There is no federal carbon tax coming to the U.S. any time soon, not as long as a revanchist, reactionary bunch of fruitbats runs the Republican Party and gerrymanders itself a decade-long House majority. (Ahem.) But just as an intellectual exercise, if nothing else, let’s take note of the fact that warnings about the calamitous effects of a carbon tax are nonsense.

Two new data points on this.

First, as it happens, there’s a real, honest-to-God carbon tax happening, as we speak, right above our heads (at least our heads in Seattle): British Columbia has had a carbon tax in place since 2008. Per design, it started at $10 per metric ton of carbon dioxide equivalent (CO2e) and rose $5 a year until it reached $30 in 2012. It’s focused on petroleum fuels, since most of B.C.’s electricity comes from low-carbon hydro. Also, it is revenue neutral, which means it is offset by decreases in corporate and personal income taxes.

How’s it doing? Turns out, just fine.

A couple of University of Ottawa scholars just put out a short report on the B.C. carbon tax, examining its environmental and economic effects.

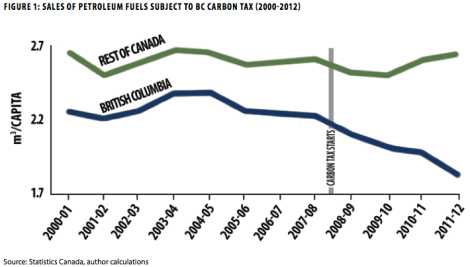

Has it reduced fossil fuel consumption? Yes. Consumption of all petroleum fuels subject to the tax declined in B.C., 18.8 percent more than in the rest of Canada:

Sustainable ProsperityClick to embiggen.

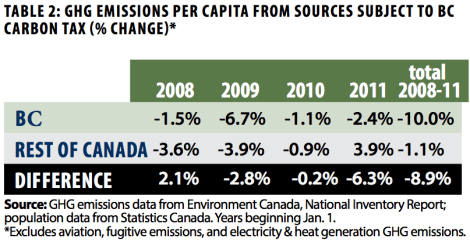

Has it reduced greenhouse gas emissions? Yes. This is a comparison of B.C. and the rest of Canada, showing per-capita GHG reductions from sources covered by the B.C. tax:

As you can see, over the first four years of the tax, B.C. greenhouse gases fell 8.9 percent more than GHGs from the rest of Canada.

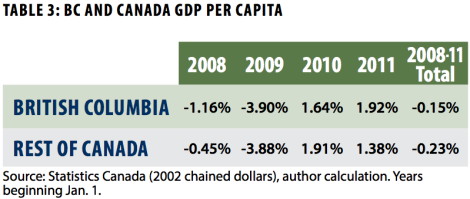

Has the tax destroyed the economy? No. B.C. has slightly outperformed the rest of Canada:

Sustainable ProsperityClick to embiggen.

To sum up: fuel consumption declining, greenhouse gas emissions declining, economy doing fine. The carbon tax is, by any reasonable measure, a success.

Now. It’s worth saying that four or five years is a small amount of data and $30/tonne is a pretty small tax. A great many factors can affect fuel consumption, GHGs, and GDP, and it will take more time, and more technical work than this paper attempts, to truly pick the carbon tax signal from the economic noise. But directionally, it’s about what sane economists would predict: falling emissions, stable economy. The first tentative steps to decouple economic growth from climate pollution have been taken.

This modest success will not subdue the political inanity in Canada around the tax, which has been predictably and effectively demonized. The conservative party says they’ll scrap it. The center-right party that passed the tax is now promising to freeze it at its current level for five years. The left party also says they’ll freeze it, but they’ll expand the based of coverage to include fugitive natural gas emissions (a crucial omission in the original tax proposal). Only the greens say they would steadily increase it.

Which goes to show: The empirical success of the tax is largely unrelated to its political effects. Also, politics is stupid.

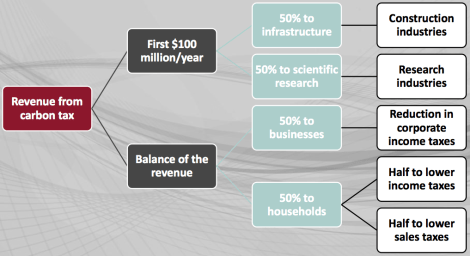

Anyway. The other data point is a recent study by Regional Economic Models, Inc. (REMI, a venerable policy analysis shop) of a carbon tax proposal for Massachusetts.

They ran scenarios for a carbon tax that would start out at $5 a ton and increase by $10 per year. There were three scenarios, with the tax peaking at $15/ton, $30/ton, and $45/ton respectively. In all scenarios, the revenue from the tax was recycled back into the economy, in the following way:

REMIClick to embiggen.

