This post was written by Casey Bell, senior economic analyst at the American Council for an Energy-Efficient Economy and a contributing author at the ACEEE blog.

With unemployment hovering at a stubborn 9 percent, it is no wonder that job creation has become a hot topic. It is nearly impossible to read the news without encountering an article describing how a policy or industry creates a given number of jobs. Often, job creation is used as a justification for public sector investment in a program, policy, institution, or project. You may also see numbers from the energy industry proclaiming the ways their particular resource creates jobs. These claims, however, rarely or clearly explain how job creation assessments are carried out and what the jobs numbers actually mean.

For many years, ACEEE has done analyses and written reports on the role of energy efficiency in creating jobs. Recently, we released a fact sheet, “How Does Energy Efficiency Create Jobs?” [PDF] that seeks to demystify how net job impacts should be estimated, and demonstrate how investments in cost-effective energy efficiency improvements can yield a net positive benefit for the nation’s overall employment.

A recent New York Times column raised a question on whether or not anybody, be they politicians or CEOs, can actually “create” jobs. The article points out that in many cases, policies or investments are not creating new jobs but, at best, are simply shuffling them around amongst different industries, and asserts that “jobs are not the cause of a healthy economy; they’re a byproduct.” It concludes that we need to find a way to train Americans for jobs that will help them earn a living wage, which is an argument of merit. Yet, there are also ways we can streamline our energy use and alter our spending patterns to free up additional funds to support higher levels of employment overall, as well as promote a healthier and more robust economy.

Net jobs vs. gross jobs

Energy efficiency, for the most part, creates net gains in employment (defined below), which extend well beyond the jobs that shift among industries. It does so in two ways. First, an initial effort or investment will create opportunities for workers (e.g., an investment in infrastructure improvements). This stimulates opportunities for the construction sector and industries that support it. Second, energy bill savings that stem from the initial effort or investment will free up the funds to support additional employment throughout the economy. In other words, energy efficiency investments not only inject funds into the economy to stimulate job creation, but they also have the potential to alleviate systemic unemployment by reducing energy bills and making those dollars available to support broader economic activity.

Readers should be aware that other analysts often opt to report job creation in terms of gross jobs (defined in Table 1) without assessing impacts relative to a business-as-usual case — in other words, the number of jobs that would have been supported on average across all sectors of the economy by that same investment amount. This approach ultimately inflates the estimates by neglecting to provide context (i.e., a power plant may support 100 jobs, but the economy might be able to support 170 jobs if funds were not required to keep the plant running). In this scenario, saying that the power plant creates 100 jobs is misleading.

How does energy efficiency impact employment and create jobs?

To understand how a cost-effective energy efficiency investment can create net jobs, it is important to consider how efficiency diverts funds away from less labor-intensive sectors of the economy in order to support greater overall employment. On average, $1 million spent in the U.S. economy supports approximately 17 total jobs (including direct, indirect, and induced jobs — defined in the example below). It is important to note that the $1 million expenditure does not divide neatly into workers’ salaries (17 people are not making $59,000 a year as a result of this investment).

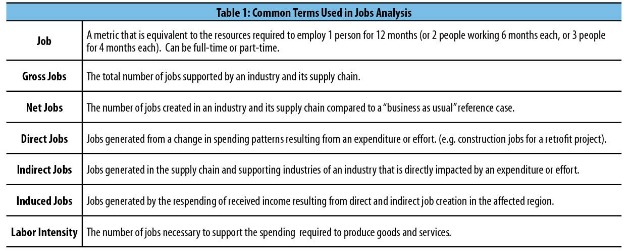

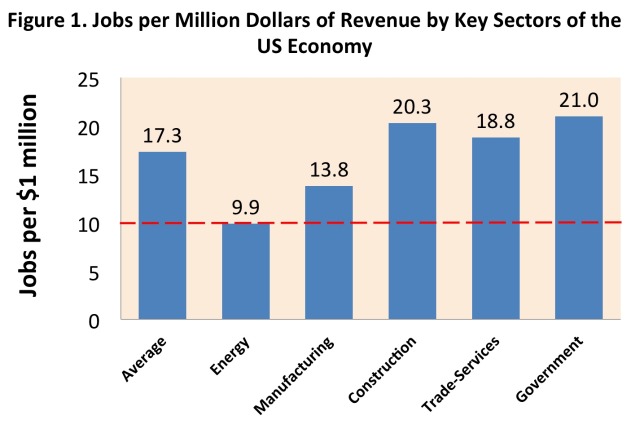

Investments directed towards a specific industry may support greater or fewer jobs depending on the industry (you can see in Figure 1 that manufacturing supports approximately 14 jobs per $1 million investment, while the trade-services sector supports just under 19 jobs).

