Solar panels are blooming. (Photo by Shutterstock.)

Pollution is not the only thing wrong with the U.S. power system. It is also governed by inconsistent rules and opaque, unaccountable organizations. The average citizen has little understanding of how it works, who is in charge, or how it might change for the better. The financial benefits of electricity, like power generation itself, tend to be centralized, concentrating in the hands of shareholders and executives.

Just as a cleaner electricity system would be preferable, so too would a more small-d democratic system, one that distributes economic and social power more widely.

One measure that serves both those goals at once is simply to get renewable energy in more people’s hands. Let more people get jobs in it, invest in it, receive tangible benefits from it. Nothing diminishes partisan opposition like an income stream. That’s why renewable power remains untouchable in German politics — lots of Germans are directly involved with it.

The biggest barrier to spreading renewable energy is its high up-front costs. Some of that is helped by state and federal financial incentives, but those are expected to decline sharply in coming years. However, there is a positive countervailing trend: innovations in the financing and ownership of solar projects that are opening distributed solar PV to a wider and wider market. Here are three financial models that are helping to drive this solar expansion.

Leasing

The conventional route to rooftop solar is to buy some panels and enjoy the payback … in five to 10 years. This restricts solar PV to those willing and able to a) cobble together enough cash or get a home equity loan in crappy economic times, b) stay in the home long enough to earn positive returns, and c) take on the responsibility of operating and maintaining a small power plant. That’s a comparatively small segment of the public.

With a lease, you don’t own the panels on your roof; they are owned, operated, and maintained by a solar leasing company like Sunrun, SolarCity, or Sungevity. The solar company effectively becomes a utility. You pay them a monthly fee for the electricity the panels produce. At the end of the lease period (typically 15-25 years), depending on the details, you can re-up the lease, buy the panels, or have them removed.

Ideally, a homeowner will be paying less for electricity than they were before. Their utility bill will be lower because the house is now getting some power from the solar panels on the roof; those utility-bill savings should be enough to offset the lease payment. For now, though, that math depends on solar being subsidized with state mandates or rebates. This AP story lays out a typical scenario:

Tim Johnson, a high school math teacher in Philadelphia, had wanted to put solar panels on his roof for years. Like many people concerned about the environment, the thought of powering his home without burning fossil fuels had a strong appeal. But with two kids in college, he couldn’t justify spending $15,000, after subsidies, to do it.

But since March, he has generated 50 percent to 75 percent of his electricity with a set of solar panels on his roof, saving 20 percent on his electricity bills. His upfront cost for the system: $0.

Instead of buying and installing the panels himself, he signed up with SunRun, one of a handful of companies that build, own and maintain solar systems on homes. These companies earn money by charging customers for the power the panels produce.

Johnson pays SunRun $52 a month, and he pays his traditional utility for whatever extra power he needs from the grid. In all, he pays $60 to $100 a month for power; he used to pay $90 to $120.

SunRun can charge Johnson a competitive rate because federal and state subsidies pay for a portion of the installation. Also, the arrangement allows SunRun to take advantage of one of solar’s big advantages. Because it is generated near where it is needed, it doesn’t have to pass through hundreds of miles of wires, transformers and other equipment. The power price SunRun has to beat in order to entice customers like Johnson is an expensive retail rate, bloated with transmission and distribution charges that home solar doesn’t incur.

The leasing model is taking off like crazy, particularly in southern California, where it has generated some $1 billion in economic activity since 2007. A recent study by the National Renewable Energy Laboratory found that solar leasing “has enticed a new demographic to adopt PV systems that is more highly correlated to younger, less affluent, and less educated populations than the demographics correlated to purchasing PV systems.” In reaching farther down the income scale, “third-party PV products are likely increasing total PV demand rather than gaining market share entirely at the expense of existing customer owned PV demand.” According to Sunrun President Lynn Jurich, “about 75 percent of Californians switching to solar now choose solar power service” over ownership.

The biggest states for solar leasing are California and New Jersey, but leases are also available in Arizona, Colorado, Massachusetts, Oregon, Pennsylvania, and Texas. Here’s a Solar Lease 101 that can compare products and generate a free quote.

The growing popularity of leasing (along with falling panel prices) is one reason that U.S. solar installations more than doubled in the second quarter of this year, bringing the total capacity to 5.7 gigawatts.