There are all sorts of details in the paper about the models used. I won’t bore you. Instead let’s skip to the results!

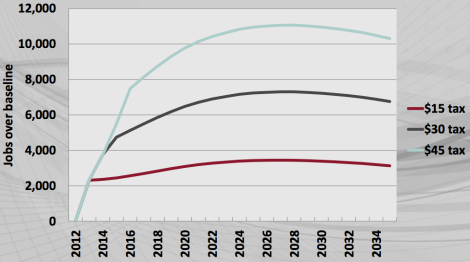

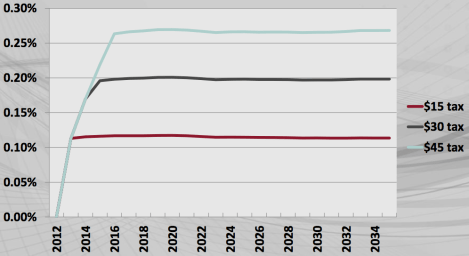

Here’s the effect on employment:

REMIClick to embiggen.

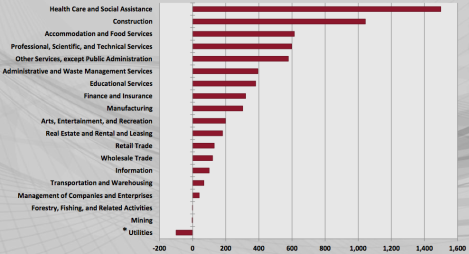

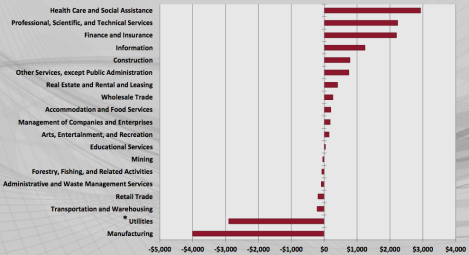

The more technically inclined among you will note that all three of those lines go upward — that is, the carbon tax would, on net, create jobs. Here’s the job impact by industry, assuming an average year under a $30/ton tax:

REMIClick to embiggen.

Basically it would create all sorts of service and information jobs while killing a tiny number of extractive and utility jobs.

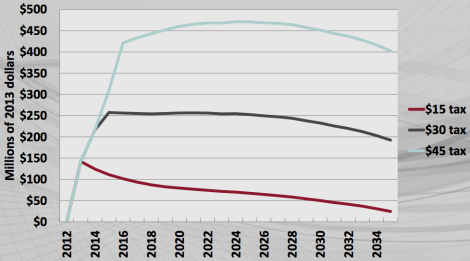

What about the effect on GDP?

REMIClick to embiggen.

Yes, these lines also go upward, especially at first — there would be a big spike as investments in fossil-fuel alternatives flooded the system. In every scenario, GDP would remain higher for the next several decades with the tax than without it. Note in particular that the boost to GDP would be greatest under the highest tax.

Here’s a graph of the impact on output by industry, cumulative over 2013-2035, for a $30/ton tax:

REMIClick to embiggen.

This really tells the story: A shift away from carbon-intensive industries like heavy manufacturing and power, toward service and information jobs.

Here’s the effect on the Consumer Price Index (CPI), a handy indicator of broad consumer costs:

REMIClick to embiggen.

So yes, prices do rise a bit, though not very much.

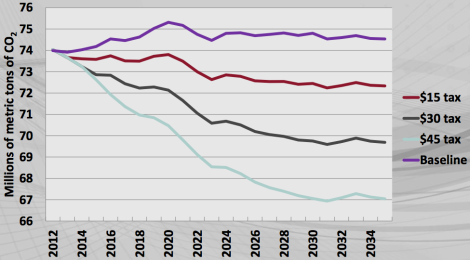

And finally, here’s the impact on greenhouse gas emissions:

REMIClick to embiggen.

Down!

So in summary: a carbon tax in Massachusetts would, depending on how steep it is, create between 2,000 and 11,000 net jobs a year, increase GDP between $1 billion and $10 billion (cumulatively through 2035), and eliminate between 1 and 8 million tons of greenhouse gases a year — all for less than a 0.3 percent rise in consumer prices. Pretty good bargain!

So yeah. A carbon tax can work. It can reduce emissions while growing the economy and creating jobs. It’s happening in B.C. There’s no reason the same thing couldn’t happen in in Massachusetts. (They may vote on a carbon tax proposal soon, in fact.)

The U.S. as a whole could price carbon, reduce carbon emissions, and continue to grow its economy. The conservatives and fossil-owned “centrists” who try to frighten you to the contrary are full of it.