Photo: David HilowitzMainstream economic modeling isn’t very good at incorporating the more severe risks of climate change, as I mentioned last week. The low-probability, high-impact possibilities that show up in the “long tail” of probability distribution — collapsing ice sheets, massive methane emissions from the permafrost — just completely short-circuit conventional models.

Photo: David HilowitzMainstream economic modeling isn’t very good at incorporating the more severe risks of climate change, as I mentioned last week. The low-probability, high-impact possibilities that show up in the “long tail” of probability distribution — collapsing ice sheets, massive methane emissions from the permafrost — just completely short-circuit conventional models.

As a result, economists have created better models largely ignored those risks. Rather than incorporating the wide range of probabilities, economists use seemingly firm numbers like the median or mean, which creates projections that have a comforting illusion of precision. “The modelling thus becomes a knob-twiddling exercise in optimizing outcomes,” says economist Martin Weitzman, “where it is easy to flirt with high carbon dioxide concentrations.” After all, if you think it’s in our power to scoot right up to the edge of “too much” CO2 but not go over the line, well then, why not do it?

Weitzman is one of the few prominent economists to have seriously grappled with long-tail risks. “The economics of climate change,” he says, “is mainly about decision-making under extreme uncertainty.” Among those uncertainties: the cost of future technology, the rate of future economic growth, and the speed and severity of future climate impacts. The cumulative effect of those uncertainties is to constrain our ability to optimize; we must acknowledge, says Weitzman, that we have only the most rudimentary control over outcomes.

It therefore makes sense to think about spending on climate change prevention and preparation as a form of insurance. Since we can’t eliminate or even manage the risk very well, we hedge against it, just as we do in the case of home, fire, or car insurance. Says Weitzman:

When confronted with the possibility of extreme damages at low probabilities, most people do not look to averages. Instead they think about how much insurance they need, and can afford to buy, to survive those events. Climate policy is better viewed as buying insurance for the planet against extreme outcomes than as the solution to a multivariate problem over which we have control. To analyse policies in terms of deterministic cost/benefit ratios is to marginalize the very possibilities that make climate change so grave.

(For a more in-depth look, see Weitzman’s “GHG Targets as Insurance Against Catastrophic Climate Damages” [PDF].)

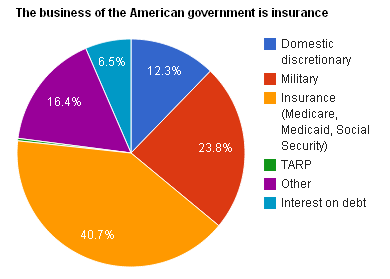

I was reminded of this line of thinking by an excellent Ezra Klein post that lays out the basic facts about what government spends money on. Turns out, it’s mostly insurance and guns:

It makes sense for government to be involved in insurance; when it comes to pooling risk, there are real economies of scale. The feds can pull together bigger risk pools, which pushes down prices. That’s why single-payer health-care systems deliver so much more bang for the buck than the unholy, semi-quasi-privatized U.S. system (and why the VA and Medicare deliver some of the most efficient outcomes within that system).

The same model makes sense for climate disruption. It threatens the entire U.S. — the entire world — in a way that calls for large purchasing pools that can broadly distribute the burdens of hedging against risk. That argues for a strong government role, even if only to establish market rules that price risk.

Very few people are completely confident in their ability to avoid car accidents, fires, or illness. That’s why we buy insurance. It may be statistically unlikely that my particular house catches on fire, but it would be so catastrophically costly if it happened, I deem it worth my while to pay into a common fund that will reimburse me if it does happen.

The shift to electrified transportation and a smart national grid running on distributed low-carbon sources will also act as insurance against fossil fuel price shocks. It will also act as insurance against the kind of cascading power plant failures seen in Texas last week. It will also, in the case of policies like feed-in tariffs or refunded carbon taxes, serve as a kind of entitlement program to bolster middle-class incomes. That’s a lot of insurance in one package.

Climate change is like a possible house fire, except in this case, under some of the more dire scenarios, liabilities are almost unlimited. If ever buying insurance made sense …