Community solar

Between 70 and 80 percent of people in the U.S. aren’t in a building suitable for rooftop solar. However, many of those people would like to be able to invest in distributed solar, not only for the financial returns but for civic or environmental reasons. “Community solar” refers to the many ways that groups of individuals can pitch in together to buy or lease solar.

A good place to start learning is this Department of Energy-funded guide to community solar [PDF]. It divides projects into three kinds:

• Utility-Sponsored Model: A utility owns or operates a project that is open to voluntary ratepayer participation.

• Special Purpose Entity (SPE) Model: Individuals join in a business enterprise to develop a community shared solar project.

• Nonprofit Model: A charitable nonprofit corporation administers a community shared solar project on behalf of donors or members.

See also this report from the Institute for Local Self-Reliance (ILSR), which “examines nine community solar projects, the policies that made them possible, and the (substantial) barriers that remain.” Here are the three policy solutions ILSR’s John Farrell recommends to unlock community solar:

1. Community net metering — to allow project owners to share the project’s electricity output. Right now, most state policies require utilities to allow net metering, but only for a solar or wind project on your own property. [Here’s what net-metering is, for those not yet in the know.]

2. Simplified securities law — to make community-based projects easier. Right now, there’s little difference between setting up a mutual fund and setting up a community solar project, and both take a lot of lawyers. (Learn more in this report.)

3. Smarter federal tax incentives — to allow community-based institutions to host community-based projects. Nonprofits, cooperatives, cities, and counties are logical entities to build projects, but they can’t (easily) use federal tax incentives for solar and wind power. This raises the stakes for problem No. 2.

Expanding and simplifying community solar will enable anyone who supports renewable energy to invest in it — kind of like carbon offsets, only with tangible results and and financial returns!

Solar power purchase agreements

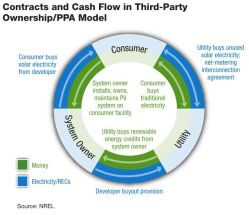

A power purchase agreement (PPA) works similarly to a lease — both fall under the rubric “solar as a service,” under which a customer contracts to buy power from solar installations owned and run by third parties — but typically at a larger scale. (Here’s a primer on solar PPAs.) For example, the military is in the process of signing PPAs with SolarCity to cover 120,000 military residences with solar panels that are expected to eventually generate some 6,400 megawatt hours of electricity a year.

A power purchase agreement (PPA) works similarly to a lease — both fall under the rubric “solar as a service,” under which a customer contracts to buy power from solar installations owned and run by third parties — but typically at a larger scale. (Here’s a primer on solar PPAs.) For example, the military is in the process of signing PPAs with SolarCity to cover 120,000 military residences with solar panels that are expected to eventually generate some 6,400 megawatt hours of electricity a year.

It’s a great model, one the military very much favors, but some states make it difficult or impossible. A Department of Energy white paper [PDF] on the subject notes that …

… many states, including North Carolina, have legislative barriers which impede the Army’s ability to utilize all of its available authorities by effectively eliminating the ability of rate payers in the state to enter into power purchase agreements with third party developers/operators of distributed generation. Typically, these legislative barriers take the form of definitions which define any entity which sells electricity as a public utility and places such an entity under the jurisdiction of the state’s Public Utilities Commission or Public Service Commission. …

Other barriers such as state laws and rules on interconnection procedures, net metering laws, the ability of electric utilities to charge onerous standby charges and limits on the ability to wheel power over private wires must also be addressed in order to remove uncertainty from the marketplace. [emphasis mine]

Indeed.

PPAs are not new, but they’ve generally involved utilities and large amounts of power. It’s only recently, in the late 2000s, that third-party (non-utility) PPAs became popular in solar markets. Though they’ve gotten more common, the fact that the amounts of power involved are typically much smaller and the number of parties greater means that much work remains to standardize them.

One nifty innovation, or at least new market, for solar PPAs involves a bunch of separate businesses and/or nonprofits leasing their rooftop space to a single solar developer (or a utility), which then treats the distributed panels as a single “virtual power plant.” (Here’s some research on the development and future of virtual power plants.) This market can draw in owners of large buildings or facilities who may not want to bother with owning solar panels, but will be attracted to a low-risk, predictable (if modest) flow of revenue.

In closing … [applause, applause]

The thread that runs through all of these innovations in finance and ownership is energy democracy. They open up the social and economic benefits of solar power to a much broader (less rich, less elite) audience. That, not some grand federal bill, is likely the first step on the road to real political change.