Germany wants to do for geothermal energy what it has done for wind, solar photovoltaics, and biogas by raising its payment for geothermally generated electricity in 2012.

Germany wants to do for geothermal energy what it has done for wind, solar photovoltaics, and biogas by raising its payment for geothermally generated electricity in 2012.

Feed-in tariffs, or fixed payments for the electricity generated by wind turbines, solar panels, and biogas power plants, have pushed Germany to world leadership in renewable energy development, most of which is in small distributed applications.

However, Germany is in the “also ran” category in geothermal energy, tying Ethiopia for the amount of capacity installed. Even France, a country not known as a hotbed of renewable energy development, has more than twice the installed geothermal generating capacity as Germany.

In the year 2000, Germany introduced a system of differentiated feed-in tariffs to pay for renewable energy generation. The policy pays one price for wind energy, another for solar energy, and so on. It also differentiates its renewable tariffs by project size and, in the case of wind energy, by resource intensity.

Germany currently uses feed-in tariffs to pay for electricity generated by geothermal power plants.

Existing geothermal status

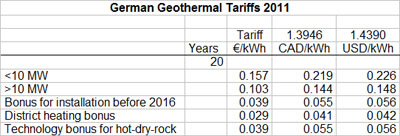

Following feed-in tariff revisions in 2009, Germany implemented geothermal tariffs for two project size classes: those less than 10 megawatts (MW) and those greater than 10 MW. However, these tariffs are the base rates only. Germany offers substantial bonus payments for when the projects are completed, how the technology is used, or the type of technology employed.

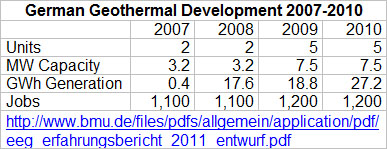

From only 220 kilowatts (kW) in 2003, installed capacity has risen to 7.5 MW in 2010. In 2010 geothermal power plants generated 27 million kilowatt-hours (kWh), still only 0.03 percent of Germany’s consumption of more than 600 tetrawatt-hours per year.

The German Renewable Energy Federation (Bundesverband Erneuerbare Energie or BEE) expects that by 2020, Germany will have installed 625 MW of new geothermal power plants or nearly two orders of magnitude more than that today. Even so, such a fleet will still only be capable of generating somewhat less than 1 percent of electricity consumption.

To reach the level expected by BEE and the government, the pace of development will have to be significantly increased. Thus, Germany is on the verge of a substantial revision of its feed-in tariffs for geothermal generation.

German geothermal costs

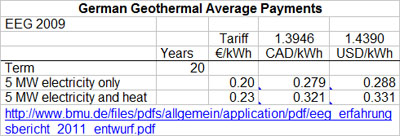

The president of the Geothermal Business Forum, Erwin Knapek, says geothermal generation to date has cost from €0.18/kWh ($0.25/kWh) to €0.28/kWh ($0.40/kWh) with plants averaging about €0.21/kWh ($0.30/kWh).

Knapek, former mayor of Unterhaching, a city south of Munich and the home of one of Bavaria’s few operating geothermal power plants, recommended to Germany’s conservative government that they scrap a subsidy covering 30 percent of drilling costs and suggested instead that the government simply raise the tariff. While this doesn’t reduce exploration risk, a big concern to geothermal developers worldwide, it does make the payment more attractive if the wells are successful. The conservative coalition government of the Christian Democrats-Christian Social Union and the neoliberal party appears to have accepted this suggestion.

For project developers, says Knapek, this simplified payment reduces bureaucracy as well as reduces the policy risk that the government will scrap exploration subsidies. In contrast to the policy risk posed by elimination of federal subsidies with each budget review, payments from feed-in tariffs and the policy they represent are much more stable in Germany and accepted across party lines.

While the Ministry for the Environment and Nuclear Safety (BMU) and the Merkel cabinet have recommended that the 30 percent exploration subsidy be continued, Germany’s upper chamber, the Bundesrat, appears disinclined to agree and early indications are the subsidy will not be extended. The Bundesrat will vote in early July.

If the feed-in tariff revisions are accepted by both chambers of the German parliament (the Bundestag and the Bundesrat), the new tariffs will go into effect at the beginning of 2012.

Proposed new geothermal tariffs

The revision of the geothermal tariffs is part of the normally scheduled revisions of all tariffs. The last revision was in 2009.

To inform the parliamentary policy debate, studies on the experience of each technology’s growth during the previous period are undertaken and a report on this experience is published by BMU. The most recent “experience report” [PDF] was delivered to the Bundestag at the end of May.

The report contains information on the cost and performance of each technology. Here are just a few items gleaned from the section on geothermal energy:

- Projects operating in Germany deliver a 90 percent capacity factor,

- Drilling costs account for about one-half of total project costs,

- New projects cost €10,900/kW ($15,500/kW),

- Most German projects are developed at intermediate temperatures,

- Higher temperature sites in Bavaria can produce electricity for €0.20/kWh ($0.29/kWh), and

- Lower temperature sites, more typical of elsewhere in Germany, need €0.27/kWh ($0.39/kWh).

The report also shows how much is being typically spent by ratepayers on each size tranche within each technology.

German geothermal development uses what the industry terms low-temperature resources. Unlike the more well known geothermal fields at Larderello, Italy or the Geysers in California that use relatively conventional power plant design, low-temperature geothermal resources, like those in Germany, France, and Switzerland, require more complex, and costly, “binary” technology.

To simplify construction and reduce costs, binary geothermal power plants have become standardized and are built in a series of small modules from 1 MW to 7 MW. The average size of binary geothermal power plants worldwide is about 2.5 MW per unit according to a reference textbook by engineering professor Ronald DiPippo. The modules are then clustered at one site.

If past experience is any guide, these clusters of small generators will be connected at the distribution level. Projects in Germany are typically found in small, distributed applications on the outskirts of cities, towns, and villages.

For example, one 3 MW geothermal plant was built on the southern edge of Landau in Rheinland-Pfalz in 2007 and another 3.4 MW plant was installed in the city of Unterhaching south of Munich in 2009.

Both geothermal plants are about the same size as modern wind turbines. However, geothermal power plants operate more often at full capacity than wind turbines. BMU assumes in its report that a geothermal power plant will typically generate 8,000 kWh/kW of installed capacity (a capacity factor of about 90 percent), whereas the average generation of wind turbines in Germany is about 2,000 kWh/kW. Thus, a geothermal power plant in Germany operating as designed should generate

four times more electricity than a wind turbine for the same generating capacity.

As yet the plant at Unterhaching hasn’t reached the level of performance expected of a mature plant. Unterhaching generated 4 million kWh in 2009 and 11 million kWh in 2010.

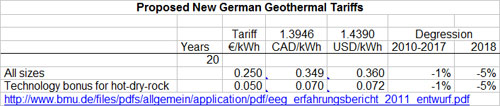

In the conclusion of its report, BMU recommends simplifying the geothermal tariff structure by eliminating separate size tranches. Most current projects, the report says, are less than 10 MW. Thus, the proposed new tariff replaces the previous two tranches with only one. Further, the BMU has incorporated the bonus for projects installed prior to 2016, and the bonus for district heating into the single tariff. They have maintained and increased the bonus for using enhanced geothermal using hot, dry rock.

BMU recommends raising the geothermal tariff nearly €0.10/kWh ($0.14/kWh) above that in 2011 to €0.25/kWh ($0.36/kWh).

Germany’s proposed new geothermal tariffs, if implemented, will put it on a par with France and Switzerland where existing tariffs range from €0.20/kWh ($0.30/kWh) to €0.30/kWh ($0.40/kWh).