Maybe not growing crops, but growing in value regardless.

Got bad news for you, America: We may have another real estate bubble. Farmland.

This morning, The New York Times reported on the continuing growth of sales prices for farmland across the country.

Across the nation’s Corn Belt, even as the worst drought in more than 50 years has destroyed what was expected to be a record corn crop and reduced yields to their lowest level in 17 years, farmland prices have continued to rise. From Nebraska to Illinois, farmers seeking more land to plant and outside investors looking for a better long-term investment than stocks and bonds continue to buy farmland, taking advantage of low interest rates.

And despite a few warnings from bankers, the farmland boom shows no signs of slowing. Almost every year since 2005, except during the start of the recession in 2008, agriculture land prices have posted double-digit gains. In the same period, the Standard & Poor’s 500-stock index has had double-digit gains in only three of those years.

The Times isn’t alone in sounding the alarm. A search for “farmland bubble” on Google News returns hundreds of results dating back months.

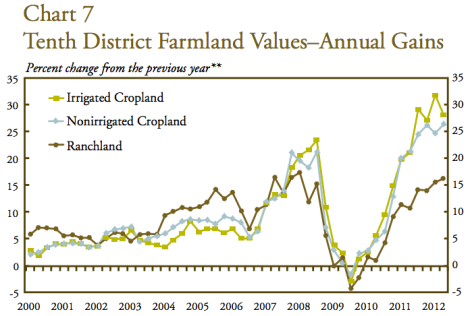

According to the Federal Reserve Bank of Kansas City, which tracks data for the Plains States, here’s what farmland prices have done over the past decade.

Note that the graph indicates percent change — meaning that prices have increased on top of last year’s increase on top of the year before’s. The last time land values dropped was in 2009. In Nebraska, a state wracked with drought, prices for irrigated farmland have increased 35.3 percent since last year.

kansascityfed.orgClick to embiggen.

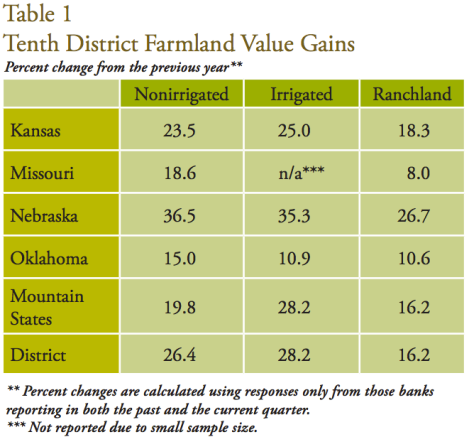

The Federal Reserve Bank of Chicago, tracking Midwest states, sees continued (but slowing) growth.

chicagofed.orgClick to embiggen.

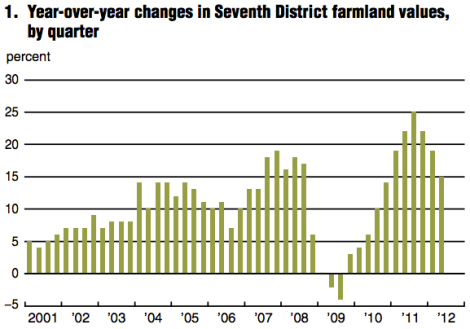

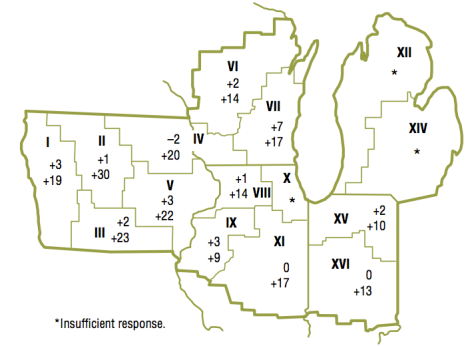

The biggest growth the Chicago Fed has seen is in Iowa.

chicagofed.orgClick to embiggen.

The Times:

According to an agriculture land survey by Iowa State University, prices have risen 32 percent since 2010. Statewide, farmland prices averaged $6,700 an acre, the highest ever, even after adjusting for inflation. Four years ago, prices averaged $3,900 an acre.

Because of the strong demand for farmland, banking regulators fear that farmers could take on more debt to make purchases, a repeat of the 1970s and early 1980s, when overleveraged farmers used their farms as collateral to buy up more land. The resulting debt led to a slew of bankruptcies and plummeting land values.

However:

Economists say that so far there are few signs of a repeat of those days.

And economists are never wrong.

In a weird way, the drought may actually be helping. In February, both reserve banks predicted lower farm income. Instead, it’s been up.

Agriculture Department data show that net farm income is expected to increase to $122 billion this year from $117 billion in 2011, a 4 percent increase even with the effects of the drought. That’s the highest income level since 1973 on an inflation-adjusted basis. Economists say farmland values are getting a boost from corn and soybean prices, which had reached records highs because of the drought.

Land values rise during good years; they rise during bad years. Almost as though prices are being inflated in an unnatural way. Like a balloon. Or a blimp. Something round and starting with “b,” anyway.