Energy deliberations in the Senate are in the home stretch. There’s a crucial White House meeting on Wednesday between Obama and key senators where some final decisions are likely to be made. There are, believe it or not, a few liberal senators fighting to keep carbon limits in the bill, but the bulk of “centrist” opinion at this point seems to be for throwing the climate provisions overboard and going with the more politically expedient “energy-only” option.

It’s worth mentioning, in this context, there’s a policy option between energy-only and a full-fledged carbon cap-and-trade system (or even the compromised system in the Kerry-Lieberman American Power Act). Namely: a cap-and-trade system that covers only the utility sector.

This utility-only idea has been floating around for a while and keeps popping up as a fallback position. Resident Senate Flake Lindsey Graham (R-S.C.) recently said, “That is what I will be pushing next year, a utility-only bill.” Jason Grumet of the Bipartisan Policy Center says, “There’s also a real possibility of setting a carbon emissions cap on the electric power sector if the White House and Senate leadership line up behind a more limited and targeted climate program.” Joe Lieberman says he’s open to it. Rahm Emanuel himself dropped this bomb on Friday, referring to this week’s meeting:

“The idea of a ‘utilities only’ [approach] will also be welcomed,” he said, emphasizing that “a wide range of ideas will be discussed.”

Clearly people close to the process are exploring this option. What should we make of it?

The merits

Let’s be clear: On policy grounds, a comprehensive, economy-wide cap on carbon is preferable to one that one covers only one sector. That is true almost by definition: The power of the economy-wide system is that it maximizes flexibility and encourages investment money to flow wherever the cheapest reductions can be found. If you create a silo’d cap-and-trade system, walling off one industry, you sharply curtail this flexibility. The result will be higher program costs and lower macroeconomic efficiency. (David Leonhardt smartly pointed out that conservatives and “centrists” are pushing policy in consistently more expensive and less efficient directions.)

At this point, however, the question may no longer be whether a comprehensive bill is preferable to a utility-only bill, but whether a utility-only bill is preferable to the energy-only bill the Senate seems bent on passing. Judged against that somewhat pathetic baseline, it is, in fact, preferable.

Focusing on electricity

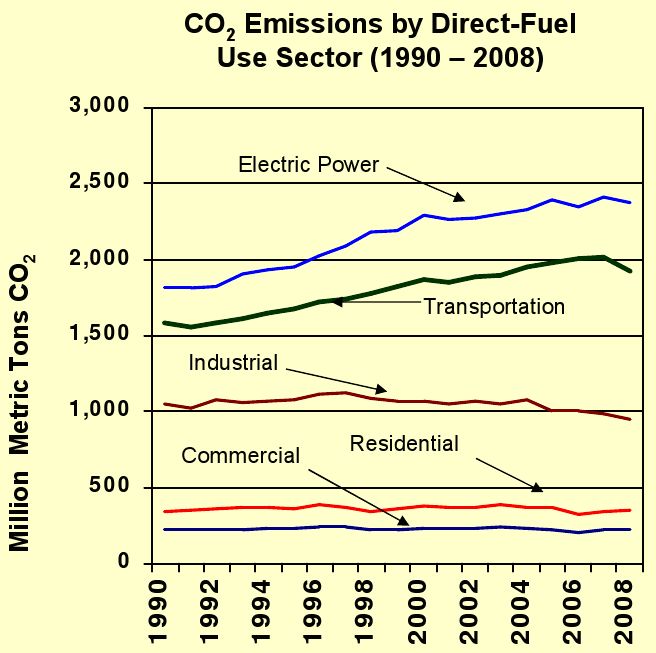

If you’re going to single out one sector for cap-and-trade, electricity is the right choice. For one thing, it’s the biggest emitter:

