Banking giant Citigroup recently issued a report [PDF] that ought to thrill fans of renewable energy. However, tucked inside the good news is a pill that some greens will find difficult to swallow.

The good news is that Citi expects renewable energy to triumph; it believes that typical forecasts like those from the International Energy Agency are too pessimistic. Contrary to a certain strain of conventional wisdom, it says, shale gas will not crowd out renewable energy. Quite the opposite.

The pill? Citi expects it will take lots of natural gas — more than we’re currently using, in the medium term — to get to a power system run primarily on renewables. In fact, renewables and shale gas are in a “symbiotic” relationship, the report says, each helping the other increase market share. If that’s true, a moratorium on fracking, called for by many greens, might serve to inhibit the spread of renewable energy.

There are two reasons to see renewables and natural gas as mutually reinforcing. The first and most familiar is that renewables — at least wind and solar — are intermittent and require backup plants that can quickly ramp on and off (“peaker” plants) to support them. Those peaker plants typically run on natural gas.

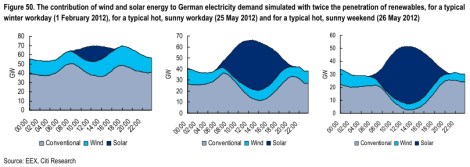

The second reason is less well understood. It is illustrated by Germany’s experience. Here’s a key graphic where Citi models what it would look like if Germany’s current portion of renewable energy were doubled. The three charts represent power supply on three days — a winter day, a sunny workday, and a sunny weekend day.

CitigroupClick to embiggen.

As you can see on the right, at the brightest part of a sunny weekend day, solar will supply not just peak demand, but almost the entire load.

That creates an interesting dynamic. At low penetration, solar just eats into the peak, which means it will push out peaker plants, mainly natural gas. That’s what’s happening in Germany now. But as solar grows, it starts eating beyond the peak, down into the baseload power that comes from coal and nukes. Here’s the thing, though: Baseload plants are not built to ramp up and down quickly or frequently, certainly not several times a week. If solar eats into a big chunk of their daily demand, they will likely start retiring. Then there will be a need for more natural-gas backup plants. (I wrote about all this in some detail here.)

Eventually, when renewables grow enough, the amount of power needed from peaker plants will decline, but because renewables remain highly variable, there will still be a need for back-up plants to be ready in case of an unexpected weather event (or, y’know, nighttime). That poses a challenge for utilities. Right now, power plants get paid for power; if they don’t produce power, they don’t get paid. Pushing more renewables onto the grid means that utilities will need to find some way to pay for capacity, not just power. In other words, they need to pay peaker plants to sit there, ready, just in case. “Ultimately,” the Citi analysts told E&E, “we believe that the system will move to a capacity payment mechanism to remunerate utilities for low utilization rates on plants that must remain open as backup generation.”

(Incidentally: the need for backup capacity is imposed on the grid by renewables, but as clean energy skeptics often complain, with some justification, it rarely gets counted among the costs of renewables. But that’s a topic for another post.)

Now. In theory, the need for natural gas to play these two supporting roles could be reduced and eliminated through a combination of wide geographic dispersion of renewables, a more robust grid, more energy storage, and more non-intermittent renewables like geothermal or biogas. But given how fast renewables are ramping up, and how far those other pieces are from being in place, natural-gas peakers are likely to play a key role for several decades to come.

Anyhoo, the report concludes that “the requirement for ‘peaking power’ rises as renewable penetration increases,” so “gas-fired power is not only compatible with renewables, it is in many ways essential for its large-scale adoption.”

But there’s an important qualification:

However, this symbiotic age of gas and renewables can only really come about if renewable technologies become more competitive against conventional fuels, and this is the key area of analysis of this note.

That’s what Citi drills into: whether renewables are getting cheap enough, fast enough, to enter into this mutually reinforcing cycle with natural gas.

Good news: They are!

