Joachim S. MüllerThe fennec fox will be your adorable guide for part 2.

Electric utilities! They are to me what sideboobs are to Huffington Post — I just can’t stop writing about them.

A couple of days ago I posted a brief introduction to utilities and the way they currently work. The take-home lesson is that current regulations give utilities every incentive to build more infrastructure and sell more power, but very little incentive to cut costs or innovate.

The situation is no longer working for us. We need rapid, large-scale innovation in low-carbon electricity systems, and we need it now. It’s time to fundamentally rethink the utility business model.

I hope you’ll indulge me just one more scene-setting post before I finally get to the long-awaited post on solutions. Today we’re going to take a look at the way electricity has typically gotten from generator to customer, the electricity “value chain,” so we can better understand which parts need to change. This is a complicated topic, to say the least, but I’ll do my best to break it down in the simplest terms I can, with the proviso that I’m glossing over lots and lots of important details.

The electricity value chain

OK. Think of the electricity value chain as having three basic links:

Joachim S. MuellerThe fennec value chain.

- Generation: These are the power plants that generate (most of) the electricity.

- Transmission and distribution (T&D): These are the poles and lines that carry electricity to customers, both high-voltage long-distance transmission lines and lower-voltage local distribution lines, along with all the substations and transformers that help the power along its way.

- The distribution edge: This one takes a little explaining. The point where the grid meets the customer is the power meter, which tracks the customer’s electricity consumption for billing purposes. Most of the time that meter is on a house or building, though sometimes, in the case of “microgrids,” there is one meter for a whole collection of buildings. Everything that goes on in the building(s), before net consumption is tallied up by the meter (think rooftop solar panels, smart appliances, electric cars, energy storage, energy management software, etc.), happens “behind the meter.” Everything at and behind the meter is known as the “distribution edge.”

In the beginning, most utilities, especially investor-owned utilities, were “vertically integrated,” meaning they owned and operated the entire value chain, from the power plant to the meter. At the time, electricity was viewed purely as a commodity; the utility’s sole job was to get as much of it as possible to customers as cheaply as possible. What customers did with it on their side of the meter was of little concern, as long as they kept using more of it.

In the electricity-as-commodity model, it’s all about economies of scale. The bigger you make the power plants, the cheaper the power. That’s why utilities were monopolies: so they could maximize the benefits of scale.

The physical expression of the commodity model is the “hub and spoke” electricity grid, with large centralized power plants sending power out long distances to surrounding customers. It helps to think of it as a hydrological system. Electricity springs from power plants and flows down great rivers of transmission cables into the smaller canals and streams of a distribution system. In this system, power flows only one way, from hubs outward. It’s like gravity pulling water downhill.

Since there is no way to store the power, there must always be enough flowing into the streams to sate customer thirst. When demand surges in certain areas at certain times, grid operators fire up more power plants to supply the extra need. The plants that are always running are “baseload,” usually coal, nuclear, or hydro. The ones that get fired up for the busy daytime hours, the “mid-merit” plants, are typically natural gas combined-cycle plants. And then when demand “peaks” for a few hours, usually in the afternoon and again when people come home in the evening, they fire up the more expensive oil or gas “peaker plants.” There must always be enough power plants online — enough “generation capacity” — to supply well in excess of any expected peak, establishing “reserve margins” of 15 to 20 percent. That’s how reliability is assured: The canals and streams are kept full at all times.

Previous utility reforms

yvonne nPrevious utility reforms!? This fennec fox is all ears.

In 1978, seeking to open up the generation side of things to smaller and cleaner power plants, Congress passed the Public Utility Regulatory Policies Act, or PURPA. (There’s some talk that it could be used to drive a new wave of distributed renewables, but the details are complicated and not essential to the story I’m telling.)

More significantly, in the 1990s, there was a wave of regulatory restructuring that “unbundled” generation from transmission and distribution. These changes created competitive wholesale and retail power markets on the generation side, but left transmission and distribution — getting power to customers and billing them for it — to regulated utilities.

(This is often referred to as “deregulation,” but I think that’s a misleading term; the whole industry remains regulated from top to bottom.)

Restructuring was proceeding at a brisk clip until California happened in 2000-2001. Remember that? Enron? Maximum fubar? More or less overnight, “deregulation” and “consumers get f*cked” became synonymous in the public mind and restructuring of the utility industry froze in place.

