Cross-posted from Climate Progress.

Like the natural gas sector, which has experienced an incredible boom due to new drilling techniques that allow companies to cost-effectively access unconventional gas, the geothermal sector is going through a renaissance that may open up a vast new set of resources.

Traditional utility-scale geothermal, often called hydrothermal, utilizes hot water or direct steam beneath the earth to run a turbine and generate electricity. While there’s only about 11 gigawatts of capacity built around the world (the solar photovoltaic industry built 17 gigawatts in 2010 alone), the actual electricity generation from these baseload plants typically doubles the output from an equivalent wind or solar project.

The U.S. Geological Survey estimates that there are about 35 gigawatts of hydrothermal resources left to harness in America with the potential to provide around 3 percent of the nation’s electricity. Last year, two researchers published a paper [PDF] in the Journal of Energy Policy suggesting that the world could get about 4 percent of its electricity from traditional geothermal by 2030.

However, when looking at so-called “unconventional” resources, the potential is far greater. There are three main kinds of unconventional resources: enhanced or engineered geothermal systems (EGS); geothermal co-production; and geo-pressured systems [PDF]. By collectively harnessing these resources, we could feasibly get hundreds of gigawatts of projects online, which some geothermal supporters suggest may supply upwards of 20 percent of the world’s electricity.

Here’s a video overview of EGS from Google:

However, unconventional methods of procuring geothermal energy are not easy. In fact, they’re not really new — some of these techniques were researched in the ’70s, but were abandoned when the U.S. shifted its focus away from renewables. But now that we have better technologies and more pressing environmental and economic factors, there’s a growing list of companies working to address technology barriers. Here are five:

Potter Drilling: Unlike traditional hydrothermal where a developer must zero in on good pockets of hot water, EGS projects can theoretically be developed almost anywhere. Developers engineer their own wells (hence, the name engineered geothermal systems) by drilling deep bore holes, pumping cold water through the bedrock, and letting it heat up as it moves through the natural fractures.

But drilling bore holes thousands of feet beneath the earth is expensive and time consuming; a traditional diamond-tipped drill bit needs to be replaced every hundred feet or so. Constantly taking the drill in and out of the ground increases the chance that a bore hole will collapse.

California-based Potter Drilling is working on a drilling technique called Hydrothermal Spallation that uses superheated water to bore holes — eliminating the need to use a drill bit. The company raised $4 million from Google and received $5 million in stimulus funds to develop the drill.

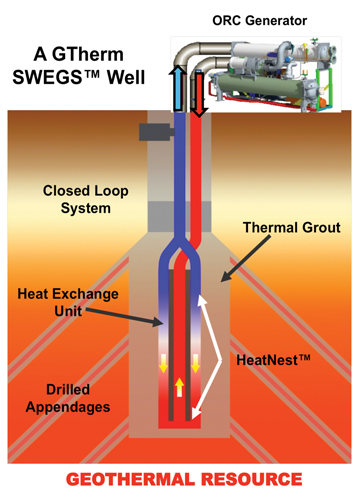

GTherm: One of the concerns about EGS is that deep drilling and fracturing will cause seismic activity. A Connecticut-based company, GTherm, says it has an EGS solution that takes away the need to fracture the rock entirely.

GTherm: One of the concerns about EGS is that deep drilling and fracturing will cause seismic activity. A Connecticut-based company, GTherm, says it has an EGS solution that takes away the need to fracture the rock entirely.

GTherm has developed a closed-loop heat exchanger it calls a “heat nest” that will be deployed at the bottom of a well thousands of feet down. Rather than pump water directly in and out of the ground, it uses a heat transfer fluid that can be used to run a binary-cycle turbine designed for low-heat applications.

Don’t assume this is an easy answer to EGS though: GTherm is still in the modeling phase and will be working with the Electric Power Research Institute to deploy a one megawatt demonstration project in 2012. While an intriguing way to harness deep heat, this concept remains to be proven.

GreenFire Energy: Rather than use water as a working fluid, Utah-based GreenFire Energy is using CO2 — a great way to save water in arid regions while also recycling and sequestering carbon. The process is very similar to a traditional hydrothermal power plant; however, the working fluid is pressurized, supercritical CO2 that may actually have higher heat recovery rates and lower pumping costs than water.

At first, Greenfire is focusing on naturally-occurring CO2 for its demonstration project in Arizona. But it hopes to site plants near coal facilities and utilize waste CO2 for geothermal power production. If it can prove the concept works at its two-megawatt facility in the early phases of development, this could expand the number of sites suitable for geothermal projects. But again, like GTherm, we still haven’t seen if the concept works in practice.

Universal GeoPower: Geothermal co-production and geo-pressured resources also have the potential to expand production while piggybacking off existing fossil fuel infrastructure. In co-production, a developer takes warm waste water from an oil and gas well and uses it to boil a working fluid and power a generator. The Texas-based company Universal GeoPower is trying to deploy this concept along the Gulf Coast where there are more than 37,000 wells that bring up billions of gallons of warm waste water each year.

Universal GeoPower will lease a well or partner with an existing pump operator, deploy one megawatt of “off the shelf” low-temperature units, and sell the electricity to the local utility. Depending on water-flow rates, these projects could be used to offset on-site energy use or even be net-positive energy producers.

Louisiana Geothermal: Like co-production, geo-pressured resources are produced in partnership with gas drillers. In this case, the hot brine is trapped and pressurized under a layer of sediment. But these fluids often contain large amounts of dissolved natural gas, which makes it economically difficult for a pure-play geothermal developer to exploit or for a natural gas driller to access. By developing projects with a hybrid approach, the brine and the methane can be separated; the brine would be used to heat a working fluid and power a low-temperature generation unit and the methane would be used in a gas turbine.

In partnership with the leading geothermal consultancy GeothermEx, Lousiana State University, and the Shaw Group, Louisiana Geothermal is working on building a 5 megawatt project at the Sweet Lake Oil and Gas Field in Cameron Parish, La. The companies hope to be the first to prove that these two resources can be used together in an economic way.

Given that it takes so long to build a geothermal project (we’re talking many years, versus months for a solar project), it may be a while before we see these new technologies come to fruition — if at all. In the meantime, traditional hydrothermal projects will continue to dominate the geothermal market for the foreseeable future.

But there is a lot of innovation happening in this sector. With new approaches to harnessing the Earth’s abundant heat, it’s not unrealistic to think that geothermal can move well beyond the conservative prediction of 4 percent global electricity production in the coming decades.