A new report [PDF] from the International Monetary Fund tries to tally up fossil fuel subsidies around the world and finds that they add up to an eye-popping $1.9 trillion a year. That’s 2.5 percent of global GDP!

Brad Plumer has a typically lucid summary on the report’s conclusions, but I want to dig in a little on one part, because believe it or not, the IMF’s conclusion may be too conservative. The real truth about global fossil fuel subsidies may be more eye-popping yet.

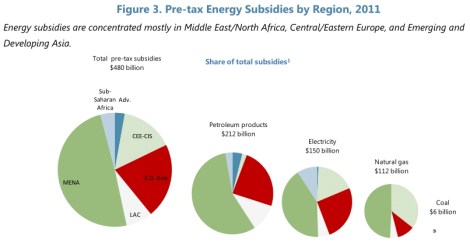

So, where does that $1.9 trillion come from? Around $480 billion of it comes from direct subsidies, i.e., government handing out money. This is what people usually think of when they hear “subsidies.” Contrary to popular opinion, the developed world does very little of this kind of thing. Direct fossil fuel subsidies (“pre-tax” subsidies) are overwhelmingly concentrated in the developing world and mostly devoted to making petro-products affordable for poor people:

IMFClick to embiggen. (The details of this chart aren’t that important, but just for your edification: Adv. = Advanced, CEE-CIS = Central and Eastern Europe and Commonwealth of Independent States, LAC = Latin America and Caribbean, S.S. Africa = Sub-Saharan Africa, MENA = Middle East and North Africa, and E.D. Asia = Emerging and Developing Asia.)

Those direct subsidies are a) a growing problem for the budgets of those countries, and b) a fraught and delicate political issue. Needless to say, people don’t like suddenly losing a big pot of financial assistance. They often retaliate by rioting or, you know, starving. The report contains a big section on ways that countries can wind back those subsidies without unduly hurting the poor. It’s interesting.

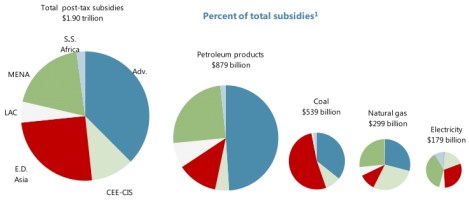

But my focus here is on the other $1.4 trillion, which is IMF’s tally of “the effects of energy consumption on global warming; on public health through the adverse effects on local pollution; on traffic congestion and accidents; and on road damage.” These are the “externalities” you’re always hearing about, and by failing to make fossil fuel companies pay for them, governments are implicitly subsidizing those companies. IMF calls this under-taxing of fossil fuels “mispricing,” but it’s easier to think of them as indirect subsidies.

Indirect subsidies are much larger than direct subsidies — a point I have made before — and are concentrated in developed countries:

IMFClick to embiggen.

Among these externalities are the damages wrought by climate change. How much damage does a ton of carbon do? How large is that particular indirect subsidy? Climate damages are calculated based on the “social cost of carbon” (SCC). The IMF uses an SCC of $25 per ton, derived from the work of the U.S. Interagency Working Group on Social Cost of Carbon [PDF].

So, for every ton of carbon that is emitted but not taxed, there is a $25 implicit subsidy.

However! There are good reasons to think that the real SCC is considerably higher than $25 a ton. I don’t want to bore you, but here are a few nerdy things to read if you want to dive in on the subject:

- Economist Frank Ackerman introduces SCC.

- A white paper [PDF] from Ackerman and Elizabeth A. Stanton explains why the government’s SCC figure is almost certainly too low.

- A peer-reviewed paper from Laurie Johnson and Chris Hope argues that a properly assessed SCC would be “2.6 to over 12 times larger” than the U.S. government’s official SCC.

- I wrote here about what it would mean to accommodate stochastic change in the SCC (spoiler: it would be higher).

- I wrote here about how discount rates shape (and misshape) the SCC. Guess what a more morally defensible discount rate would do to it? Yup, raise it.

I don’t want to pretend this is a settled matter — it is the subject of lively, ongoing academic debate — but I’m pretty convinced that the SCC used in the IMF’s report is hugely, misleadingly conservative. So what would happen if it weren’t?

Ackerman and Stanton write:

In the United Kingdom, which started estimating prices for carbon emissions several years ago, the government’s latest calculation is a range of $41-$124 per ton of CO2, with a central case of $83.

So, just for the sake of argument, say the IMF adopted an SCC of $83 — more than three times the figure it actually used. What would happen?

It’s hard to say precisely, since the IMF paper is not clear what portion of the indirect subsidies are carbon-related. (Or at least, I lack the fortitude to dig that info out.) I suspect it’s well over half, but to be conservative, let’s just say half. Based on my back-of-napkin calculations, if carbon were responsible for half the indirect subsidies, and the SCC were $83 instead of $25, the grand total of annual global fossil fuel subsidies would rise from $1.9 trillion to around $3.5 trillion.

Three and a half trillion dollars a year. That’s about 5 percent of global GDP. Crazy.

As enviro hero Paul Hawken is fond of saying, “we are stealing the future, selling it in the present, and calling it GDP.” I can’t think of a better description of these fossil fuel subsidies. And when we use a more realistic cost for carbon damages, we get a better sense of just how much we are stealing from our descendents — trillions and trillions of dollars a year. The heedless radicalism and grotesque immorality of it are breathtaking.