Cross-posted from Climate Progress.

In 2010, the U.S. Energy Information Administration (EIA) projected that coal would drop to 44 percent of America’s electrical generation by 2035. Actual generation dropped to that level in 2011.

This week, the agency again adjusted its long-term figures for coal in the U.S., projecting that generation will fall to 39 percent by 2035. But groups on the front lines of fighting coal plants say those figures are still far too conservative.

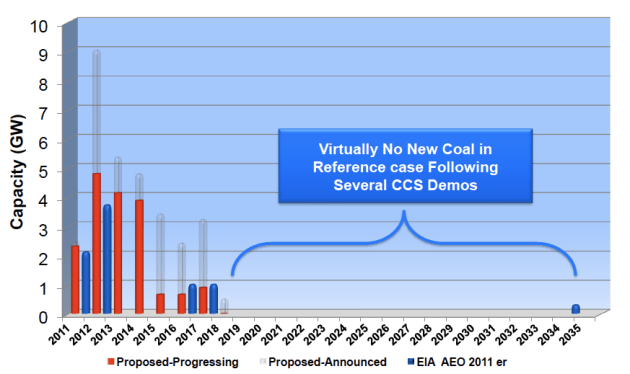

Current proposed and forecasted coal-fired capacity in the U.S., as projected by the EIA’s scenario in 2011. (Click to enlarge.)

Due to a combination of cheap natural gas, higher coal prices, increasingly cost-competitive renewable energy, and an aggressive community of activists working to prevent the building of new coal plants, the coal sector is facing an unprecedented decline in generation. At least, that’s what leaders of Sierra Club’s Beyond Coal campaign are saying.

“The pipeline has essentially dried up,” said Bruce Nilles, the senior director of the Beyond Coal campaign, to Climate Progress. “Our view is that the rush is almost over.”

Here are some of the top indicators for coal’s future that Sierra Club pointed to after this week’s release of the EIA’s figures:

- At least 33,000 megawatts’ (MW) worth of existing coal-fired power plants are expected to retire in the coming decades, not including any retirements due to the recently finalized mercury and air toxics standard from the Environmental Protection Agency (EPA). For reference, an average-sized coal-burning power plant is approximately 500 MW.

- The biggest difference from last year’s EIA projection is that more coal retirements will be driven by rising coal prices, state renewable energy standards, and EPA clean air standards. All these signs point to reduced market share for coal and expanded market share for clean energy.

- No new coal plants are predicted to be constructed in the time period, beyond those few that are already under construction.

- The share of electricity production from clean energy sources (including hydropower and biomass) should increase from 10 to 16 percent during the time period.

- Overall electricity demand growth is expected to remain below 1 percent annually.

Certainly, the outlook for coal isn’t good. But there’s a common misconception that coal is completely dead.

A look at the pipeline for projects in the top chart shows that there are still a fair amount of projects underway. EIA projects the portfolio of plants in various stages of development will actually increase coal generation after 2015.

But the EIA reference case assumes no change to existing policy — meaning it doesn’t factor in a price on carbon or any upcoming EPA standards for power plant emissions. The combination of those two policies could dramatically change the prospects for coal.

“I’d say that coal is on the ropes,” says Nilles. “Many of the plants you see in development are rural electric cooperatives and municipal projects — no merchant projects because of sticker shock. Our view is that the rush is basically over.”

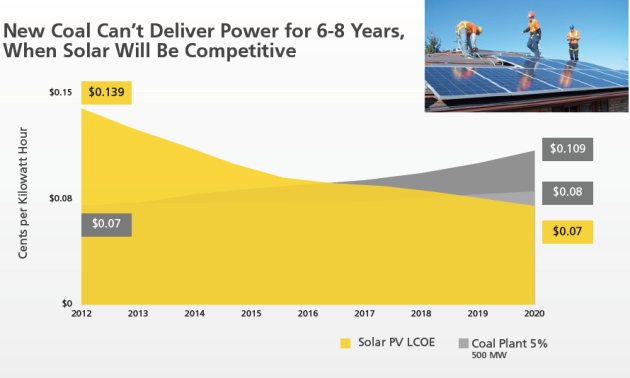

There’s one other factor being ignored by current conservative analysis: the dramatic changes in cost of renewable energy versus the increase in cost for constructing coal plants. For example, in Mississippi, the $2.4 billion, 500-MW Kemper County coal plant is expected to raise rates by more than 45 percent — increasing the average monthly bill by roughly $60.

Compare that to the stunning drop in the price and installed cost of solar technologies. According to some estimates, the changing economics for coal plants — assuming a new one actually gets built — makes the resource less competitive than solar photovoltaics in many areas of the country over the next few years.