If there were a war on coal — which, sadly, there isn’t — it appears that the tide of battle has turned. Coal is making a comeback.

In an extensive article entitled “Coal Claws Back,” the Rhodium Group, a think tank that assesses global trends, outlined the fuel’s resurgence in the U.S. In short:

While the decline in coal-fired power generation, driven in large part by cheap natural gas, has helped reduce emissions to levels most policymakers and climate diplomats thought impossible absent economy-wide legislation, it looks as though it has just about run its course. Natural gas prices bottomed out in April of last year at $1.82 per MMBTU at Henry Hub, and have since climbed to above $3. While still low relative to the high gas prices that had become the norm before the shale boom took hold, this rebound has been enough to stop the bleeding for coal-fired power. Coal’s share of electricity generation increased from 33% in April to 42% in November, the most recent month for which public data is available, and industry consultancy GenScape estimates that coal’s share stabilized at these levels through January.

The picture is more clear in graph form.

Last summer, we noted that electricity generation from natural gas had nearly matched that from coal. This is one reason our CO2 emissions plummeted recently. But the coal-versus-natural-gas trend hasn’t held. (Note: All of the data used below is from the Energy Information Administration; November 2012 data is the most recently available.)

[protected-iframe id=”3e8bc6fb28b1a5665167920a8b6bb4c2-5104299-13952526″ info=”http://pbump.net/files/grist/coalgas.php?c=1″ width=”470″ height=”320″ frameborder=”0″]

In October and November, the gap between coal and natural gas increased. Coal clawed back.

One reason is that the price of natural gas used for electricity generation increased. Below, it’s compared to the always-cyclical price of residential natural gas. Since April 2012, the price has risen steadily — up 58 percent by November.

[protected-iframe id=”341be8047eb7cd0ab42bfc522cb4f1ad-5104299-13952526″ info=”http://pbump.net/files/grist/coalgas.php?c=2″ width=”470″ height=”320″ frameborder=”0″]

That uptick correlates with the trend away from natural gas in energy production. Higher natural gas price, less incentive to use it to power electricity generation.

[protected-iframe id=”e36d7c7d9a34b6b812a316f293d83778-5104299-13952526″ info=”http://pbump.net/files/grist/coalgas.php?c=3″ width=”470″ height=”320″ frameborder=”0″]

And the Rhodium Group suggests that, at least for the next year or two, the cost difference between coal and natural gas will hold steady.

Rhodium GroupClick to embiggen.

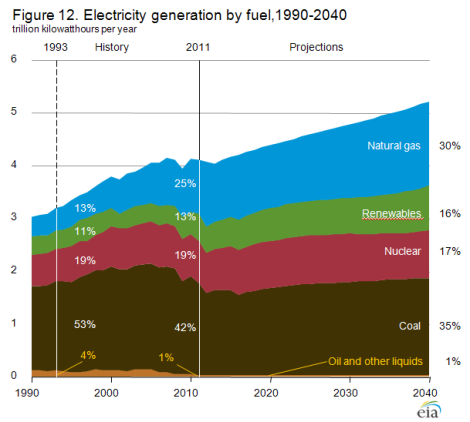

The EIA, meanwhile, projects that coal will hold a consistent if smaller share of the generation market for another 30 years, with natural gas and renewables inching up in the percentage of generation. Overall amount of generation, which had fallen in recent years, will start going back up.

EIAClick to embiggen.

More coal use and more electricity produced means more greenhouse gas emissions.

Rhodium GroupClick to embiggen.

Welcome back to the fight, coal. You weren’t missed.