Daniel Yergin is to peak oil and limits to growth what Richard Lindzen, Anthony Watts, Christopher Monckton, the Heartland Institute and Exxon Mobil are to climate change. That is, Yergin's entire reason for being in the public eye is his rejection of the possible arrival of this calamity.

So of course it's perfectly logical that the Wall Street Journal, long a bastion of climate change denial, would give Yergin a stage on which to spew his unique brand of half-truths. The simple fact is that people who are invested in the status quo like hearing that everything is hunky dory and that nothing out there will ever threaten their privilege, so there will always be an audience for the Yergins of the world.

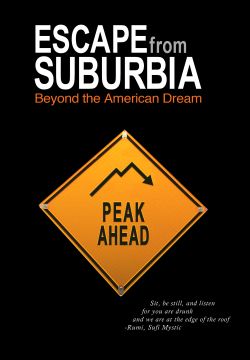

Despite all evidence to the contrary — namely, that world supplies of oil have not budged for some time even as prices have skyrocketed — Yergin argues in Saturday’s Wall Street Journal that more and more oil will be available until "perhaps sometime around midcentury" at which point supply will hit a "plateau."

The thing is, Yergin has been demonstrably getting it wrong about oil for years. There are countless examples, well chronicled here, but he is so wrong, so often, that it only takes about 5 minutes with Google to find an egregious example.

Here's Yergin in 2005, when oil was $60 a barrel, predicting that world oil production would grow from 85 million barrels a day to 101 million by 2010, "reliev[ing] the current pressure on supply and demand." It's 2011, and we're still only producing 89.1 million barrels a day. Meanwhile the cost of a barrel of oil is hovering around $90, and that's with a depressed world economy keeping prices in check.

So why does the WSJ publish the rantings of a repeatedly-discredited crank? Well, he runs Cambridge Energy Research Associates, which does a fine job of promoting itself, running a conference on energy, and just generally telling people what they want to hear. They peddle the exact same variety of denialism on peak oil that others peddle on climate change, and to the exact same customers — namely, Exxon Mobil and its ilk.