Adapted from a post at ad cerebrum.

Adapted from a post at ad cerebrum.

Renewable portfolio standard (RPS) legislation is quickly becoming the most popular way for states to show their concern about climate change. According to the Database of State Incentives for Renewable Energy, 29 states (plus D.C. and Puerto Rico) have binding RPS legislation in place as of June 2011, while another eight have non-binding RPS goals. The details of these policies vary wildly in terms of the target renewable penetration and the date by which that penetration must be reached, but it seems likely that all will result in additional renewable penetration relative to business-as-usual.

Yet there is considerable uncertainty, among green energy advocates and detractors alike, about the cost of achieving this increase in renewable generation. Advocates point to studies that show wind’s cost-competitiveness with natural gas-fired generation and claim RPS policies will have little or no effect on consumer rates, while detractors cite the intermittency and generally low availability of wind and solar (as compared to a conventional fossil-fueled plant) as evidence that RPS policies will cause rates to skyrocket.

A recent article in Midwest Energy News (MWEN) took a look at the experiences of Midwest utilities to date and concluded that

… the most comprehensive studies to date and the experience of utilities so far suggest that, by and large, renewable portfolio standards haven’t had a significant impact on customers’ bills. Still, there’s room for more study, and in some states, including Minnesota, there remains relatively little data about the ratepayer impact of renewable policies.

The article acknowledges that there are plenty of studies on either side of the issue, and specifically mentions the following data points:

- Minnkota Power Cooperative locked in wind contracts to cover its renewable energy needs for 25 years when Minnesota’s Renewable Portfolio Standard was passed in 2007. Since then, demand and market prices have both decreased, and it now has a surplus of wind generation that it is selling at a loss. According to the article, Minnkota is “making up the difference with a half-cent per kilowatt-hour surcharge on its customers.”

- A 2008 Lawrence Berkeley National Lab (LBNL) study [PDF] found the rate impacts of RPS programs in force in 2007 to be near or below 1 percent for the 12 states in which renewable energy credit prices could be used to estimate those impacts. LBNL is updating the report but does not expect the conclusion to change.

- A 2009 EIA study [PDF] on a national RPS, according to MWEN, “projected no impact on rates through 2020, followed by a less than 3 percent increase by 2025. By 2030, however, it projected little difference in rates with or without a national renewable mandate.” More on this study below.

- A Minnesota Free Market Institute study [PDF] estimated a rate increase between 9 and 37 percent depending on the assumptions. This study criticized the EIA resource cost estimates as “a rather optimistic picture of the cost and generating capacity of renewable electricity, particularly for wind power.” More on this study below as well.

- Xcel Energy estimates a $0.003/kWh increase in 2025 from complying with Minnesota’s RPS, compared to the case in which it stops adding new wind capacity in 2012. Xcel projects 19 percent of its load will be met by renewables in 2012, most of the way to its 30 percent requirement in 2020, though that percentage will decline as load grows from 2012-2020.

- Representatives from Otter Tail Power and Minnesota Power estimated that renewable additions to date did not have a significant impact on power costs.

- Great River Energy in Wisconsin estimated a 1.8 percent rate increase due to wind energy purchases.

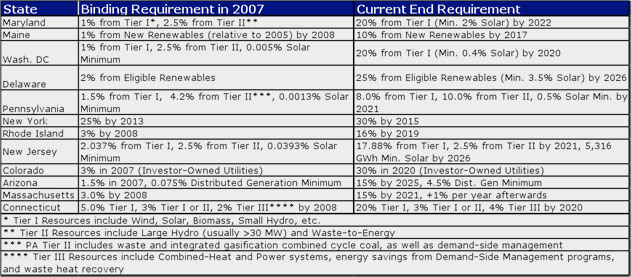

First, a few comments on some of the studies. The LBNL study looked at rate impacts in 2007 rather than over the life of the RPS requirement. This means that it only captures the effect of progress to date, which in many cases is relatively modest when compared to the final requirements of the RPS programs. The table below shows a summary of the binding requirement in 2007 and the currently legislated final requirement in each state for which LBNL calculated a rate impact:

Click for a larger version. Data summarized from www.dsire.org, see site for more complete details.

Click for a larger version. Data summarized from www.dsire.org, see site for more complete details.

Given the relatively modest requirements in 2007 compared to the final requirements of these RPS policies, it is unsurprising that there has been relatively little impact on rates to this point. Though the modest rate impacts found by LBNL are favorable, it would be hard to argue that these rate impacts are truly indicative of the total impact once the full requirements are met.

The bigger problem is MWEN‘s characterization of the EIA study. While they got the percentages right, they failed to note the assumptions of the underlying case to which the national RPS was compared. The EIA study calculated that a 25 percent national RPS would have no impact on rates in 2020 relative to existing state RPS standards. The EIA predicts that existing state policies will result in 11 percent of the national mix in 2025, meaning that the national RPS would not actually increase renewable penetration at all in 2020. In 2025, when a national RPS would increase nationwide renewable penetration to 17 percent (if credits for efficiency programs are allowed) or 21 percent (if they are not), rates would increase by 2.7 percent or 2.9 percent, respectively. This result is substantially different than that implied by the MWEN article.

