These prices are actually low by today’s standards.

The Wall Street Journal is tremendously incensed about gas prices. For the record, it tells us in the headline of an article, gasoline was the most expensive ever in 2012.

The national average price of [gasoline] for the year was $3.60 a gallon, a significant jump from the previous record of $3.51 set in 2011. While 2008 is famous for a huge summer spike that drove the average above $4 a gallon, price[s] weren’t as consistently high as this year, leaving 2008 in third place overall at $3.25. …

AAA said the national average has broken a daily record high for a total [of] 248 days in 2012, including 134 consecutive days of records. April 5 and 6 marked the highest daily national average of the year at $3.94 a gallon … while the price dropped to its low point of $3.22 on Dec. 20.

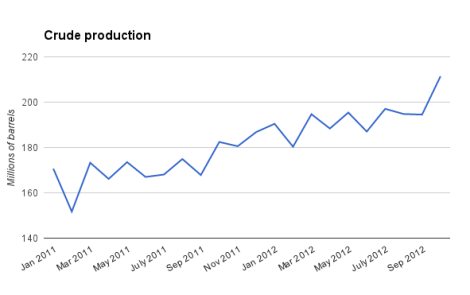

The paper’s heavily conservative readership might be puzzled by this news. After all, this is what domestic oil production is doing:

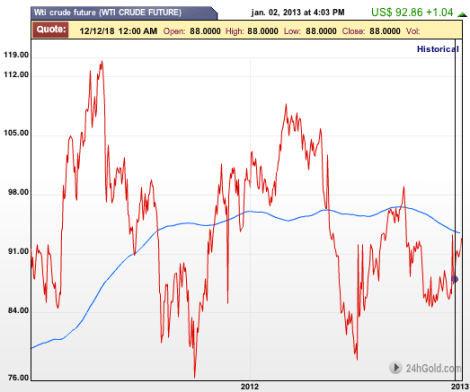

And as we know from Republicans, increased drilling means gasoline prices should be going down. But they aren’t (as we’ve noted before). They’re bouncing all over the place.

If we’re to believe that the key to reducing gas prices is more drilling, the second chart in this post should look like the first, except upside down. It doesn’t. It looks like this chart …

… which is the price of a barrel of oil over time. Because that’s what gasoline prices correlate to: how much a barrel of oil costs on the international market.

That gas-prices chart also looks a little like this one.

This graph shows quarterly earnings for oil companies. Up in the summer of 2011, back down, then up again. The correlation is between how much gas costs and how much oil companies earn.

At the end of this month, those companies will start releasing their 2012 profits. If the all-time high average price is any indicator, Exxon and Valero and Chevron and BP probably had a pretty good year.