Cross-posted from Wonk Room.

A strong cap on carbon would significantly cut the flow of petrodollars to Iran’s hostile regime, a Wonk Room analysis shows. The economic and political strength of Iran’s dictatorship is a threat to the national security of the United States and the world, and its nuclear ambitions threaten to destabilize the Middle East. Yesterday, diplomats from “six world powers have met for the first time to discuss imposing new sanctions on Iran for its failure to suspend work on its controversial nuclear program,” but negotiators have not yet figured how to achieve President Barack Obama’s goal of being “consistent and steady in applying international pressure.”

Iran, “which holds the world’s second-biggest oil and gas reserves and supplies about 4.5 percent of the world’s oil production,” uses its oil power “as a strategic asset.” Even though oil is “one of history’s Big Levers concerning Iran,” the idea of gas sanctions to control Iran’s oil income is not likely to succeed, and could even backfire.

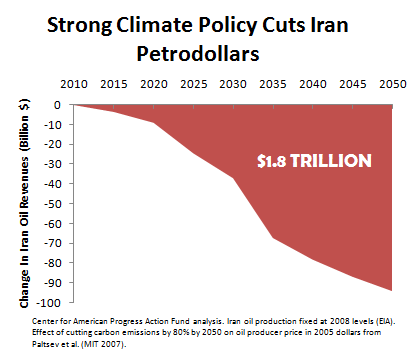

One mechanism to control the flow of petrodollars to Iran — whose oil production is worth $120 billion a year at current prices — is for the United States to control its appetite for oil. Based on an economic analysis by the Massachusetts Institute of Technology of a carbon cap that reduces global warming pollution by 80 percent by 2050, the Wonk Room has found that Iran would lose approximately $1.8 trillion worth of oil revenues over the next forty years — over $100 million a day:

The United States is by far the world’s biggest consumer of oil, accounting for 25 percent of world production. Our demand is more than the four next biggest consumers — China, Japan, India, and Russia — combined, despite having only 11 percent of their population. Unilateral action by the United States to reduce oil consumption has a profound effect on the world market, and is the first step towards global climate policy that builds a zero-carbon economy.

If the world moves away from oil dependence, Iran’s regime will no longer be able to rely on petrodollars to stay afloat. Other unfriendly regimes propped up by carbon-fuel money, such as Hugo Chavez’s Venezuela, will also feel the pinch, improving our national security and making it less likely our armed services will fight battles amid the oil fields. For that to happen, the United States must pass comprehensive climate and clean energy legislation as fast as possible, the stronger the better.

A note about methodology:

Iran’s oil production is assumed fixed at 2008 oil production levels of 4,174,000 barrels/day [EIA]. Iran’s lost oil production value is calculated by the projected effect of strong global climate policy on the world oil price for producers, as determined by the 2007 Massachusetts Institute of Technology report Assessment of U.S. Cap-and-Trade Proposals, which calculated a reference scenario crude oil price and a 167 bmt scenario producer crude oil price [see reference data]. That difference is multiplied by Iran’s annual oil production to estimate lost production value. The 167 bmt scenario has cumulative US carbon dioxide emissions between 2010 and 2050 of 167 billion metric tons, equivalent to emissions targets of 1990 levels by 2020 and 80 percent below 1990 levels by 2050. These targets are similar to those in current legislation. Under the reference scenario, global CO2 concentrations reach 880 ppm and temperatures increase 3.5 – 4.5°C over current temperatures, a global catastrophe. Under the 167 bmt scenario, CO2 concentrations reach 520 ppm, and temperatures increase only 1.8 – 2.2°C.