This coverage is made possible through a partnership with Grist and WABE, Atlanta’s NPR station.

On a sweltering Friday this summer, a who’s who of Georgia political and business figures gathered under a large tent on a dusty expanse of vacant land outside of Savannah, sipping champagne. They were waiting for the governor to confirm the week’s exciting rumor: Hyundai was going to build electric vehicles here.

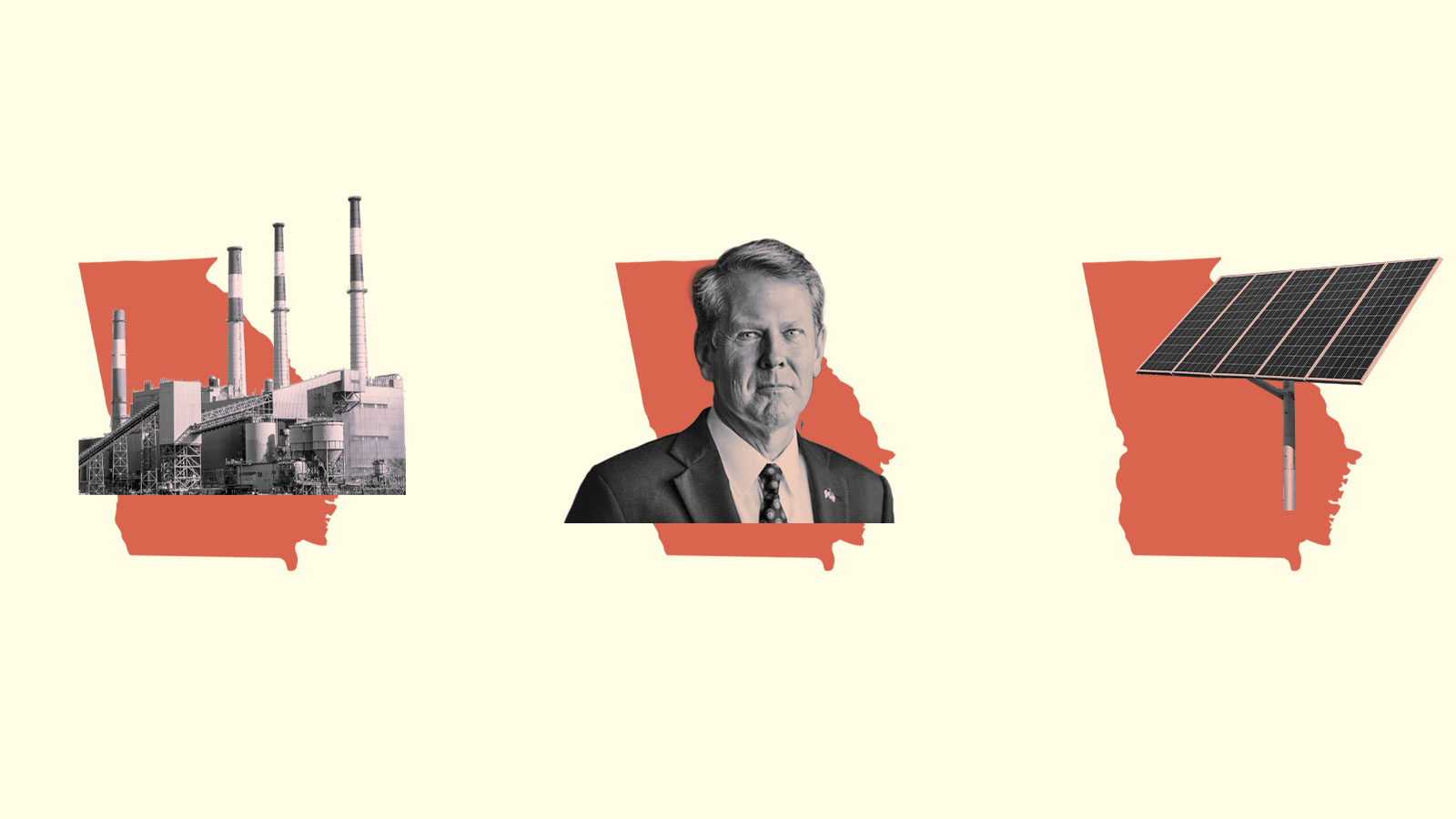

“It is my great honor to officially announce that Hyundai Motor Group will build their first dedicated electric vehicle manufacturing plant right here in this good soil in Bryan County,” Governor Brian Kemp, a Republican, announced to whoops and cheers.

He went on to boast that 20 EV-related projects had come to Georgia since 2020, promising thousands of jobs and billions in investment. The state has actively pursued these companies, offering billions in tax breaks and other incentives to lure Hyundai, electric truck and SUV maker Rivian, EV battery maker SK Innovation, and others to Georgia. Kemp called the state “the unrivaled leader in the nation’s emerging electric mobility industry.”

And it’s not just EVs. Solar panels have been made in Georgia since Suniva was founded out of Georgia Tech in 2008, and the industry has expanded in the last few years. The solar manufacturer Qcells opened a plant in 2019 and announced an expansion this year, and last year NanoPV announced another plant in the state.

This green manufacturing boom comes even as Georgia lags on climate policies that could spur the adoption of EVs, solar panels, and other green technologies. The state has no emissions reduction goals and charges EV owners an annual fee of more than $200. The state Public Service Commission, which regulates Georgia’s largest utility and therefore most of the state’s electricity generation, has mandated more large-scale solar in the last decade but sets no overarching emissions goal for power generation. The commission recently approved more gas-fired power and put off decisions on closing coal units and expanding rooftop solar.

Georgia isn’t alone in this disconnect. A December 2021 report by the Centers for Strategic and International Studies, or CSIS, found that many states without what it called “climate ambition,” like Texas, Louisiana, Wyoming, and South Dakota, are still pursuing the economic opportunities of clean energy. In Georgia, officials see a chance to attract new businesses that promise jobs and investment, while companies feel the lure of massive tax breaks and convenient ports to move their goods. It’s a deal that makes economic sense, regardless of climate policy.

“Just because a state does not have targets to reduce greenhouse gas emissions itself does not mean it has no aspirations to sell its products to others that do,” the report found.

‘Jobs of the future’

For economic development officials in Georgia, pursuing clean energy and tech facilities is a simple matter of reading the writing on the wall. It’s where manufacturers are investing their money.

“We’re trying to make sure that every small town in Georgia has an opportunity to thrive and really reach the jobs of the future,” said Pat Wilson, commissioner of the state’s Department of Economic Development. “It’s imperative on us … that we go after the jobs that are going to be here for the next 50 years.”

In the automotive industry, those jobs will be in electric vehicles, not gas-powered ones. Georgia is already home to a Kia manufacturing plant and numerous facilities that make car parts for other manufacturers, meaning a lot of Georgians work in the industry.

“There are 55,000 Georgians whose life is really tied to an internal combustion engine,” Wilson estimated. In enticing EV companies, battery makers, and other links in the EV supply chain to the state, he said, officials are aiming to line up jobs those workers can transition to as their industry increasingly goes electric.

The same is true in other states. “We can think about the desire to preserve some of their legacy industries,” said Morgan Higman, the author of the CSIS report on climate ambition and clean tech jobs. “There’s this sort of external market pressure.”

Michigan, another state with strong automotive ties, recently expanded the economic development incentives it can offer to lure large-scale manufacturing projects. State lawmakers earlier this year approved a $666 million incentive for GM to make EVs and batteries there.

Higman’s report also identified a similar motive in states with big oil industries, like Texas, Louisiana, and Wyoming. In Louisiana, for instance, the state’s Climate Initiatives Task Force adopted a Climate Action Plan earlier this year that calls for investment in “Louisiana-based low-carbon industry through tax incentives” as well as programs to train oil and gas industry workers for clean energy jobs. In Texas, Exxon has proposed a $100 billion carbon capture and storage project that it says will need public funding, including tax breaks; local officials in Harris County have supported the idea.

Why build here?

Renewable energy and electric vehicle companies list a lot of reasons for choosing states like Georgia, even though they’re not those companies’ biggest U.S. markets and they lack policies that help promote the companies’ products.

Tax incentives are a big piece of the puzzle. Georgia offered Hyundai $1.8 billion in tax breaks and other incentives to attract its new EV plant. Rivian got a $1.5 billion incentive package for its Georgia EV plant, and battery maker SK Innovations got $300 million.