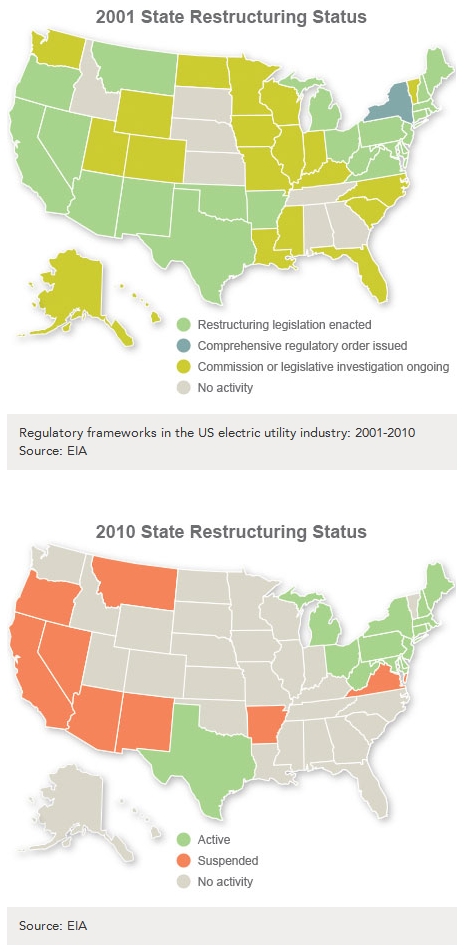

I stole these handy maps from American Electric Power:

The top map shows all the states that were investigating or implementing restructuring in 2001. On the bottom you see the situation in 2010 — only Texas and the Northeast have stuck with restructuring. (Arizona is apparently looking into it.)

So we’re left with a mix of public and investor-owned utilities, some vertically integrated and some with only T&D, and just for fun, some have undergone decoupling (which we’ll talk about in a later post) and some haven’t. All these categories overlap. Oh, and some holding companies own both independent power producers and regulated utilities. It becomes very difficult to make generalizations or simplifying assumptions about utilities — and it also becomes super-boring.

I think I speak for all Americans when I say that contemplating the post-partial-quasi-halfway-restructured U.S. electricity industry gives me an intense, nagging pain just above my left eye socket. This is what happens when you bang into the force field of tedium.

What has changed in electricity

So let’s take a few steps back and think about what’s changed in electricity. The traditional utility model made sense in the context of rapidly rising demand, economies of scale, and blissful climate ignorance. But today, two big counter-trends loom large.

Joachim S. Müller“Wake up. He’s not done yet.”

First, climate change has become an urgent priority. U.S. policy may look stuck right now, but action on climate is inevitable, and utilities know it. Doing what really needs to be done on climate would involve an immediate and rapid scaling up of low-carbon power along with aggressive, system-wide pursuit of conservation, energy efficiency, and demand response.

Second, electricity is beginning to behave less like a commodity and more like information. It’s no longer a one-way affair, from generator to meter. Now it’s hundreds of thousands of small, distributed generators (think rooftop solar panels) sharing with each other on local distribution networks. Electricity is increasingly managed: monitored, fine-tuned, time-shifted. Big customers, and increasingly small ones too, want energy services rather than raw kilowatt-hours. They want to know how to tie together solar panels, microturbines, energy management software, smart appliances, electric cars, batteries and other storage, and energy-effective design into smart systems. They want to know how to create microgrids that incorporate electricity generation and management and can “island” off the larger grid in case of emergency or attack. They want all the pieces of the electricity puzzle to fit together in a way that reduces consumption, minimizes waste, and maximizes resilience. Or if they don’t want it yet, they’ll want it soon.

That’s where things are headed: an electricity grid, particularly on the distribution side, that is infused with information technology and looks a lot like the internet. (This is usually referred to as the “smart grid,” though it extends beyond just the grid. Al Gore tried to make “enernet” catch on, but it never really took.)

So, two changes: the low-carbon imperative and the shift from a dumb one-way system to a smart, multi-directional network. Both point above all to the need for innovation, not just in technology but in business practices, financing models, and investment strategies.

The best tool we currently know of for producing rapid innovation, product development, and jobs is a competitive market. That’s what’s missing.

Now, I mentioned before that some markets have restructured to provide for competition on the generation side. I think that’s all to the good, and it should continue. But what’s really needed today is competitive markets on the distribution edge. It makes no sense to have utilities hostile to distributed energy and local energy management. We need entrepreneurs thinking about how to package energy services in new ways for customers, and we need utilities not just to stop impeding them or to get out of their way, but to actively empower them.

Joachim S. MüllerGet ready for part 3.

But we still need the reliability and stability with which regulated utilities have traditionally been charged. How can utilities provide that, make sure the grid keeps humming, while also structuring competitive markets on both the generation side and the distribution edge? That’s that knotty subject that we will (finally) tackle in my next post.