Fracking proponents like to use an evocative economic metaphor in talking about their industry: boom. The natural gas boom. Drilling is exploding in North Dakota and Texas and Pennsylvania. Only figuratively so far, but who knows what the future holds.

The Post Carbon Institute, however, suggests in a new report [PDF] that another metaphor would be more apt: a bubble, like the bubbles of methane that seep into water wells and then burst.

PCI presents the argument in its most basic form at ShaleBubble.org:

[T]he so-called shale revolution is nothing more than a bubble, driven by record levels of drilling, speculative lease & flip practices on the part of shale energy companies, fee-driven promotion by the same investment banks that fomented the housing bubble, and by unsustainably low natural gas prices. Geological and economic constraints — not to mention the very serious environmental and health impacts of drilling — mean that shale gas and shale oil (tight oil) are far from the solution to our energy woes.

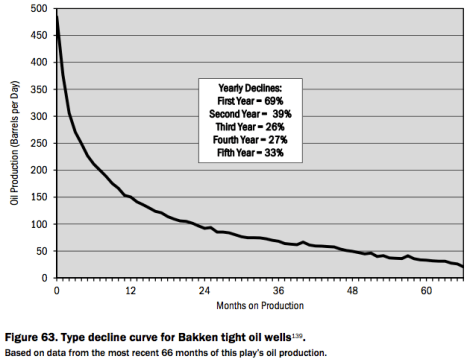

PCI’s strongest argument may be on the rapid depletion of drill sites. The case is made using the data in this graph, showing the amount of oil extracted over time from wells in the Bakken formation in Montana and North Dakota.

Bakken wells exhibit steep production declines over time. Figure 63 illustrates a type decline curve compiled from the most recent 66 months of production data. The first year decline is 69 percent and overall decline in the first five years is 94%. This puts average Bakken well production at slightly above the category of “stripper” wells in a mere six years, although the longer term production declines are uncertain owing to the short lifespan of most wells.

If five years after a well is drilled it’s only returning 6 percent of its peak production, it becomes harder to justify spending money to operate the well. With less production, more wells need to be drilled.

This steep rate of depletion requires a frenetic pace of drilling, just to offset declines. Roughly 7,200 new shale gas wells need to be drilled each year at a cost of over $42 billion simply to maintain current levels of production. And as the most productive well locations are drilled first, it’s likely that drilling rates and costs will only increase as time goes on.

This is another version of the production problem in the coal industry, but on a much shorter timeline. Wells run out, requiring more wells, fast.

PCI also argues that the low price of fracked fuels, usually attributed to the abundance of supply, is unsustainable too. Taking issue with claims that shale production is a job creator and economy builder, the organization wrote a separate report [PDF] outlining how it believes the marketplace has been manipulated.

- Wall Street promoted the shale gas drilling frenzy, which resulted in prices lower than the cost of production and thereby profited [enormously] from mergers & acquisitions and other transactional fees.

- U.S. shale gas and shale oil reserves have been overestimated by a minimum of 100% and by as much as 400-500% by operators according to actual well production data filed in various states.

The timing of this report is important. As we noted last week, natural gas prices (particularly for electricity producers) are again increasing. Natural gas has been touted as a bridge fuel from carbon-heavy coal to renewables. If the price of natural gas is being kept artificially low and if production is necessarily going to taper off, that clung-to promise looks remarkably shaky.

Or, to use PCI’s original analogy: The bubble may be about to burst.

Fracking well in Scott Township, Penn.