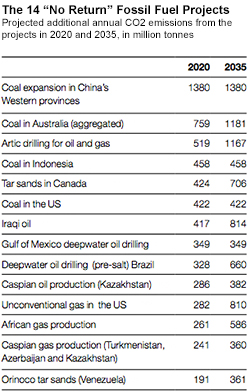

Greenpeace recently issued a call for coordinated action to halt development of the 14 most threatening fossil fuel projects on the planet. These coal, oil, and gas projects, by increasing greenhouse gas emissions 6.3 gigatons a year by 2020, would push the world’s climate to a “point of no return.”

The report suggests to me that we climate advocates need to reexamine our strategies and how we’re spending limited resources. Specifically, we need to focus as much on oil and gas as we have been on coal. And, believe it or not, the path to a low-carbon future lies through cheap, and indeed ever cheaper, oil.

It’s not just coal, stupid

Coal has long been the big villain for climate advocates, and the focus of most campaigning. But only four of Greenpeace’s 14 biggest threats involve coal, while 10 involve oil and gas. Indeed, by 2020, annual carbon emissions from new “no return” oil and gas projects are expected to exceed those from coal: 3.3 gigatons of carbon from the “cleaner” fossil fuels vs. 3 gigatons from coal. And by 2035, the gap will grow: 6.2 gigatons of oil and gas carbon vs. 3.4 from coal.

There are two reasons why oil and gas will pose more of a threat than coal in the future. First, the assumption that oil and gas resources were very limited, while coal was abundant, has been stood on its head by the emergence of new oil and gas technology — ultra-deep ocean drilling, horizontal drilling and fracking, and increased efforts to develop both on- and offshore Arctic resources.

Second, where civil society is robust, climate and environmental advocacy is proving effective against coal. In the U.S., anti-coal activism — led by the Sierra Club, spurred by state-level renewable standards, and lubricated by very cheap natural gas — has driven coal’s share of electricity generation down from more than 50 percent to 35 percent. Coal industry leaders called 2012 their worst year in history; major companies like Patriot Coal and America West Resources have filed for bankruptcy. All projections of domestic demand for coal show it continuing to decline, which leaves U.S. coal companies scrambling to find new export markets for their product.

And finding those markets is increasingly difficult. While European climate advocates were slower to engage in the fight against coal, and have lacked the tailwind provided by cheap natural gas, the underlying trajectory on that continent is similar to the one in the U.S. if about three years later. New coal plants are no longer commencing construction and renewables are taking a larger and larger market share. Even in India, while the government remains fully committed to an unaffordably coal-heavy future, communities are fighting back, and 50 percent of the coal projects challenged in India’s courts are being stopped. Indian private equity companies will no longer lend to coal power plants. China is talking of setting caps on its coal consumption, driven by public outcry over air pollution and increasing shortages of water for coal power plants. Coal prices around the world have slumped.

Coal is not yet beaten. But an effective campaign is underway.

The same is not true of oil, and the “no return” analysis shows clearly that beating coal, while essential, is no longer enough to curb climate catastrophe.

Bad projects in bad neighborhoods

Many of the “no return” projects are not very vulnerable to classic environmental campaigning.

Solid campaigns can be mounted against coal exports in Australia and the U.S., as well as oil and gas drilling in the U.S. A campaign against the Canadian tar sands also has promise, given the dependence of Alberta producers on more environmentally conscious jurisdictions to get their product to market.

But at least two-thirds of the 6.3-gigagton threat from “no return” projects lies in places where civil society campaigns have virtually no hope of shutting down fossil fuel extraction: Kazakhstan, Turkmenistan, Venezuela, Iraq, Russia, Angola, Nigeria. You can imagine some success building anti-drilling or anti-mining campaigns in Brazil, Mexico, and Indonesia, but relying on local campaigns to keep these resources permanently and reliably in the ground is a very long bet. Public unrest over air pollution and water supplies may force China to limit its coal reliance, but classic environmental campaigning is still off the table.

Also, campaigning directly against dirty, “no return” fossil fuel extraction — even where such campaigns are possible — has not always proven a high-leverage investment. The success of the anti-coal push in the U.S. has not come from reducing coal supply. U.S. coal producers didn’t go bankrupt because they ran out of coal — they ran out of customers. Energy efficiency reduced demand for electricity, wind and solar grew in key states, environmental regulations made coal plants expensive, cheap gas took significant market share. It was the economics on the consumption side, not supply shortages, that hurt coal. Even in China and India, it will be the number of coal plants and the price of coal power, not the number of coal mines, that determine success or failure in decarbonizing the utility sector.

