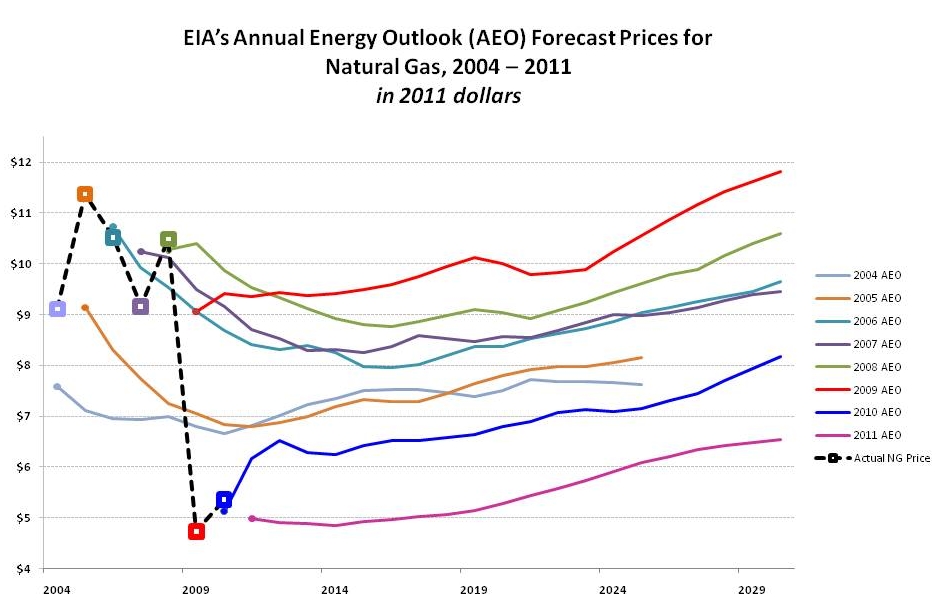

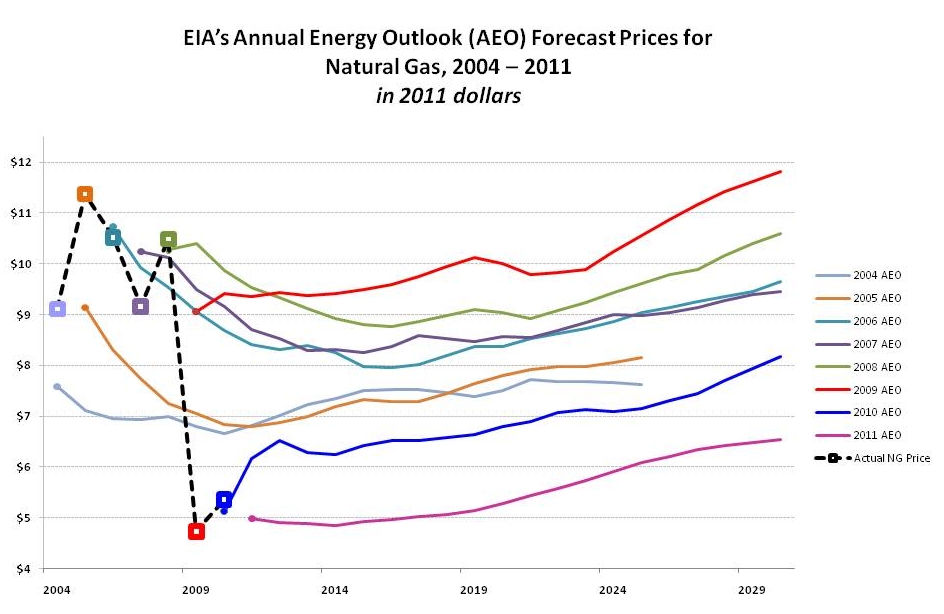

Last October, I had some fun looking at the Department of Energy’s historic predictions of natural gas prices and noting their consistent failure to, uh, predict. From 2004 to 2010, natural gas prices were massively volatile, ranging from $4 to $11 per million British thermal units (MMBtu) (on an annual, inflation-adjusted basis). Not only did DOE’s predictions fail to anticipate this volatility, but every year they seemed to assume that the best 20-year predictor of future gas prices was … last year’s price. This has created an odd situation: The only thing more volatile than actual natural gas prices has been the year-on-year variation in their forecasts! (Despite the fact that those forecasts never predict volatility. Oh, the irony.)

This week saw the release of the 2011 DOE Annual Energy Outlook (AEO), giving us a chance to see whether their logic has gotten any more sophisticated. Recall that last year natural gas prices had rebounded a bit from their 2008-2009 collapse, and the 2010 AEO duly predicted that gas prices would quickly rebound to $8-$9 per MMBtu levels.

That didn’t happen in 2010; prices stayed low. So was 2010 an anomolous deviation from a robust AEO forecast that got long-term fundamentals right even if it missed a bit of year-on-year volatility? Perhaps. But not according to the 2011 AEO. It now predicts that for the next 20 years, gas will stay at historically cheap levels, never approaching the levels predicted by … AEO forecasts from 2004-2010.

This means that one of two things has happened:

- Everything has changed. U.S. natural gas markets have totally different fundamentals than they did at any time in the past decade and we should throw all prior forecasts out the window, relying instead on the newly informed AEO prediction to make long-term energy decisions. Or …

- Nothing has changed. Natural gas is still volatile and unpredictable and 20-year AEO forecasts are still based on little more than last year’s price.

The second seems more likely, but an awful lot of people continue to believe the first. As the global energy manager of a Fortune 500 industrial recently told me, “in our company, we consistently make long-term energy decisions based on short-term energy prices. We know it’s wrong, but we can’t stop ourselves.” AEO forecasts should include the same candor.