The new natural gas conventional wisdom says that “shale changes everything.” Access to these large volumes of relatively low-cost gas will raise U.S. natural gas supplies and decrease price volatility. That’s why prices are low now, and why they’ll stay there in the future.

This narrative has caused significant shifts in U.S. capital flows. Many industrials are now deferring gas-conservation projects, given reductions in projected future savings. Trouble is, the narrative really doesn’t hold water. Maybe gas prices will stay low in the future, maybe they won’t. But whichever the case, it won’t be because of shale.

The narrative fallacy

Nicolas Taleb has written at length about the “narrative fallacy,” which he describes as “our need to fit a story or pattern to a series of connected or disconnected facts.” Taleb can be insufferable at times, but this observation is supported by lots of neurological research; the part of our brain that makes us prone to superstition (we won because I didn’t wash my socks yesterday) gets co-opted when we analyze historic economic data. The overpaid banker is no more likely to ascribe his success to undeserved lucky breaks than the poor single mom is likely to chalk up her struggles to the well-deserved outcome of her poor judgment.

Energy price forecasting is a veritable museum of narrative fallacies. A day doesn’t go by that I don’t get an email offer to attend a $5,000 conference or buy a $15,000 report that will tell me how energy prices will react to economic growth, wellhead counts, regulatory reform, infrastructure condition, currency fluctuation, new technologies … you name it. I’ve bought a few, and often learn something useful, but when it comes to price forecasting — their raison d’etre — they are spectacularly lousy.

