Taxes on cigarettes are considered “sin taxes,” costs intended, in part, to punish bad behavior. One bad behavior that cigarette taxes in New York punish: being poor.

Photo by DucDigital.

From the AP:

Low-income smokers in New York spend 25 percent of their income on cigarettes, according to a new study, which led advocates for smokers’ rights to say it proved high taxes were regressive and ineffective. …

In New York, which has the nation’s highest cigarette taxes, a pack of cigarettes can cost $12, though many smokers have turned to buying cheaper cigarettes online or to using roll-your-own devices.

Wealthier smokers — those earning $60,000 or more — spend 2 percent on cigarettes, according to the study. …

[The American Cancer Society’s Russ] Sciandra said state statistics showed that smokers earning less than $30,000 a year paid 39 percent of state and city taxes on cigarettes. He added that more of the cigarette tax revenue should be used to finance smoking-cessation programs.

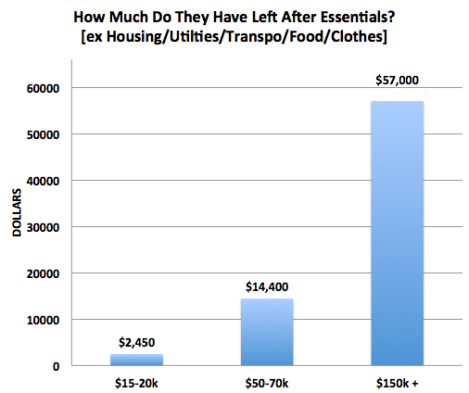

To some extent, this is a function of percentages. If you only have $100, $25 will seem much more dear than if you have $1 million. But the impact is real. The Atlantic‘s Derek Thompson wrote about how people at various income levels spend their money. For an average low-income household, housing, utilities, and transportation alone generally eat up almost three-quarters of the budget.

More telling, though, is this graph.

Image courtesy of The Atlantic.

If low-income households have $2,450 to spend at their discretion each year, dropping $12 a few times a week on smokes is a massive cost. And for a behavior that is rooted in physical addiction, it’s a tremendously difficult cost to eliminate.