It’s also unclear the extent to which the EIA included the cost of transmission necessary to access these resources, though my reading of the study indicates that these costs were not fully included. Given the extensive transmission that will likely be necessary to connect remote renewable resources to load, this could have a significant impact on the cost of meeting these RPS requirements. This study [PDF] conducted by Energy and Environmental Economics, Inc. for the California Public Utilities Commission estimates that the new transmission required to deliver renewable energy to loads will increase the cost of those renewables by about 10 percent. (I worked on this study during my time at Energy and Environmental Economics, Inc, or E3. This article represents my own views, not those of E3.)

On the other end of things, the 9 to 37 percent range predicted by the Minnesota Free Market Institute relies on some questionable assumptions as well. The languag

e isn’t totally clear (see page 16 of the report linked above), but it appears that they penalize wind for its lower availability relative to conventional coal and gas resources despite the fact that the levelized cost of wind should already account for this. This assumption would have a drastic effect on the cost of meeting an RPS.

The MWEN story has some issues, but provides a good starting look at the issue. My reading of the examples they cite is that there are mixed results so far: some utilities are seeing modest price increases, while others do not. I would say that it hedges pretty well and avoids drawing big sweeping conclusions about the long-term impact of these RPS policies. But a repackaging of this article posted here at Grist a few weeks ago was not so cautious:

Many states have “renewable portfolio standards” mandating that they produce a certain percentage of their electricity from renewable sources. Libertarian and tea bag-ish critics of these standards have said that they will cause electricity rates to “skyrocket.”

But the numbers are in, and guess what? Science says the critics are wrong.

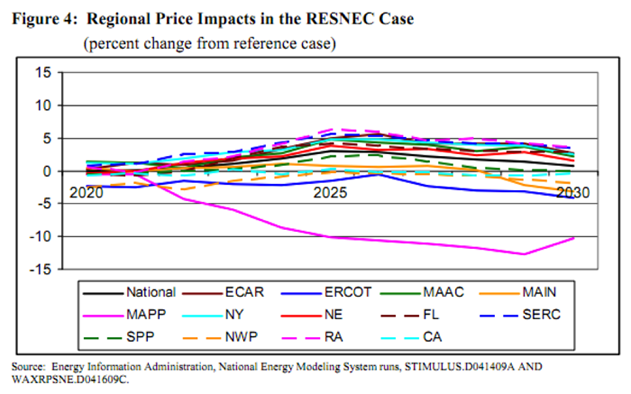

I don’t quite agree with this, for a few reasons. The first is that it confuses the small impacts seen so far with the impacts of the RPS policies when they are fully realized. The second (and much more significant) is that it takes the result of a regional look and implies that it holds for the nation as a whole. MWEN, as its name implies, focuses on energy news in the Midwest. The Grist story makes no mention of the regional nature of this story, which is significant because the Midwest is likely to be the least affected by RPS policies due to the extensive wind resources in Minnesota and the Dakotas. The below graph from the EIA study (page 8) I talked about above shows the regional impacts that compose the estimated 2.9 percent impact of a national RPS (RESNEC stands for “Renewable Energy Standard with No Efficiency Credits):

See that pink line that is way below all of the other ones? That shows the results for the Mid-Continent Area Power Pool, which is composed of Minnesota, most of the Dakotas, and parts of Iowa, Montana, and Wisconsin. These states, not so coincidentally, are the target audience for MWEN. This is essentially the least representative area of the country for looking at the cost impact of RPS policies, so experiences provide little indication as to what will happen in the rest of the nation.

So what?

This doesn’t mean that I think that we should abandon RPS policies and continue generating with the cheapest, dirtiest energy sources available. I’ve worked in energy consulting field for the last four years, and I firmly support efforts to increase the use of renewables in our energy mix. But studies that say that we can do this without increasing the amount that people pay their utility every month worry me. My experience with policymakers and utilities has convinced me that these changes will not be free, and may be more expensive than lawmakers thought they were when they passed these bills. When this happens, people will start blaming renewables that didn’t live up to their “no impact on rates!” expectations. This hurts the long-term viability of these policies, which I believe to be a very important step on the way to drastically reducing emissions and reducing the dangers of climate change. We’ve already seen some of this in California with Proposition 23 in 2010, which sought to kill the bill requiring reductions in statewide greenhouse-gas emissions under the guise of suspending it until unemployment decreased. Luckily, Prop 23 was voted down.

In my opinion, to give these policies (and renewables) the best chance at success, we should not pretend that renewable policies will not affect electricity prices. Rather, we should acknowledge that these policies will likely increase the cost that people see on their monthly electricity bills, while arguing that the costs of inaction are significant enough to be worth it.