U.S. Energy Information Administration

U.S. Energy Information Administration

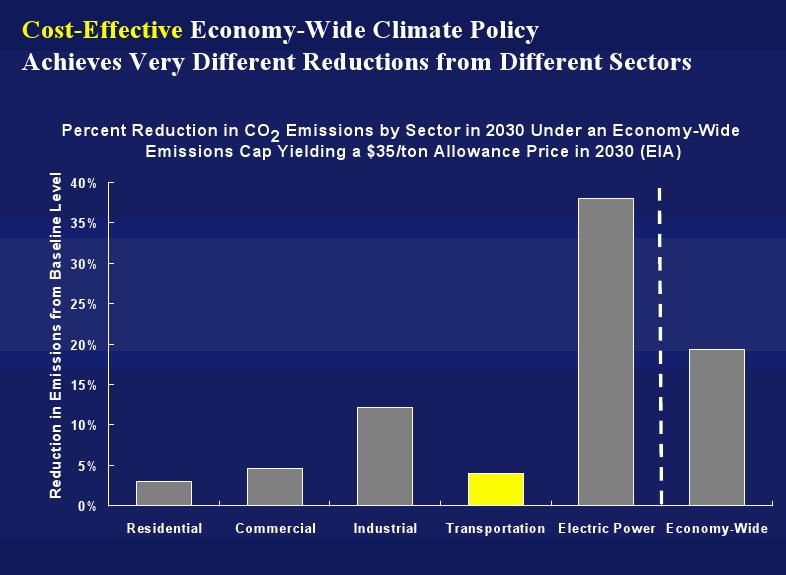

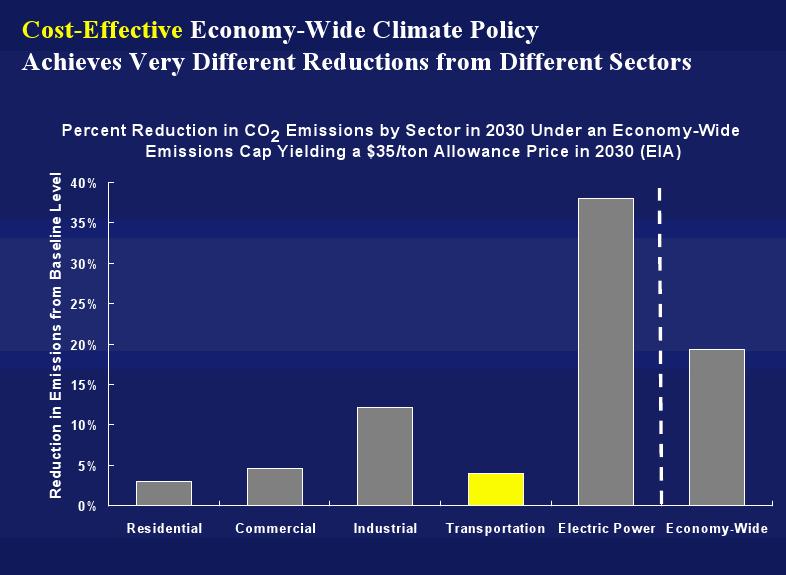

For another, most of the lowest-cost carbon reductions are expected to come from electricity. Here’s how the EIA projects an economy-wide cap-and-trade system would affect various sectors:

via Ezra Klein via Harvard’s Robert Stavins

via Ezra Klein via Harvard’s Robert Stavins

As you can see, about half the total carbon reduction under an economy-wide cap-and-trade system is expected to come from the utility sector. By contrast, transportation is scarcely affected. The reason for this is simple: It takes an extremely high price on carbon to substantially raise the price of gasoline.

Under the American Power Act, the ceiling on the price of a ton of carbon in 2013 is $25. Even in the unlikely event that the price hits the ceiling, that will boost the price of a gas by just under a quarter per gallon. Given that gas has swung around over a $2-3 range just in the last few years, a quarter isn’t much more than noise. A recent study at Harvard found that in order to reduce carbon emissions in the transportation sector 14 percent from 2005 levels by 2020, gas will need to rise to $7 a gallon by then. Getting there from today’s $4 gas would require a carbon price of well over $300 a ton, and that, in turn, would completely upend the utility sector. So it won’t happen.

In sum: Cap-and-trade was always mostly about the utility sector, so if it becomes explicitly about the utility sector, it’s not a total loss, if a few conditions are met.

Utility-only cap-and-trade could work if accompanied by strong energy provisions

The effects of a utility-only cap-and-trade system obviously depend on where the cap is set and how offsets are treated. Assuming the target would be the same as in previous bills (between 14 and 17 percent reduction from 2005 levels by 2020) and offsets are treated the same (2 billion tons available), its main effect would be to induce the purchase of lots of offsets. There will also be lots of fuel-switching to natural gas and some boost in renewable power.

That leaves a great deal of needed work unaddressed. To amount to a credible bill, a utility-only cap-and-trade system would need to be accompanied by three things:

- Measures to reduce oil use, along the lines of those Sen. Jeff Merkley (D-Ore.) proposed last week.

- Measures to increase energy efficiency, along the lines of those, um, Sen. Jeff Merkley proposed last week.

- Measures to accelerate research, development, and deployment of renewable energy, in particular: a) a renewable energy standard much stronger than those now on the table, and b) substantial investment in energy R&D.

And one more thing: If cap-and-trade is to begin with utilities, it cannot be permanently thus restricted. There must be something in the bill that allows for the expansion of the program to other sectors. (We can always hope for a future Congress that’s less cowardly.)

If those conditions are met, a bill with a utility-only carbon price could be a credible step forward. Being realistic, one has to assume that they will be met partially if at all.

The politics

Darren Samuelsohn looked into the politics of utility-only carbon policy earlier this year and concluded, “the focus on just one industry also comes with perils, and it is far from certain that Senate politics would be any different.” For one thing, electric utilities aren’t particularly excited about being the guinea pigs for cap-and-trade.

Then again, utilities have been involved in a cap-and-trade program for 15 years (for acid-rain pollutants) and they’ve always been amenable to carbon cap-and-trade as long as coal is protected and the EPA is blocked from regulating CO2 (both of which, unfortunately, have been accomplished in previous negotiations). There’s reason to think they could be brought on board for this. And there’s reason to think exempting manufacturers might harvest a few Midwestern votes.

Perhaps cap-and-trade for utilities is where the downward slide of this bill will finally stop. Or maybe it’s just another way station on the road to total capitulation, the preferred destination of the Senate’s “moderates.” We’ll know much more after the meeting on Wednesday.

UPDATE: CFR’s Michael Levi also has some smart thoughts on the subject today.