About a year ago, when the last episode of Gas Price Mania was gearing up, Sen. Jeff Bingaman (D-N.M.) gave an extraordinary speech on the floor of the Senate. He explained that the price of gasoline is tied to the price of oil, the price of oil is tied to events outside America’s control, and the only way to reduce vulnerability to gasoline and oil prices is to use less gasoline and oil. It’s a simple truth, rarely spoken among national politicians.

About a year ago, when the last episode of Gas Price Mania was gearing up, Sen. Jeff Bingaman (D-N.M.) gave an extraordinary speech on the floor of the Senate. He explained that the price of gasoline is tied to the price of oil, the price of oil is tied to events outside America’s control, and the only way to reduce vulnerability to gasoline and oil prices is to use less gasoline and oil. It’s a simple truth, rarely spoken among national politicians.

Last week, Bingaman did it again, using handy charts blown up on poster board. First, he explained that the U.S. has very little control over oil and gasoline prices:

Let me state this as clearly as I can — what I believe is really without dispute among experts. That is, we do not face cycles of high gasoline prices in the United States because of a lack of domestic production. We do not face these cycles of high gasoline prices because of lack of access to federal resources, or because of some environmental regulation that is getting in the way of us obtaining cheap gasoline.

As was made clear in a hearing we had in the Senate Energy Committee in January, the prices that we are paying for oil and the products refined from oil, such as gasoline, are set on the world market. They are relatively insensitive to what happens here in the United States with regards to production. Instead, the world price of oil and our gasoline prices are affected more by events beyond our control, such as instability in Libya last year or instability in Iran and concerns about oil supply in Iran this year.

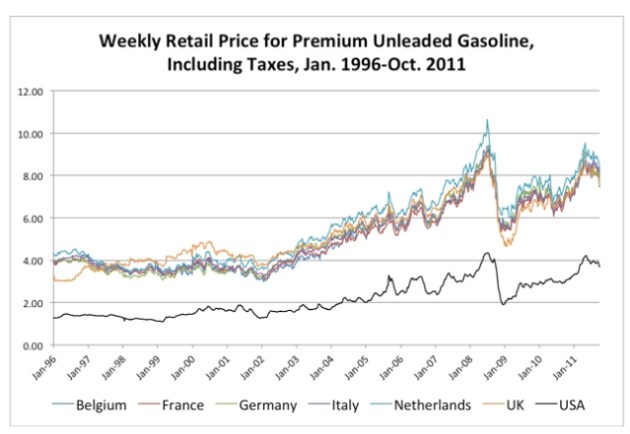

Second, the price of gasoline fluctuates with the price of oil, across all countries:

(Side note: as the chart shows, U.S. gas prices are actually extremely low by developed world standards; we pay fewer taxes on gas.)

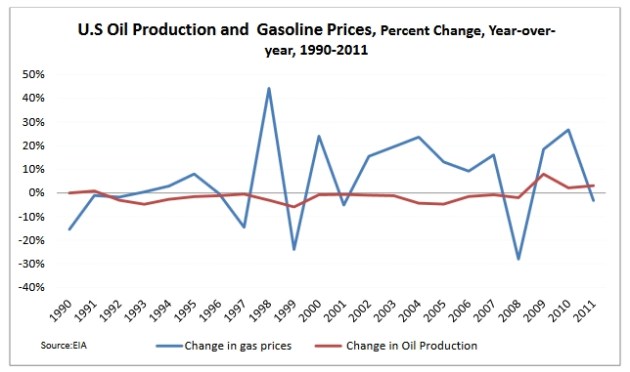

Third, the price of gasoline bears very little relationship to U.S. oil production, for the simple reason that U.S. oil production is a small fraction of the world’s total:

See any relationship? Me neither.

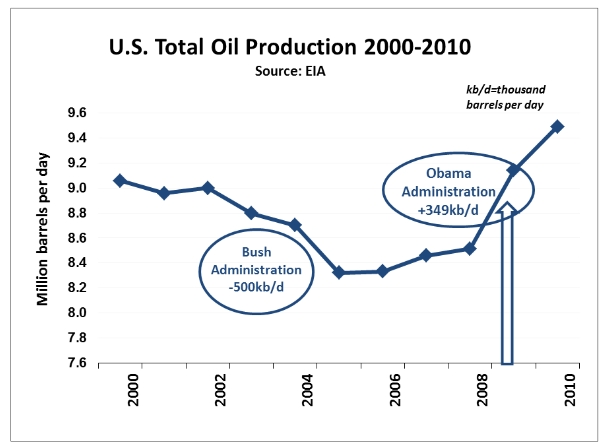

Fourth, despite what you hear from conservatives, there is no turn against domestic fossil-fuel extraction under Obama. U.S. oil production is rising sharply (and imports falling):

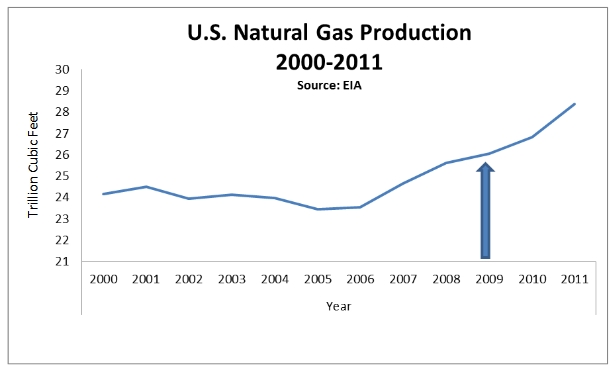

U.S. natural gas production is also rising, making the U.S. the world’s lead producer (we just passed Russia):

So the whole notion that Obama is against fossil fuels, or catering to his green base, is an absurd fantasy. I wish!

This explosion of fossil fuel extraction might boost the U.S. economy for a while, says Bingaman, but it is still not enough to substantially dent world oil supply and so not enough to exert any control over gasoline prices. (Newt Gingrich notwithstanding.) There’s only one solution to that problem:

If we want to reduce our vulnerability to world oil prices and to volatility of world oil prices, the most important thing we can do is to find ways to use less oil.

Say it again!

The long-term solution to the challenge of high and volatile oil prices is to continue to reduce our dependence on oil, period.

[claps, sways, waves hands in the air]

This is much more plainly put than what we usually hear from Obama, though the energy speech the president gave last week at the Daimler plant in Mt. Holly, N.C., had this:

We need to invest in the technology that will help us use less oil in our cars and our trucks, in our buildings, in our factories. That’s the only solution to the challenge. Because as we start using less, that lowers the demand, prices come down. It’s pretty straightforward. That’s the only solution to this challenge. [my emphasis]

The only solution. So why aren’t politicians competing to see who can lower oil consumption more? Republicans are going after programs they once supported to seed the advanced battery and auto industries. They’re fighting to protect oil subsidies and slash transit funding. They’re scolding the military for trying to use less oil. They love oil, love oil companies, and love sprawl.

Dems, meanwhile, have managed to hang tough on fuel-efficiency standards and fight off serial attacks on EPA, for the most part anyway. But that’s about it. When gas prices go up, they panic, and it’s the usual cacophony about speculators and strategic oil reserves and Big Oil profiteering.

Into this pall of ignorance and fear, Bingaman has once again cast a little light. It’s too bad he’s retiring this year. He’s one of the few senators left, maybe the only one, with deep knowledge of energy policy, the ability to forge bipartisan coalitions, and the power to get things done. Without him, the Senate will be much dumber on energy, and that, friends, is saying something.