So, an investment in energy efficiency will first create opportunities for workers in industries that are more labor intensive than average (as you’ll see in our example, a retrofit project will create jobs in the construction sector, which supports approximately 20 jobs per $1 million, compared to the all-sector average of 17). Then, it will continue to support jobs year after year by saving energy. The energy savings generated by the investment diverts spending away from power generation and distribution, which supports just under 10 total jobs per $1 million (see Figure 1) back into the overall economy (which supports 17 jobs per $1 million).

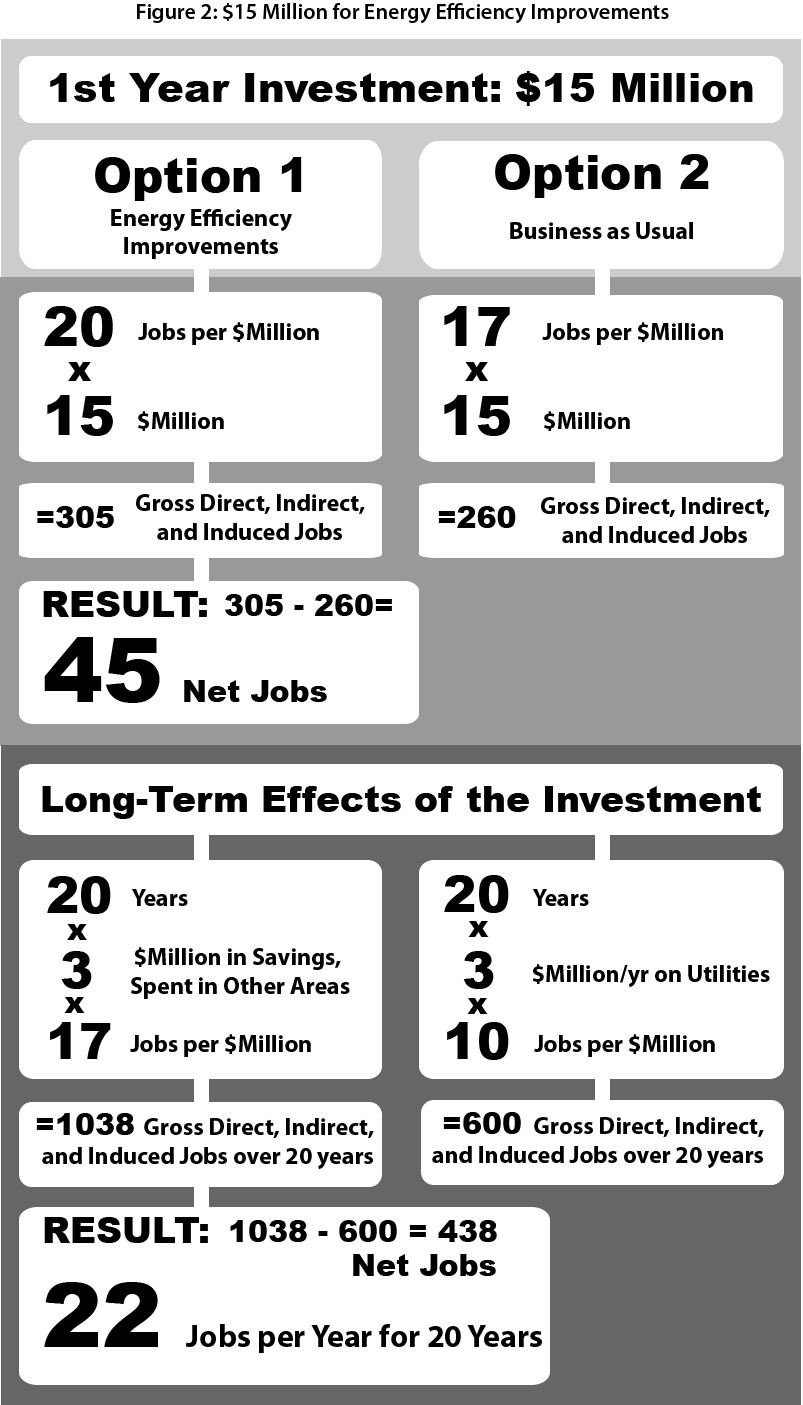

Let’s look at an example: A city decides to use $15 million of its revenue to improve energy efficiency in public buildings. These improvements will save the city $3 million a year for the next 20 years.

