The Wall Street Journal reports that an increasing number of energy analysts think that U.S. gasoline sales will never surpass their 2007 record:

Among those who say U.S. consumption of gasoline has peaked are executives at the world’s biggest publicly traded oil company, Exxon Mobil Corp., as well as many private analysts and government energy forecasters…

Many industry observers have become convinced the drop in consumption won’t reverse even when economic growth resumes. In December, the EIA said gasoline consumption by U.S. drivers had peaked, in part because of growing consumer interest in fuel efficiency.

Now, I’ve got something approaching zero confidence in the ability of energy analysts to predict the future. (Or, perhaps more to the point, different analysts say different things, and I’ve got no confidence in my ability to pick and choose which ones are making sense.)

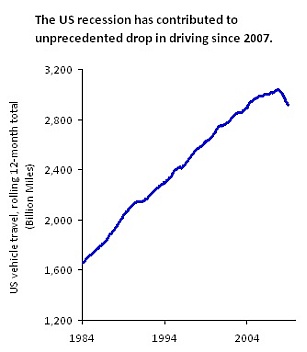

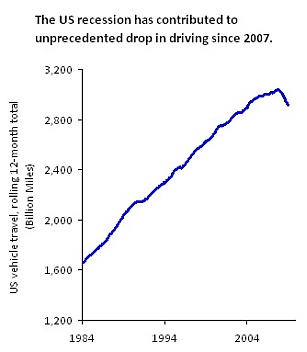

Still, it’s interesting to read that Exxon is beginning to bet against a resurgence in highway fuel consumption, by easing out of the retail gasoline business. They’ve got actual skin in the game, and if they’re betting against a short-term rebound in gas consumption, then at a minimum the other analysts aren’t crazy. And, of course, recent trends add some heft to the belief that consumption is falling: despite my skepticism a few months back, it looks like U.S. vehicle travel is continuing its freefall.

This post originally appeared at Sightline’s Daily Score blog.