So how can we fight “no return” oil projects?

The dirtiest oil and gas enterprises all share a weakness: Tar sands in Canada, drilling in the Arctic, Venezuelan bitumen, and ultra-deep offshore exploration in Brazilian waters and the Gulf of Mexico are the most expensive sources of oil in the world. In fact, the cost of producing them is why they are not already in the marketplace. That means that these sources of oil are at the margin of the demand curve.

Ironically, the best way to keep most of Greenpeace’s “no return” oil deposits safely in the ground is to bring the producer price of oil down. If world oil prices were at $70 or below, not $100 and above, investment in these extreme crudes would dry up. More than half of the total carbon locked in the world’s reserves of crude oil will only be profitable with oil prices above $70 — below that level, investors will flee projects like new tar sands mines or Shell’s Chukchi Arctic caper.

And contrary to the conventional wisdom, getting oil back down to $70 is not that hard — indeed, it’s an unavoidable consequence of any serious commitment to breaking oil’s monopoly in the transportation sector.

That’s because there is enough cheap, conventional oil in the market to meet most, but not all, of our needs — and we can rapidly make up that small difference with more efficient cars, trucks, and planes, greater reliance on rail and electricity, and alternative fuels. Displacing only 7 percent of today’s demand for oil with cleaner energy sources would bring the price back down below $70.

And, of course, if we are to have any hope not only of stopping the “no returns” oil projects but also of phasing out the cheaper, more conventional oil that is already poisoning the climate, we are going to need transportation alternatives to petroleum’s current monopoly.

Aggressively replacing oil with clean energy can transform oil markets very quickly, reducing demand and driving down price, which would keep extreme “no return” crudes in the ground. The key to cheaper gasoline is not more “drill, baby, drill” but tougher “CAFE, baby, CAFE.” Indeed, once the new Obama fuel efficiency standards for cars go into full effect in 2025, they will drive the global price of oil down by about $20 per barrel — just by reducing demand by 2.5 million barrels per day (mbd).

Cheaper oil is the key. This is not what we are accustomed to thinking, this is not what we have been told. The conventional narrative is that oil prices control consumption, rather than consumption setting prices. Higher prices are supposed to keep oil in the ground. But in a monopoly, which oil enjoys in transportation, higher prices don’t do much to consumption. Drivers and shippers have no choice but to pay more.

We have also been told that something called “the market” sets the price of oil, and the U.S. can’t influence “the market.” But what matters most in oil markets is demand — there’s about 80 mbd a day of really cheap oil sitting under the Persian Gulf, and it’s only when the world starts using more than 85 mbd that the price soars. The U.S. still represents a fifth of total demand, and if we collaborated with other oil importers like Japan, Europe, and China to encourage transportation efficiency and fuel diversity, then expensive oil — and Greenpeace’s “no return” projects — would become a nightmare of the past.

(Some of Greenpeace’s targeted oil projects are not high price and might find markets even in a $70-per-barrel world. But if we replace current Canadian tar-sands production with conventional, low-cost Iraqi crude, that’s a good first step — since the Iraqi oil has a smaller carbon footprint — as long as we keep flooding the transportation system with more clean alternatives to displace ever larger amounts of oil.)

What matters is that oil producers get low returns. Taxes on carbon and fees on oil imports would be very helpful, particularly if we use the revenue to finance substitutes for oil. Policies like California’s Low-Carbon Fuel Standard, if they spread, would be the death knell for extreme crude investments. But overall we’re short of solid models for breaking apart oil’s monopoly, and funders have been slow to invest in this space.

Beyond waiting for better batteries, how do we rapidly grow market share for electric vehicles? Who is even tracking, much less shaping, the ratio of new rail to new roads in India, China, Brazil, and Africa — which may turn out to be one of the key metrics of climate progress? What would it take to drastically cut jet-fuel consumption by replacing inefficient hub-and-spoke air routing in the U.S. with more direct flights [PDF]? How do we make New York City, not Houston, the model for new urban growth around the world?

If we take the Greenpeace “no return” analysis seriously, we have a lot of thinking, and rethinking, to do. But if we benchmark ourselves against these 14 projects, we will also come much closer to a real road map of where we need to go.