an occasional Grist contributor).

I’ll spare you the utility industry calculus of “time differential avoided costs,” but Browning has run the numbers and believes that SMUD will pay essentially the same price for solar electricity as it would for fossil fuel-generated power when demand peaks. (Solar farms typically supply peak power as their output coincides with the time of day when demand spikes.)

“The point here is that this is an entirely revenue neutral investment for SMUD,” Browning says. “They got solar electricity for what they would have paid for fossil, which is a significant milestone.”

SMUD officials did not return requests for comment so I could not verify those numbers with the utility, but given that solar developers must put down a deposit of $20 a kilowatt for winning bids — that’s $100,000 for a five-megawatt project — it seems unlikely there were many speculators in the bunch willing to walk away from a six-figure commitment.

Truth be told, we’re going to need every kilowatt of green electricity we can wring from Big Solar, distributed solar, wind, waves and geothermal. But the rise of distributed solar generation will help ease the load as well as the environmental pressures from developing other forms of green energy.