Photo courtesy kimberlyfaye via Flickr Using energy more efficiently in buildings may be the fastest, cheapest way to substantially reduce carbon emissions in the short-term. How can we make it happen?

Photo courtesy kimberlyfaye via Flickr Using energy more efficiently in buildings may be the fastest, cheapest way to substantially reduce carbon emissions in the short-term. How can we make it happen?

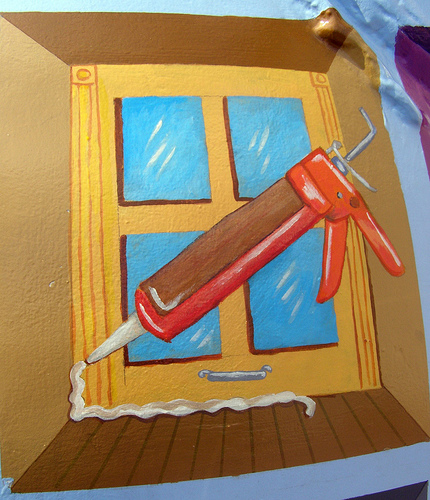

Last week, New York Times‘ David Leonhardt wrote a great column about a new proposal bouncing around the White House: “cash for caulkers,” a stimulus program to support building retrofits and efficiency. (Leonhardt has more details on his blog.) And as I wrote on Saturday, Sen. Jeff Merkley (D-Ore.) is pushing to have a similar program included in the upcoming Senate jobs bill. So it seems that national policymakers may finally be getting serious about this stuff. Unfortunately, efforts to increase building efficiency face all sorts of barriers: fragmented markets, information failures, misaligned incentives, high upfront capital costs, difficulty finding financing, and more.

As Leonhardt notes, for building owners it’s just damn complicated to figure out what auditor to use, which improvements to prioritize, how to fund them, and how to choose between competing products. That complexity is a barrier. It’s not just that people won’t go out of their way to figure these things out, though. Most people won’t do anything. I once talked to a guy from Australia who’d arranged for efficiency products to be packaged, delivered by a single entity, and paid for out of energy savings. All homeowners had to do was call to arrange a day to be at home while the work was done. Tens of thousands of people indicated on surveys that they would take advantage of such a program. When it launched … only a handful did. A simple phone call was too much!

Conventional economists have trouble grappling with the kind of market and behavioral anomalies that plague efficiency generally and retrofits specifically. Neoliberal economics begins, after all, from the premise that people are rational self-interest maximizers. If that’s true, prices reflect willingness to pay. And if that’s true, whatever people will pay for efficiency is, prima facie, what it’s worth. On this view, the only way to induce people to save more energy is to raise the price of energy. Price becomes the only policy lever that matters.

That kind of econo-centric policymaking is second nature in American politics. Not to pick on Ezra Klein, who’s an astute critic of econo-centrism in health care policy, but his comment in response to Leonhardt’s story is a good example: “pricing carbon — either through cap-and-trade or a tax — would get a lot of people interested in weatherizing their homes without requiring a specific government program to help them do it.” In other words, correcting a single market failure — unpriced carbon emissions — can obviate the need for additional interventions, all those clunky regulatory and industrial policies. Price can accomplish the same goals more simply and elegantly.

I don’t think we should accept that approach, particularly when it comes to efficiency.

How much impact would a price on carbon have? It depends on how easily people can adjust their behavior in response to price signals (what economists call “elasticity of demand”). If people can easily reduce their energy use or switch to low-carbon energy, you don’t need a very big price on carbon. If they can’t, you have to jack up the price until there’s real pain.

Evidence indicates that the elasticity of energy demand is weirdly low. The price signals that already exist aren’t getting a rational response. People can already save lots of money by investing in efficiency, but they aren’t doing it. They absorb a lot of price pain before they adjust their behavior. They’re leaving profitable investments unexploited on a systemic scale, if you believe research like McKinsey‘s. Why? Credit goes to the inhibiting presence of a variety of market and behavioral failures. Because of these failures, even with a jacked-up energy price, even with stimulus money dumped on the market, progress on efficiency will be slower than it should and could be.

Which raises the question: why should price-based policies be our exclusive focus? Why not instead, or in tandem, try to increase elasticity of demand? If the federal government wants to get good job and economic results from its stimulus investments — and it surely does — it should not only spend the money, it should start attending seriously to the project of meliorating the market and behavioral failures in efficiency markets.

How do we remove the barriers? It turns out we know a decent amount about them but comparatively little about how to overcome them. A great primer on this is “Energy Efficiency Economics and Policy” from Resources for the Future. It’s a survey of research on efficiency economics, market and behavioral failures therein, and policies to address those failures. When assessing such policies, the authors say a lot of things like, “Data indicating the cost-effectiveness of these programs are not readily available.” And, “These net benefit estimates have to our knowledge not been subject to independent verification in the economic literature.” We’ve had three decades of cheap energy, so there’s been little reason to focus on accelerating efficiency; our know-how froze in the 1970s.

What’s clear is that getting the most out of efficiency will not only mean federal policy but state and local policy, public-private partnerships, new financing models, new models of information sharing, and much more creative thinking. Because we know so little, there’s a lot we can learn quickly with an all-hands-on-deck effort.

More on (non-price-based) ways of rationalizing and accelerating efficiency markets tomorrow, with a focus on retrofits.