I’ve argued before that electricity cost comparisons are, in Walt Patterson’s memorable phrase, "an artifact of prior decisions otherwise concealed" — i.e., based on unstated moral, social, and economic assumptions. Most of those assumptions, for reasons of habit, custom, and occasionally pecuniary interest, are weighted toward the traditional way of doing things: a hub-and-spoke electricity grid driven by massive coal, gas, nuclear, and hydro plants. (To take just one example: the costs of grid transmission and distribution are not counted against central plants, even though small-scale distributed generation substantially reduces those costs.)

In my moderately informed but widely broadcast opinion, if cost comparisons were done with a more defensible set of assumptions — defensible given what we know about trends in climate change, information technology, fossil fuel prices, federal regulation, freshwater availability, you name it — renewable sources like solar thermal and wind would already come out ahead. And of course efficiency already comes out ahead.

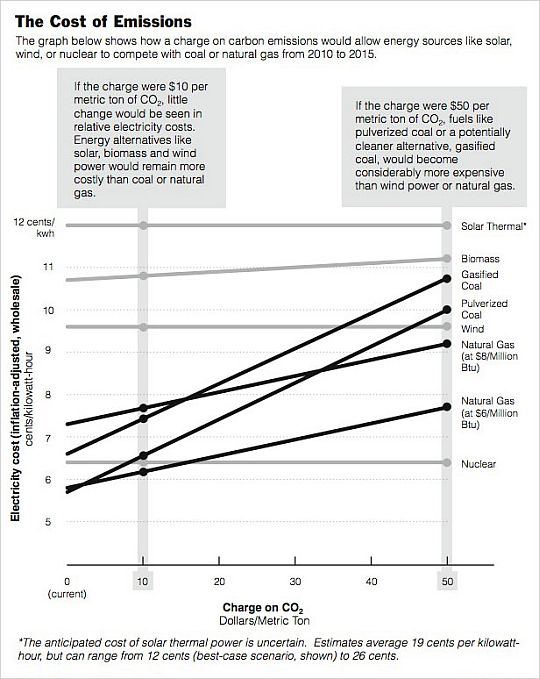

This is all by way of introducing a piece in today’s NYT. It tries to show what price on carbon would be necessary to make renewables competitive with coal. It is based on conventional cost comparisons from EPRI. (For some bashing of EPRI assumptions, see this post from Sean.)

The result: based on EPRI’s cost comparisons, a price on carbon of $50 per metric ton of CO2 equivalent would catapult wind and natural gas ahead of coal. Given how deeply skewed those assumptions are, and how rapidly renewable costs are falling, I’m guessing the needed price is much, much lower.

Lesson: regulatory reform can cause enormous shifts in the electricity industry, even absent futuristic new pony technology.

The graphic from the NYT story is below the fold: