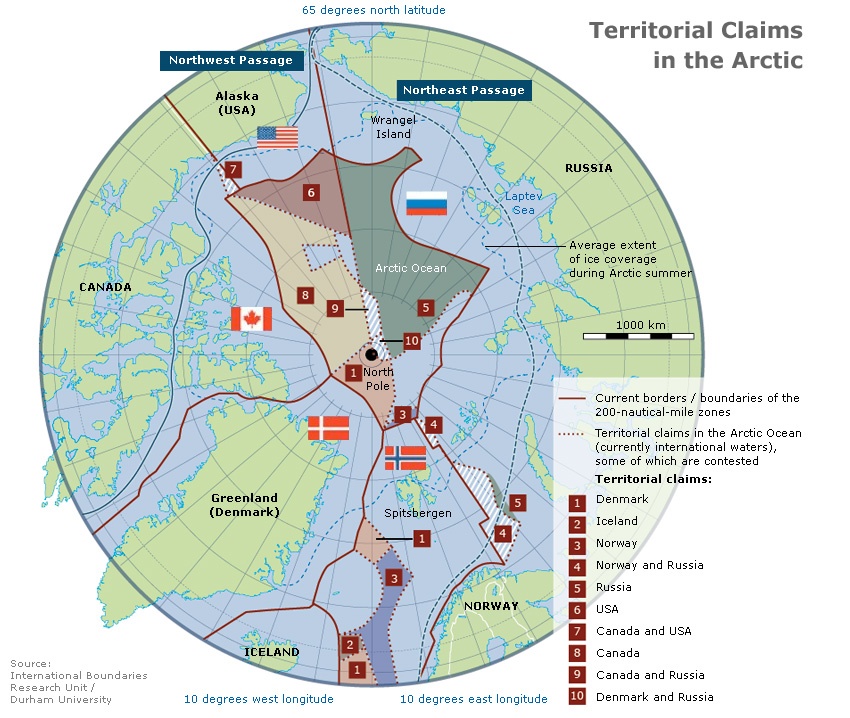

Quartz (a new business news website, not the rock) raises a good point about oil drilling in the Arctic: It’s still much more expensive than drilling in most other places.

Little is known about the average cost of producing oil or gas in the Arctic, since none of the fields under scrutiny has been developed. But a geologist from the United States Geological Service who evaluated drilling in Greenland estimated that it would require prices of $100 to $300 a barrel and more to extract the larger volumes that are attracting company interest. That’s way above the marginal cost of existing oilfields.

Meanwhile, a boom is under way in less-expensive drilling locales—Mozambique, French Guiana and Angola among them, where break-even production costs are less than $70 a barrel. Given that plans for this drilling stretch into the 2020s, activity in the Arctic is likely to be far in the future.

The prompt for Quartz’s story was the $100-$300 estimate mentioned in the first paragraph. From Der Spiegel:

[T]he amount of oil that can actually be pumped out of [the Arctic] is likely to be significantly lower than previous estimates indicated, according to [unpublished interim findings by the U.S. Geological Survey]. Assuming production costs of up to $100 per barrel, only 2.5 billion barrels of oil could be lifted, according to the USGS calculations — and only with a 50 percent probability.

In order to reach further reserves, companies would have to spend much more. Even based on outlandish exploitation costs of $300 per barrel, only 4.1 billion barrels could be raised, with the same 50 percent probability. “And that is before paying a cent of tax or making any profit,” says [geologist Don] Gautier.

The figures are based on statistical calculations and should therefore be treated with caution. But they indicate that only a fraction of the oil and gas believed to be in the Arctic could likely be exploited at economically viable costs.

This has long been one of the best arguments for investment in renewable energy: Remaining fossil-fuel reserves are becoming increasing expensive to exploit. Renewables will likely only get cheaper.

That’s not even including the costs incurred when something goes wrong. The CEO of France-based Total suggested yesterday that such risk would be prohibitive to Arctic development. It took months to halt the BP spill along the heavily populated Gulf Coast — and more than two years later, cleanup is still incomplete. Imagine how hard it would be to clean up a spill near the North Pole.

None of this means that companies aren’t still pushing to drill in the Arctic. It just means that an already questionable enterprise is even more questionable than we might previously have suspected.