A new house in Germany. Photo by Tim Fuller

Germany has become a world leader in renewable power thanks in part to its Renewable Energy Act (EEG), which came into force in 2000. It established a feed-in tariff program that guarantees producers of carbon-free power an above-market rate of return for 20 years. EEG pays tariffs to solar PV, concentrated solar, wind, geothermal, biomass, hydropower, and landfill or sewage gas. The tariffs vary according to capacity and level of technological development; they drop every few years based on the latest costs and level of penetration. German electrical ratepayers fund the program through a small fee that amounts to about 15 percent of their electrical bills.

When EEG was passed, the Greens responsible for writing it proclaimed that they intended to double the percentage of Germany’s power coming from renewables within 10 years. They were roundly mocked as unrealistic. And they were indeed wrong: between 1999 and 2009, German renewables tripled, from 5.4 to 16.4 percent.

The EEG is so well-designed and successful that policies roughly based on it (though adapted to local circumstances) have since spread to 50 countries — no laborious international treaty required.

Naturally, though, it has its detractors. Count among that group pretty much all U.S. conservatives and quite a few economists, who in various ways say that the program is too costly. I want to hone in on one specific economic critique and an interesting response to it, found in this paper by scholars at the Wuppertal Institute (and supported by my generous hosts in Germany last week, Heinrich Böll Stiftung). This will be slightly wonky. You’ve been warned.

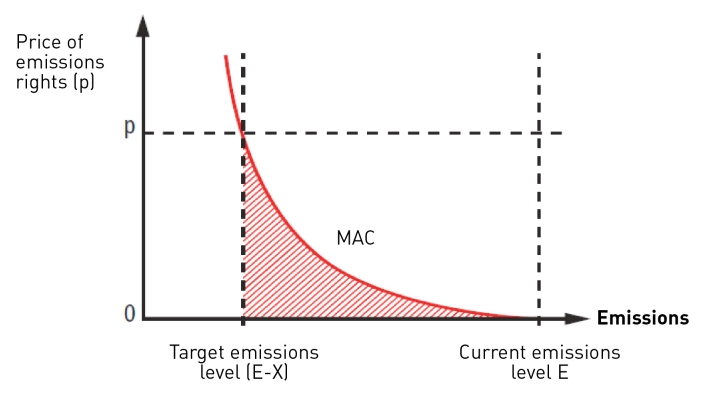

Generally speaking, environmental economists believe that the most cost-effective way to reduce greenhouse gas emissions is to put a price on carbon. Economists like that a carbon price is tech agnostic. It doesn’t mandate this or that form of energy, this or that business practice. Instead it leaves the market, via the famous Invisible Hand, to find the cheapest reductions first, gradually moving on to the more expensive ones as the price on carbon rises.

The result, they say, is the lowest total marginal abatement costs (MAC) for a given level of emission reductions. It looks like this, the classic cost curve:

Many economists will tell you that any additional policies that mandate (or ban) or subsidize (or penalize) particular forms of energy will only muck up this market process and raise the MAC. That’s why they tend to frown on policies like Renewable Electricity Standards and feed-in tariffs. (I have written about this subject before.)

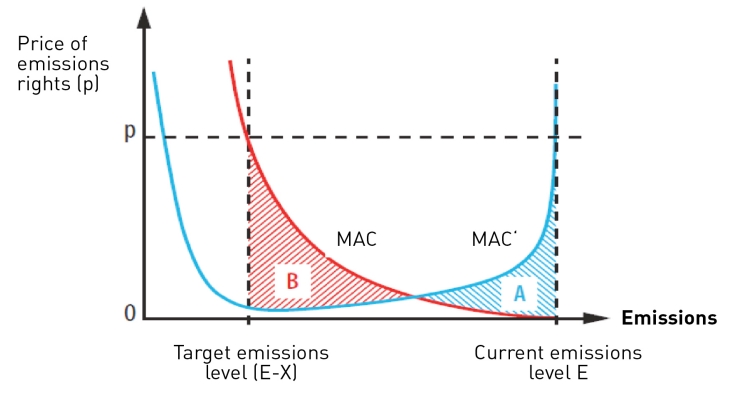

Is there an economic counter-argument? The Wuppertalians (I just made that up) have one. They begin by noting that the analysis above is basically static. That is, it assumes an extant set of technologies to reduce emissions that range from cheap to expensive; as the carbon price rises, market actors move up the ladder from the former to the latter.

But what if some of today’s expensive solutions could be made cheaper with more up-front support? What if, by paying more now, we could pay less total? That would produce a different cost curve, MAC’, as seen here in blue:

The German renewables law amounts to a bet on that MAC’ curve.

The idea is this: if emissions trading is the only instrument, initial investment will go to things like making power plants more efficient or switching coal plants to natural gas. These options produce immediate reductions in emissions for relatively low cost, but there isn’t much of a learning curve effect. That is, the cost of these options does not drop substantially as they are used more. Also, they have the effect of further entrenching current energy infrastructure, making it that much harder to dislodge later.

By contrast, technologies that are earlier in their development but promise greater contributions to the emission reduction effort in the future display substantial learning curve effects. Solar PV is a particularly salient case: every time the use of PV doubles, the cost drops by 20 percent. (In fact, PV costs have been falling so fast that Germany has lately had to revisit — and ratchet back — its PV tariffs every six months. As this paper says, PV is “tantalisingly close to requiring no feed in-tariff support in Japan, Austria, Denmark, Germany, Cyprus, Italy, Portugal, Spain and Brazil where there is combination of market volume, higher electricity bills or a sunnier climate.”)

The thing is, left to their own devices, market actors will not invest in those technologies at sufficient scale to fully exploit the learning effects. Why not? Because no investor can capture the full benefits of their investment. The learning is disseminated via “knowledge spill-over,” which is great for the public (and the climate), but not so great for the investor — their investment ends up partially benefiting their competitors. This is a well-known market failure.

One response to that market failure is R&D spending, and of course, Germany does that too. No one really opposes more R&D spending (except Republicans, that is), but R&D is not enough. For one thing, many of the learning-curve effects come not from research but from market dissemination. As a tech is used more, market actors learn more about the best way to install and service it, the best way to market and distribute it, the best way to build infrastructure for it, and the best business models to build around it. (For example, check out this piece on how solar PV vendors are turning to business efficiencies to drive costs down.) R&D alone will not drive that kind of practical learning. History is littered with clever new technologies that never crossed the “valley of death” between the lab and the market.

Another way of saying this is that the energy system needs to be innovated, not just isolated energy technologies. That can only happen through market introduction of new technologies and the subsequent experimentation and organizational change it brings. The Stern Report, quoted by the Wuppertalians, puts it this way: “In addition to direct emissions pricing through taxes and trading and R&D support, there are strong arguments in favour of supporting deployment in some sectors where spillovers, lock-in to existing technologies, or capital-market failures prevent the development of potentially low-cost alternatives.”

That’s what the German feed-in tariff is about: directly supporting the accelerated deployment of low-carbon technologies to drive down their cost and enable their wide dispersion. In effect, German ratepayers — along with ratepayers in other feed-in tariff countries — are reducing the cost of renewables for the rest of us. They deserve our thanks, but maybe we should also, y’know, do our part.