This story was originally published by the Guardian and is reproduced here as part of the Climate Desk collaboration.

Insurers have warned that climate change could make coverage for ordinary people unaffordable after the world’s largest reinsurance firm blamed global warming for $24 billion of losses in the Californian wildfires.

Ernst Rauch, Munich Re’s chief climatologist, told the Guardian that the costs could soon be widely felt, with premium rises already under discussion with clients holding asset concentrations in vulnerable parts of the state.

“If the risk from wildfires, flooding, storms, or hail is increasing then the only sustainable option we have is to adjust our risk prices accordingly. In the long run it might become a social issue,” he said after Munich Re published a report into climate change’s impact on wildfires. “Affordability is so critical [because] some people on low and average incomes in some regions will no longer be able to buy insurance.”

The lion’s share of California’s 20 worst forest blazes since the 1930s have occurred this millennium, in years characterized by abnormally high summer temperatures and “exceptional dryness” between May and October, according to a new analysis by Munich Re.

Wetter and more humid winters spurred new forest growth which became tinder-dry in heatwave conditions that preceded the wildfires, the report’s authors said.

After comparing observational data spanning several decades with climate models, the report concluded that the wildfires, which killed 85 people, were “broadly consistent with climate change.”

Nicolas Jeanmart — the head of personal insurance, general insurance, and macroeconomics at Insurance Europe, which speaks for 34 national insurance associations — said the knock-on effects from rising premiums could pose a threat to social order.

“The sector is concerned that continuing global increases in temperature could make it increasingly difficult to offer the affordable financial protection that people deserve, and that modern society requires to function properly,” he said.

Munich Re’s insurance coverage in hurricane-prone regions such as Florida is already higher than in northern Europe, by an order of magnitude.

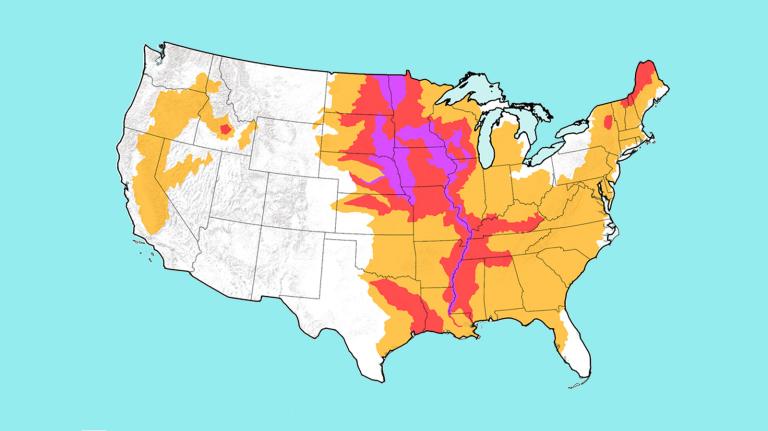

Premiums are also being adjusted in regions facing an increased threat from severe convective storms which hold an energy and severity primed by global warming. These include parts of Germany, Austria, France, southwest Italy, and the U.S. Midwest.

Increases in the intensity and frequency of California’s wildfire season are predicted by climate models, and the Munich Re analysis combines monthly meteorological data with financial losses to graph the trend’s rise since 2001.

Average annual wildfire losses trailed well below $5 billion even within this millennium, until 2017 and 2018, when they leapt to more than $20 billion. Munich Re believes that global warming made a “significant contribution” to this.

No insurer has linked wildfires to climate change before, although a Lloyds report into Superstorm Sandy in 2014 found that global warming-linked sea-level rise had increased surge losses around Manhattan by 30 percent.

Climate scientists say that linking extreme weather events to climate change is akin to attributing the performance of a steroid-taking athlete to drug use — the connections are clearer in patterns than in individual disasters.

Paul Fisher, the Bank of England’s former coordinator on climate change, and a fellow at the Cambridge Institute for Sustainability Leadership, said: “In general, one can’t prove that a single event is the result of climate change, but it is likely to cause more such events of greater severity.”

“It is very interesting if insurers conclude that climate change was a significant contributory factor to the event and will make the insurance companies think carefully about the pricing and availability of similar insurance policies,” he added.

It may also influence several court cases testing the liability of fossil fuel companies for the effects of global warming.

Ben Caldecott, the director of Oxford University’s sustainable finance program, said: “Company directors and fiduciaries will ultimately be held responsible for avoidable climate-related damages and losses and urgently need to up their game to avoid litigation and liability.”

Munich Re has divested its large thermal coal holdings. However, it maintains some gas and oil investments.