This is one of those “good news/bad news” things. We’ll start with the bad news, from The Hill:

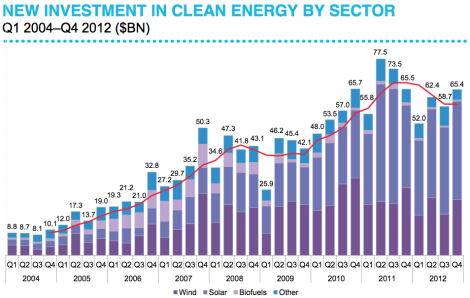

Green energy investment fell in 2012 globally after hitting record levels the year before, driven in part by reduced activity in the United States, according to new data from Bloomberg New Energy Finance.

The research firm reported Monday that overall investment was $269 billion, down from $302 billion in 2011 …

And now the good.

… but still the second highest level ever, according to its database. …

“We warned at the start of last year that investment in 2012 was likely to fall below 2011 levels, but rumors of the death of clean energy investment have been greatly exaggerated,” Michael Liebreich, the company’s CEO, said.

“Indeed, the most striking aspect of these figures is that the decline was not bigger, given the fierce headwinds the clean-energy sector faced in 2012 as a result of policy uncertainty, the ongoing European fiscal crisis and continuing sharp falls in technology costs,” he said.

One of the main drivers for the decline was the wind industry, which spent the latter half of the year being treated by D.C. the way a cat treats a mouse.

The U.S. experienced a steep, 32 percent drop amid fears that a popular wind energy tax credit would lapse (it ultimately was extended in the “fiscal cliff” deal), and as renewable power faced competition from low-cost natural gas.

The company said wind investment also fell in Spain, which enacted a moratorium on subsidies for projects that have not yet been approved; India, where wind incentives expired; and Italy.

BloombergClick to embiggen.

The Energy Information Administration suggested in December that renewable costs will continue to drop in 2013, and, combined with state mandates for renewables, that could mean an increase in installation this year.

Which would be a “good news/good news” thing.