Cap-and-trade is dead, but some folks never tire of kicking the corpse. Corpse kickers received a boost last week from a paper published in the journal Proceedings of the National Academy of Sciences, which purported to show that cap-and-trade programs “do not provide sufficient incentives for energy technology innovation.”

Cap-and-trade is dead, but some folks never tire of kicking the corpse. Corpse kickers received a boost last week from a paper published in the journal Proceedings of the National Academy of Sciences, which purported to show that cap-and-trade programs “do not provide sufficient incentives for energy technology innovation.”

This strikes me as a classic example of a press release overhyping and oversimplifying a paper to get attention. Consequently, I bet a lot of people are going to misread it, and discussion of cap-and-trade, to the extent it still exists, will get even more caricatured and divorced from reality. Too bad — the paper is actually pretty interesting. It’s worth teasing out what it does and doesn’t show.

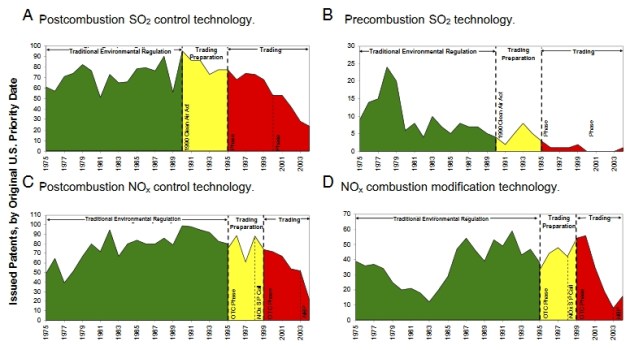

Scientist Margaret Taylor of the Lawrence Berkeley National Laboratory analyzed two existing cap-and-trade programs: the national U.S. market for sulfur dioxide (SO2) and the nitrogen-oxides (NOx) trading program in Northeast and mid-Atlantic states. (Right off the bat, we need to be careful. The SO2 and NOx programs can be instructive, but a robust carbon trading system would be very, very different, incomparably larger and more complex.)

In particular, Taylor looked at the relationship between those two cap-and-trade programs and the rate of technological innovation. Here’s the story she tells:

When the programs were being developed, everyone overestimated how expensive they would be (which always happens). Two things followed from that. First, politicians got scared and set emission-reduction targets too low. Second, the private sector overestimated how much technology innovation would be demanded and thus over-invested in R&D.

When the programs went into effect, regulated entities responded with “an unanticipated mix of the abatement strategies of fuel modification, combustion modification, postcombustion control, demand reduction, and generation replacement.” It turned out to be fairly cheap to comply with the low standards using existing practices and technologies; not much technological innovation was needed. As a result, “commercially oriented inventive activity declined during trading for SO2 and NOx indicator technologies” (my emphasis).

“The implication,” Taylor writes, “is that [cap-and-trade programs] do not inherently provide sustained incentives for private sector R&D investments in clean technologies, but may add to the uncertainty inherent in inventive activity.”

Now, this is certainly true, but a lot of work is being done by “inherently” and “may.” Let’s try to tease out the conclusions in more detail.

Embedded in the paper is the fact that cap-and-trade programs are working exactly like they’re supposed to. They are harnessing market dynamics to reduce emissions at least cost. When costs are held low, there’s no need to innovate. In that sense, yes, there’s nothing “inherent” in cap-and-trade programs that spurs innovation. High prices spur innovation, and a cap-and-trade program with a modest target won’t raise prices much, if at all.

But modest targets are not “inherent” in cap-and-trade programs. A cap-and-trade program with stricter targets would cost more, and thus spur more innovation. In that sense, a cap-and-trade program obviously can spur innovation. Just implement stricter targets! The more vexing question is whether they ever do. The evidence thus far seems to indicate that cheap compliance costs are taken as victories for politicians involved, not as a sign that environmental stringency should be increased. In fact, there’s arguably not a cap-and-trade program in the world with environmentally sufficient targets. It may be that insufficient targets, while not inherent in cap-and-trade, are, as a matter of contingent fact, always part of it. (I don’t think this argument is as settled as some take it.)

Innovation-wise, the news gets worse for a carbon cap-and-trade system. If SO2 and NOx compliance were more varied and less expensive than expected, there are reasons to think CO2 compliance would be doubly so. Not only will targets inevitably be set too low (at least in the early years), but, since almost every modern industrial activity releases CO2, the number and variety of compliance strategies is almost endless. Plenty of reductions require no technological innovation at all, and plenty more “low-hanging fruit” remains to be rooted out. Allowance prices will likely be “unexpectedly” low for a good long while, especially if the carbon cap-and-trade program goes global. Thus there will be little direct incentive for innovation.

Is this a mark against a carbon cap-and-trade program?

Well, in one sense, of course not. It will reduce emissions more cheaply than expected! That’s a good thing. However, it does go to show that, particularly in its early years, such a program would be woefully insufficient to drive the kind of aggressive innovation we need if we’re going to get to global zero carbon within the century. If we want aggressive innovation before carbon prices reach $100 a ton, we need to make it happen ourselves, on purpose, with focused innovation policy.

Focused innovation policy has another benefit, related to political economy. Taylor refers to it obliquely in the press release: “policymakers also seldom set targets they don’t have evidence that industry can meet.” Until they can see the technologies that will be used for compliance, politicians don’t feel safe setting stringent targets. Even if, in reality, compliance will mostly be achieved through other channels, it is politically helpful to have whizbang technologies at hand.

What Taylor’s paper really shows — what we all should have agreed on by now anyway — is that both carbon pricing and innovation policy are needed. They are not at odds. Especially in the early decades, they accomplish different things, in terms of emissions, economics, and political economy. The fact that rival camps are arguing with each other over this, while nothing is actually happening on either front, is a special kind of stupid.