Photo by Shutterstock.

The installed cost for residential solar power systems in Germany — that is, installations of up to 10 kW — is considerably less than in the U.S. Why? That’s the subject of a fascinating analysis [PDF] from sharp minds at Lawrence Berkeley National Laboratory.

The researchers conducted a survey of German solar installers and reviewed public and private consultant data to get a handle on the German market. The answers they found aren’t as obvious as you might think.

For one thing, it isn’t mainly about the hardware, or the panels themselves. Those costs are comparable. The difference comes almost entirely in “soft costs” — customer acquisition, labor, interconnection to the grid, and the like. Long story short, when it comes to residential solar, in the U.S. it costs a little bit more to do … just about everything.

Let’s look at some graphs! (All these graphs come from the paper — you can find sources documented there.)

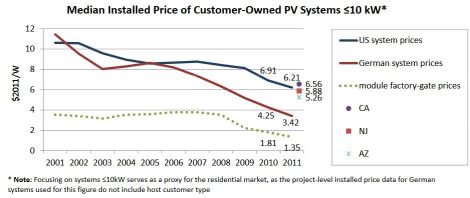

Here are installed costs of small PV systems in the U.S. and Germany:

Germany passed us in the mid-00s and hasn’t looked back. As of the fourth quarter of 2011, the difference in installed price was about $2.8 per watt. That’s a big chunk.

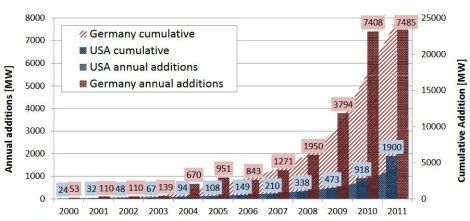

The first and most obvious explanation for the difference might simply be that Germany has installed a lot more solar than us. In 2011, they installed four times as much as us and their cumulative total is five times what we have.

With a larger market comes economies of scale, right?

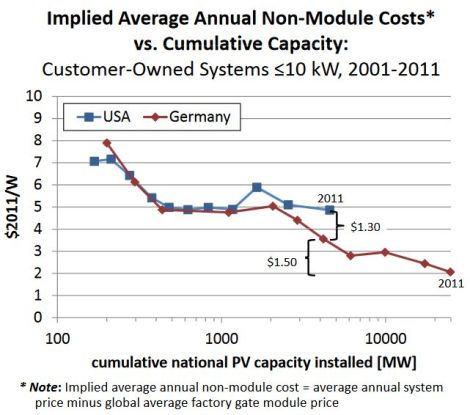

But it turns out market size only explains about half the differential. The following chart shows how soft costs have changed with total capacity in the respective countries:

As you can see, we’re well behind Germany in capacity, but our costs aren’t even as low as theirs were when they had our same total capacity. Crudely speaking, there’s still a $1.30 per watt differential in costs to explain away.

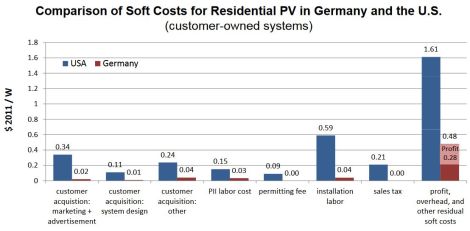

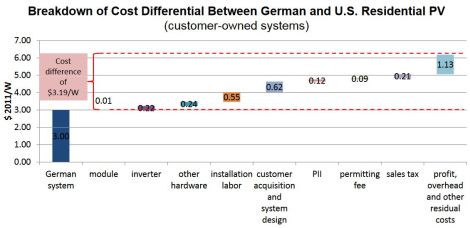

That’s where the Lawrence Berkeley survey comes in. Long story short, it looks like just about every single step in the process costs a little more in the U.S. Here are soft costs, broken out:

(PII is permitting, interconnection, and inspection.)

Here’s a breakdown of the constituents of the cost differential and how they add to U.S. costs:

U.S. projects take longer to develop and longer to install, as well. Whee!

Most of those differences can be attributed to policy, either directly or indirectly. PV installations don’t pay sales tax in Germany. Rules governing permitting and interconnection are much simpler. And of course there’s the biggie, which is German feed-in tariffs, whereby customers who install rooftop solar are guaranteed a high rate of return for the lifetime of the system.

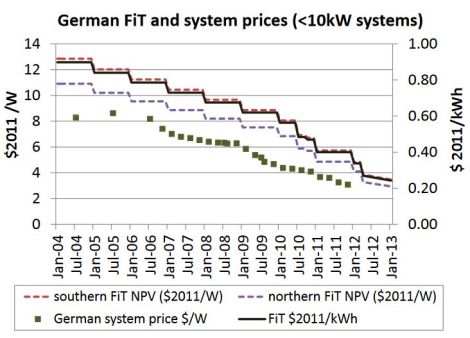

But note how the feed-in tariffs are structured:

By design, they decline every year. This has a dual effect. First, it is always pushing German consumers to act immediately, before incentives decline, thereby insuring a stable market for installers and reducing customer acquisition costs.

And second, it keeps installers competing ruthlessly to reduce costs so that they can maintain their profit margin even as tariffs decline. This is what I mean by “indirect effects.” The way German solar support is structured generates more competition, more discipline, and lower profit margins for solar installers. That’s why installers so insistently and successfully push to squeeze out excess costs.

Again: the way Germany structured its solar incentives has both expanded and disciplined the market. Capacity is up, costs are down. That is part of the design. Incentives do not have to make market participants lazy and dependent. They can do the opposite.

By contrast, U.S. solar incentives have been sporadic, inconsistent, and indirect, working through the tax code, state mandates, or big chunks of money grated to individual companies. That kind of sloppy, scattershot approach does not discipline the market. And it shows! Germany’s not only working faster than the U.S. on distributed energy, it’s working smarter.

Perhaps we could learn the lesson and pass some feed-in tariffs of our own! Crazier things have happened.