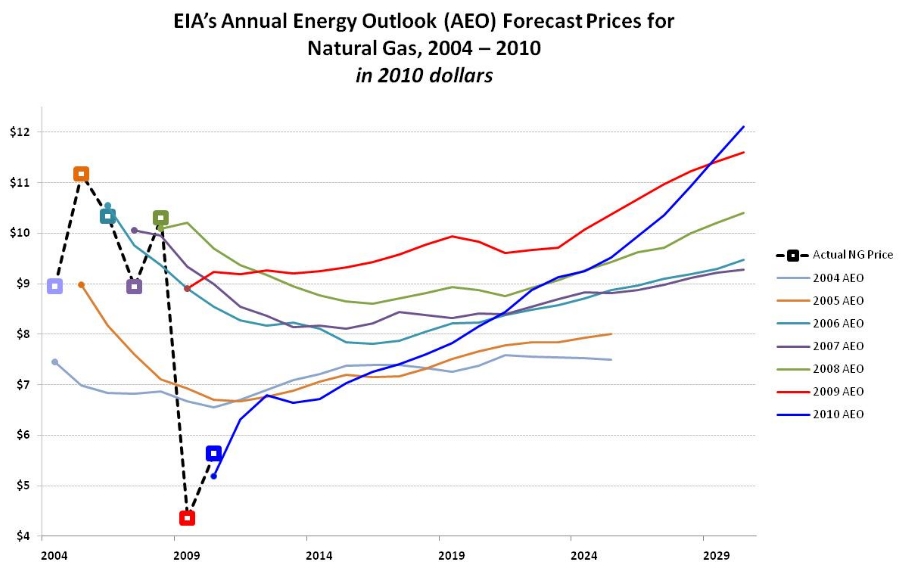

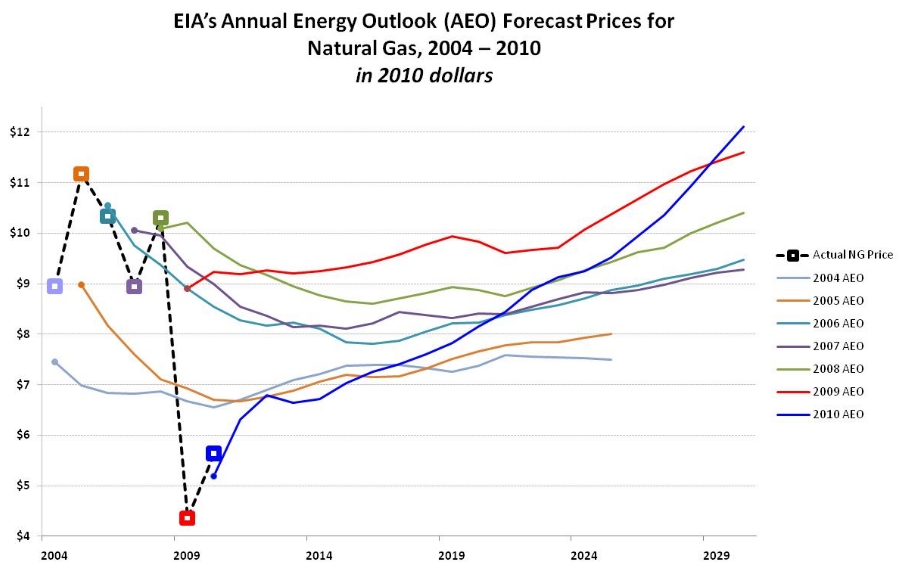

A friend at ACEEE is fond of saying that economic forecasts would be more accurate if economic forecasters were required to eat the shards of their faulty crystal balls. Unfortunately, they don’t save the balls. A notable exception is the Department of Energy. Every year, the DOE releases their Annual Energy Outlook (AEO) which includes 20-year energy price predictions. Helpfully, they also publicize their past predictions. While it’s a bit unfair to pick on the one forecaster that actually provides its past data, it’s the only one we’ve got — so let’s look:

The dashed line is the actual (inflation-adjusted) price paid for natural gas by all consumers in the year shown. The colored lines represent the forecast provided by the AEO in the year on which the first point appears.

Much could be said about this chart, but note two quick points:

- From 2002-2009, there are no AEO forecasts that come remotely close to predicting the actual price movements during the same period.

- The actual gas price in 2009 was best predicted by the 2004 forecast and worst predicted by the 2008 forecast. A forecasting tool that gets more accurate as one goes farther back in time is hardly one that we ought to rely on to provide us with a reliable view of the future based on near-term fundamentals.

Given such a lousy track record in our prognostication skills, why do we continue to put so much stock in energy price forecasts?

The shale narrative

Now let’s look at shale — the narrative that underpins most of today’s gas price forecasts.

First, the facts. Huge shale fields are now — thanks to technological development — changing the mix of U.S. natural gas supply. A fuel that was thought to be increasingly international just a few years ago (remember all those stories about LNG terminal constraints?) is becoming reassuringly domestic.

Unlike conventional natural gas, we know where the gas is in the shale beds, so exploration risk goes away: instead of sinking a lot of money in a hole that might come up dry, our risk is only that the well might cost a bit more than we thought. Finally, because shale produces gas more quickly and in smaller “batches” than conventional gas, drillers can make more discrete decisions to drill or hold back, allowing quicker reaction-time to supply and demand imbalances.

Those points are factual. Now the narrative comes in. Big untapped domestic supply + lower risk + smaller per-well investments = cheaper, less volatile natural gas in the future. The story certainly seems logical — but then, we’ve always had logical stories about the future. Why should this one be accurate?

I am not a gas expert, but it doesn’t take gas expertise to poke holes in the shale narrative. Its problems are economic. Consider:

- Price is set by supply and demand. The shale gas narrative is based only on supply. Might demand rise in response to low prices, pushing prices back up? The narrative doesn’t say.

- Once supply and demand are in balance, the price is set by the marginal cost producer — which shale is not.

Consider just the first problem for a moment. As I’ve written previously, low gas prices will start to shut down the coal fleet, just by shifting the dispatch of existing natural gas assets. That has the potential to increase total U.S. natural gas demand by 71 percent without any new investment in gas-fired assets or distribution infrastructure. Which means either that (a) the U.S. is about to stop burning coal or (b) natural gas prices will rise. Where are you placing your bets?

Warren Buffett has made contrarian investing famous: figure out where the herd of opinion is stampeding, bank on them overshooting, and invest the other direction. I don’t know where gas is going, but I do see a herd getting spooked by all this shale gas noise. It seems as good a time as any to be contrarian.

Here’s one voice suggesting the same thing: Seeking Alpha describes natural gas as the “best energy investment of the decade,” noting that future gas price forecasts are low “as they usually are after a steep economic downturn.” Maybe the right narrative is much simpler: the economy collapsed and commodity prices fell accordingly. All the rest is so much storytelling.