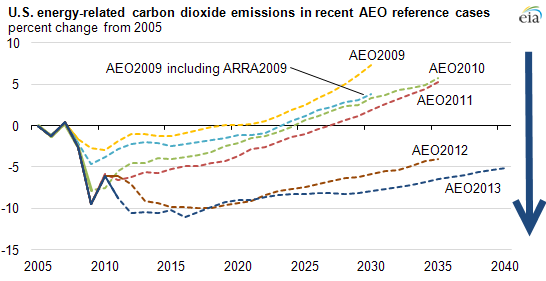

The U.S. Energy Information Agency has a graph showing how its projections for U.S. carbon dioxide output keep being revised downward. In case you didn’t get the point, it has a big blue arrow pointing down. They probably had a few meetings to discuss whether the arrow was big enough.

Year after year, the EIA has revised its projections. Its 2013 calculations suggest that 2040 emissions will still be 5 percent lower than what the U.S. produced in 2005. Which is good news!

But it is also higher than what we’re emitting today. Every projection from the agency shows an increase in emissions over 2010 levels by 2040. So the celebratory down arrow is maybe a bit much.

The agency explains why it thinks the U.S. will end up producing less carbon dioxide than it expected last year. (I am pleased to report that the reasons largely align with David Roberts’ description from this summer. Grist FTW.)

- Downward revisions in the economic growth outlook, which dampens energy demand growth

- Lower transportation sector consumption of conventional fuels based on updated fuel economy standards, increased penetration of alternative fuels, and more modest growth in light-duty vehicle miles traveled

- Generally higher energy prices, with the notable exception of natural gas, where recent and projected prices reflect the development of shale gas resources

- Slower growth in electricity demand and increased use of low-carbon fuels for generation

- Increased use of natural gas

In particular, carbon dioxide emissions from power plants are expected to continue to decline, for two reasons: economics (read: cheap natural gas) and increased regulatory curbs on pollution.

All of this data is subject to change, as the agency’s year-over-year comparison suggests. We’re all on tenterhooks to see how big next year’s arrow will be. And, of course, which direction it will point.