Shale gas, despite its triumphal reputation, faces substantial uncertainties. If methane emissions from fracking turn out be as bad as some of the high-end estimates, there could be serious environmental regulations coming down the pike. And the price of natural gas will not stay low forever. Citi estimates it will rise from its current absurd lows of $3 or $4 per MMBTU to around $5 or $6 or even $7, and that’s in the U.S., where it’s super-cheap. In other regions it is already considerably more expensive than that, and will stay so for the near future.

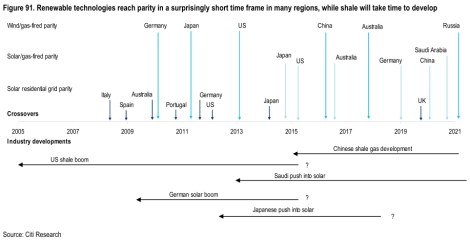

Renewables, meanwhile, are steadily, predictably heading down the cost curve toward “grid parity,” that moment when they are competitive with coal and natural gas without subsidies. Residential solar is already there in many places:

In many countries — Germany, Spain, Portugal, Australia, and the South-West of the US — residential-scale solar has already reached ‘grid-parity’ with average residential electricity prices. In other countries grid-parity is not far away; we forecast that grid-parity will be attained by Japan in 2014-2016, South Korea in 2016-2020, and by the UK in 2018-2021.

Utility-scale solar won’t be far behind:

On our analysis utility-scale solar power will gain competitiveness with gas-fired power in the medium term in many regions, even if gas prices stay low. For regions with solar insolation of 1900 kWh/kW/year — as in the South-West US or Saudi Arabia — utility scale solar is already cheaper than gas-fired power at a natural gas price of $15/MMBtu, and by 2020 for a gas price of ~$6-8/MMBtu.

And wind power is competitive in a growing number of places as well:

Wind power is significantly cheaper than solar power, and in most countries wind delivers electricity at a far lower cost than the residential electricity price. On the utility scale, wind power is already competitive with gas-fired power in many regions. In the US, for example, wind power would be cheaper than gas-fired power at a natural gas price of under ~$6/MMBtu.

Many of the places where renewables are developing quickly are places where shale gas is expensive and will be slow to penetrate. This chart, which estimates when grid parity will arrive in various countries, is information-dense but worth examining closely:

CitigroupClick to embiggen.

This has always been the strength of renewables: Once they are cheap enough, they are quick to spread. It takes much less time to build out wind and solar in a place where there are none than it does to create a shale gas industry (mine for natural gas, expand production, and build a bunch of gas plants) where there is none. The renewables boom is just waiting for falling clean-energy prices to cross over rising fossil fuel prices, and it’s happening.

Citi summarizes its investment thesis as follows:

Investors should focus initially on shale plays in areas as development continues, i.e. starting with the US, and then moving medium/longer term into other areas such as China. Renewables is currently overshadowed by austerity and dwindling subsidies, which are creating a backdrop of weak demand and crippling overcapacity, all of which is hurting manufacturers. While renewable developers therefore ought to be more attractive (via low equipment costs), subsidy cuts are having their impact, alongside other issues such as grid constraints in the markets such as China which would otherwise be growing. However, as our experience curve analysis suggests, investing in the medium/longer term in developers in regions with early competitive cross-overs of renewables vs. fossil fuels makes sense, and as this demand comes through, this should also help manufacturers with a second phase of non-subsidy-led demand once the shakeout of inefficient overcapacity and consolidation has taken place.

Translation: shale gas will boom in the short-term, but renewables will rise in the medium-term.

The message here is simple: take heart. Shale gas will not swamp and displace renewables, it will help them. Renewables will become cheaper than fossil fuels in the medium- to long-term. It’s happening now in some places, it will happen in others soon. Obviously the rise of renewables could be accelerated by policy, and should be. It won’t happen fast enough to avert the worst of climate change without a policy boost.

But it will happen. History is on the side of clean energy.