Three types of jobs are created from this investment. First, a construction contractor will have to hire workers to install the desired energy efficiency measures. These contractor jobs are the direct jobs resulting from the investment. In addition, the workers will require materials that they have to purchase from other companies (e.g., insulation, tools). These purchases create jobs throughout the economy for manufacturers and service providers who supply the building industry. These supply-chain jobs are the indirect jobs resulting from the investment. Finally, workers in these direct and indirectly created jobs may choose to spend their earnings on goods and services in the local economy, creating induced jobs.

In our example, we can assume that funds will be redirected from their business-as-usual spending pattern and channeled into the construction industry, which is more labor intensive than the average sector of the economy. This will support approximately 20 (direct, indirect, and induced) jobs per $1 million investment. In this case, the trade-off (from spending that supports 17 jobs per $1 million to spending that supports 20 jobs per $1 million) results in an additional 45 jobs in the year the upgrade occurs.

Additionally, energy efficiency generates energy bill savings over the life of the investment, which frees up funds to support more jobs in the economy by shifting jobs in the energy generation and distribution industries (lower labor intensity: 10 jobs per $1 million) to jobs in all other industries (higher labor intensity: 17 jobs per $1 million on average). We assume that our investment will save $3 million a year for 20 years and thus achieve a net gain of 22 jobs per year (see Figure 2). Please note that to simplify our calculations in this demonstrative example we assumed that energy savings would be recognized immediately in the first year of the investment, which is often not the case. For many of our analyses, we assume that energy savings are recognized at least six months to one year after the efficiency measures are implemented.

As you can derive from Figure 2, the business-as-usual (pre-efficiency) scenario supports 860 gross jobs (260 + 600) in the first year, which sounds like a lot of jobs (and 600 gross jobs year after year for the next 19 years). However, you can also see that the efficiency scenario supports 1,343 gross jobs (305 + 1038) in the first year (and 1,038 gross jobs year after year for the next 19 years), which is greater than the number of jobs supported by business-as-usual. Therefore, energy efficiency creates 67 net jobs in the first year, and continues to support an additional 22 net jobs year after year for the 20-year life of the investment.

How does ACEEE determine the number of jobs created by a given policy, program, institution, or project?

In recent years, ACEEE has explored how energy efficiency policies can drive net job creation using our in-house Dynamic Energy Efficiency Policy Evaluation Routine (DEEPER) modeling system. DEEPER [PDF] evaluates the economy-wide impacts of a variety of energy efficiency, renewable energy, and climate policies at the local, state, and national level. It is a dynamic input-output model of the U.S. economy that leverages information about how different institutions — households, industries, businesses, and governments — trade goods and services with one another to estimate the impact that a given policy or investment will have on the larger economy.

DEEPER utilizes jobs coefficients (e.g., the multipliers show in Figure 1) from the Impact Analysis for Planning (IMPLAN) modeling system’s data set. Our definition for jobs (see table 1) is consistent with their definition, which they derive from the Bureau of Labor Statistics and the Bureau of Economic Analysis. Also, the IMPLAN multipliers account for leakages, or money that will be spent outside the region’s economy.

Over the last 10 years, one of ACEEE’s priorities has been to estimate potential jobs and other economic impacts from pending federal energy efficiency legislation. A study performed in 2010 by Laitner, et al. suggested, for example, that adopting a particular suite of Senate-proposed energy efficiency policies could result in a net gain of approximately 700,000 jobs by 2030, and just over 1 million jobs by 2050. Early in 2012 ACEEE will release our analysis on the pending energy efficiency legislation introduced by Sens. Jeanne Shaheen (D-N.H.) and Rob Portman (R-Ohio) and the Implementation of National Consensus Appliance Agreements Act. While policymakers may not be able to wave a magic wand and instantly create new jobs for the unemployed, they can support legislation and investments that will save energy and make our economy stronger.

ACEEE Economic and Social Analysis Program Director John A. “Skip” Laitner contributed to this post.