It is important for everyone working or advocating around energy to understand how the power mix is expected to change in the next 20 years or so. To that end, I’ve pulled a chart out of the consulting firm Black & Veatch’s “Energy Market Perspective,” an analysis of U.S. energy markets that they update every six months. They bill it as “analytically neutral,” neither conservative nor aggressive. There’s an element of pretense to that, but I do think we can take this as something close to the average expectation of U.S. analysts.

It’s entirely possible that this is wrong. In fact, it almost certainly is. B&V bases it on a series of assumptions about natural resources, regulations, and the economy that could turn out to be off in any number of ways. As B&V says, “uncertainties abound.” All that caveating out of the way, here’s the mainstream view on how the U.S. power sector will change:

For those who want to dig in further, some thoughts and more graphs below.

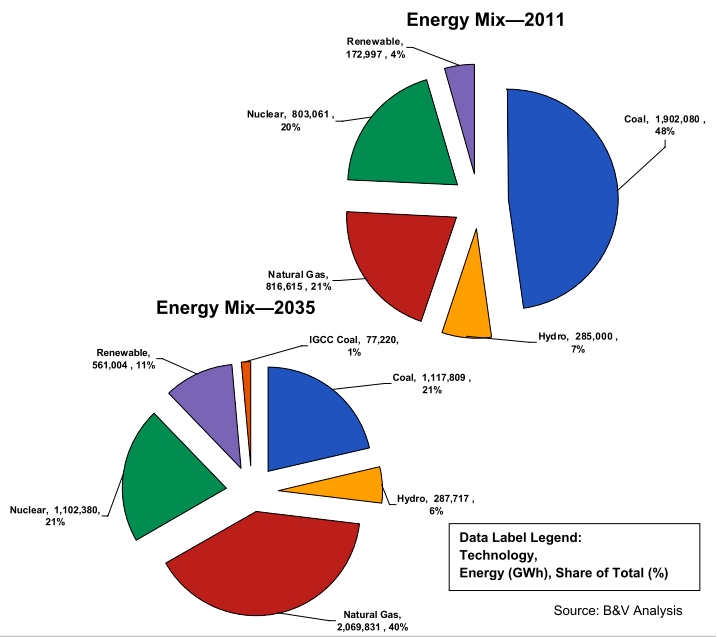

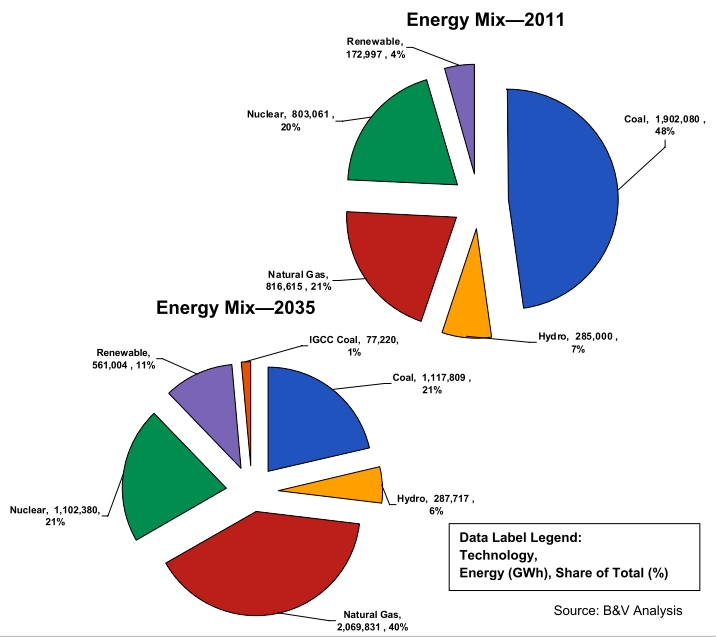

So, the main thing to notice is that natural gas is the big story. Coal is going to drop out, natural gas is going to step in. Renewables will more than double, but they’ll still be half of coal, half of nuclear, and a quarter of gas. Also worth noting: Nobody expects any significant “clean coal” any time soon. Here’s another way of looking at the same results:

Natural gas demand will stay roughly steady in the residential, commercial, and industrial sectors — it’s power generation that will drive demand, which is expected to rise from 60 billion cubic feet a day to 80 billion.