But the state has other advantages, including a well-established manufacturing sector. For instance, in 2019, solar cell maker Qcells opened a factory in Dalton, Georgia. That region has long made and exported flooring.

“So it’s already got a really strong manufacturing-focused workforce,” said Scott Moskowitz, head of public affairs for Qcells, which announced this year that it will expand the Dalton facility. “But it’s also just a really good place, both logistically and economically.”

He cited Georgia Tech as a hub for training students and developing new technologies, as well as nearby ports for importing raw materials and shipping products to consumers. The Port of Savannah is the fourth-busiest container port in the country, and the Port of Brunswick is the second-busiest for roll-on/roll-off trade — in other words, shipping vehicles.

Those factors are specific to Georgia, but lots of red states share one advantage over their climate-ambitious counterparts: land.

“They have a lot of dirt that’s relatively cheap. And these are big facilities,” Higman said, citing a manufacturing incentive program in Alabama that applies to facilities on a minimum of 250 acres. The new Hyundai plant in Georgia will be built on a nearly 3,000-acre “megasite.”

“It’s a lot cheaper to do that in a place like Georgia than it is in a place like New York or California,” she said.

‘We’re going to need suppliers’

While states like Georgia, Louisiana, and Texas lack their own climate goals, their fast-growing clean technology industries make them a key part of the national story. States that do have carbon emissions reduction targets need to buy their solar panels, wind turbines, and electric vehicles from somewhere. And billions of dollars of clean energy incentives in the Inflation Reduction Act, which President Joe Biden signed into law last month, are expected to further increase demand.

“This is a great example of the capacity of states like Georgia … to play an important role in supporting the decarbonization goals of other states and even the president’s goals for our country,” Higman said. “We’re going to need suppliers of these technologies.”

Right now, many of those suppliers are overseas. That’s creating problems in light of the ongoing, global disruption of supply chains. The COVID-19 pandemic has led to city-wide shutdowns in export hubs in Asia; shortages of dock workers, truck drivers, ships, and shipping containers; changes in the price and availability of key materials like steel and polysilicon; and an overall increase in shipping costs. Concerns about labor practices in China and alleged efforts by Chinese manufacturers to undercut U.S. solar manufacturers have added further uncertainties and delays to the solar supply chain.

The ramping up of U.S. manufacturing won’t ease the current difficulties, Higman said, but it could help prevent similar problems in the future.

A case for red state climate plans

But should Georgia, and other red states, do more to nudge the market in a cleaner direction? Wilson, the Georgia economic development commissioner, doesn’t think so. He’s counting on businesses and consumers to lead the state’s transition to electric vehicles and renewable energy, not the government.

“We have become the fifth-largest state for installed solar in the country. And the reason being is that companies are pushing for a renewable portfolio from our utilities. And companies are doing that because they’re being driven by the consumer,” Wilson said. “And so we don’t have a mandate, but we’ve created a business case.”

Similarly, he expects Georgia drivers to switch to electric vehicles without the government or regulators intervening. In that case, he said, car manufacturers are going electric and so drivers will follow suit, in what he called a “business-led transition into electrification.”

But some advocates said the state government should be doing more to speed those transitions, in addition to wooing manufacturing.

“What we’re seeing nationwide is that the states that set the conditions to really support the adoption of electric transportation, and that are aggressively working as a state but also with their investor-owned utilities to deploy charging infrastructure at scale, is where the market is strongest,” said Stan Cross of the Southern Alliance for Clean Energy, a nonprofit advocacy group.

Georgia leads the Southeast in charging stations and is number two in the Southeast for EV sales per capita, he said, but the region lags behind the rest of the country.

Cross said that a climate plan that promotes electric vehicle adoption could ultimately boost Georgia’s economy. “Georgia has no skin in the oil game,” Cross said, so a hypothetical state policy to promote the transition to EVs would be as much about the state’s economy as about emissions.

“It’s about stopping the hemorrhage of dollars leaving the state every time you pump gas and diesel,” he said. “Keep those dollars in the state by driving electric.”

In other words, for states that haven’t previously pushed EVs or renewable energy, a new case for climate policies is emerging that boils down to an old slogan: Buy local.