EDF EnergyThis nuclear plant would be really, really expensive.

New nuclear power has become so expensive that Britain intends to allow a nuke plant operator to charge double the market rate for electricity. The European Union is investigating whether that amounts to illegal government aid to a company.

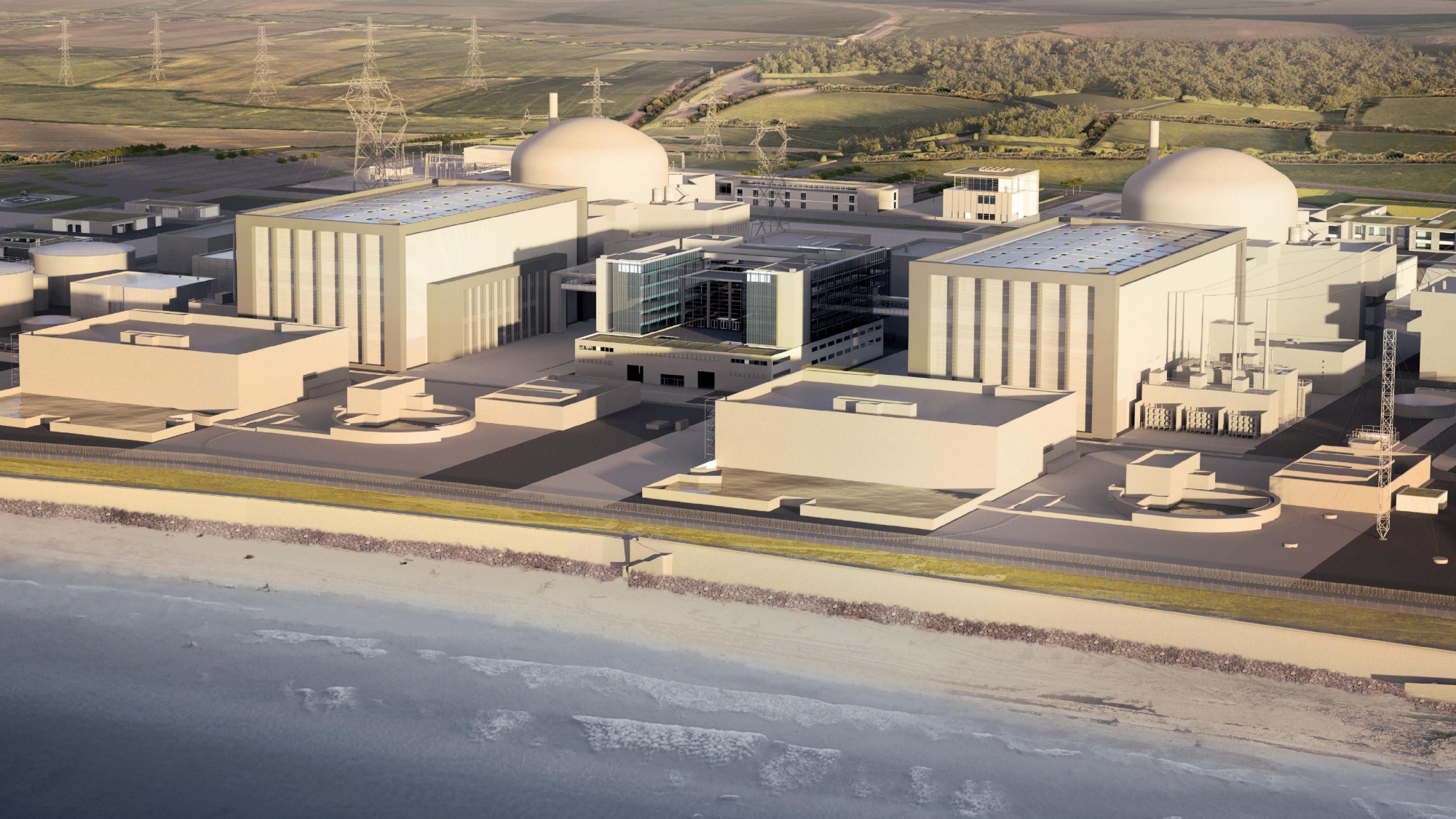

French nuclear energy giant EDF wants to build a $26 billion facility in southwest England, the Hinkley Point C nuclear plant. The U.K. government’s philosophy is that nuclear power is desirable; the new plant could meet 7 percent of Britain’s electricity needs without hurting the climate. So, the power plant would be heavily subsidized by utility customers paying roughly double the rate set by the free market for electricity.

Some say that plan violates E.U. rules that restrict government aid for individual companies. From Reuters:

The European Commission will open an investigation next week into planned British support for a new nuclear power plant, three people familiar with the matter said, in a precedent-setting case for future nuclear funding in Europe. …

If the Commission refuses state aid approval, the Hinkley Point project could fail, threatening the British government’s long-term energy and environmental plans which call for nuclear power.

“The project could not proceed,” an EU diplomatic source said when asked what would happen if the Commission rules against the plan.

Another possibility is the directorate could call for modification of the government’s planned support, involving the guaranteed price or the contract’s length.

If you think opening a nuclear power plant is a dicey and pricey proposition these days, wait until you hear how much it costs to shut one down.

The Crystal River nuclear plant in Florida went offline in 2009, following a series of maintenance-related accidents, because it could no longer compete with fossil fuels or renewables on price. This week, Duke Energy told regulators that the shutdown and cleanup will cost $1.2 billion and take 60 years. That’s nearly twice as long as the plant was in operation.