Where will it come from? Conventional reserves will decline in both Canada and the U.S. Liquefied natural gas (LNG) imports will increase a bit, as will Canadian unconventional and some new supply in Alaska. But by far the biggest story here is the huge rise in unconventional (shale) natural gas, drilled through the increasingly controversial method of hydraulic fracking. As B&V says, large-scale growth in shale will require satisfactory resolution of the water issues it raises, which are complex and uncertain. (See: fracking fluid spell in Pennsylvania.)

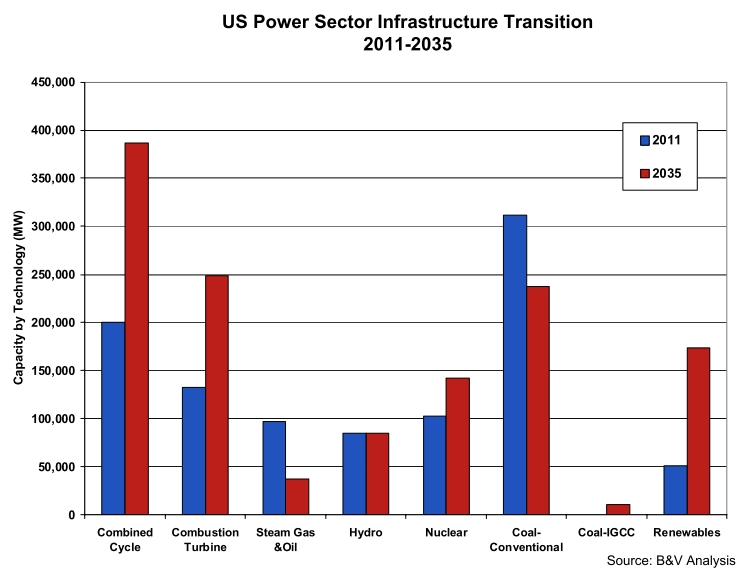

Meanwhile, coal’s going to get hit pretty hard by upcoming regulations (a subject I’ve written on quite a bit). B&V expects 52,000 MW, or 16 percent of the U.S. coal fleet, to retire:

That’s roughly in line with other recent projections. The Brattle Group puts it at 50,000 MW, while FBR Capital Markets puts it at up to 70,000.

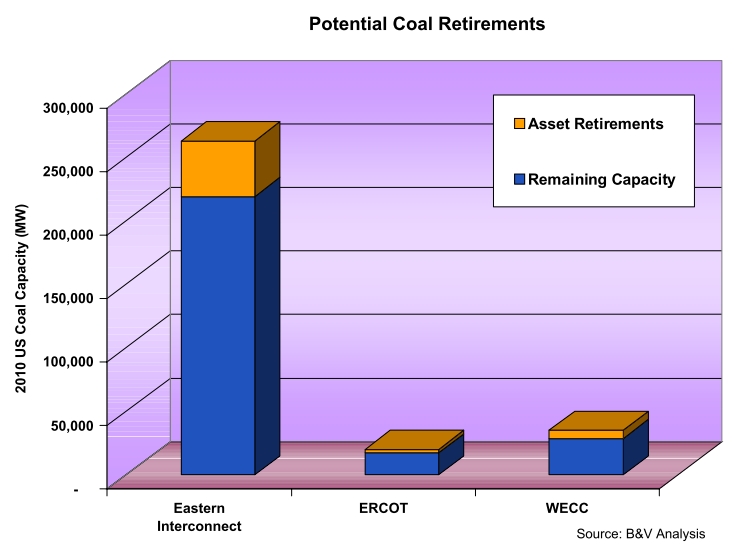

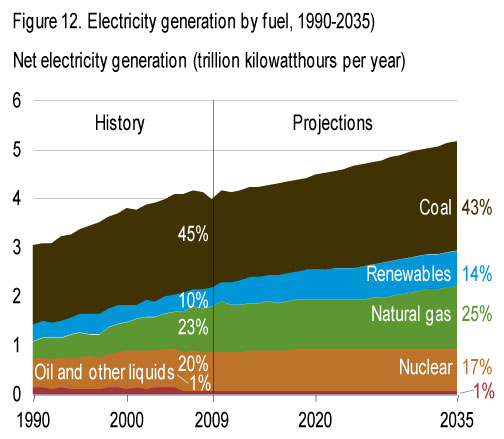

So, that’s the Black & Veatch perspective. As a final note, check out what the U.S. Energy Information Administration (EIA) projects in its Energy Outlook:

This is a more optimistic picture for coal and much more modest for natural gas and renewables (which are lumped with hydro). I think it’s insanely conservative. If you ask me, I think coal will drop farther and renewables rise faster than most current projections show.

And of course, it’s in our power to help that along!