We live in the era of meat mergers. In recent decades animal-farming companies, gobbling up competitors, became giants. Then those giants merged. Now, a meat titan is coming back for seconds.

The New York Times is reporting that Tyson has been successful in its hostile-takeover bid for Hillshire Brands. Measured in dollars, the $6.1 billion purchase is the largest consolidation in the industry ever — though other mergers have meant more when measured in terms of impact on farmers and consumers.

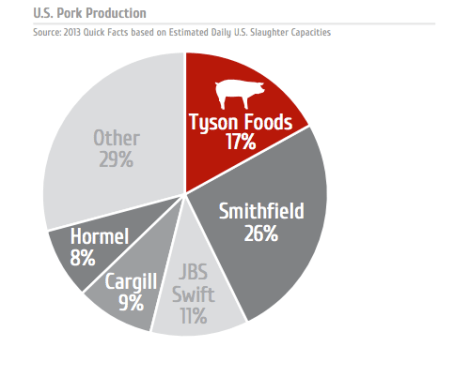

Anti-trust experts say the deal won’t create an illegal monopoly, according to Reuters, because the two companies don’t directly compete. Hillshire is in the business of selling meat to us: It owns Jimmy Dean (sausages), Ball Park (hot dogs), Sara Lee, Aidells, and others, controlling 32 percent of the breakfast sausage market, the Wall Street Journal reports. Tyson is in the business of producing meat: It owns slaughterhouses and packing plants — though it also sells to eaters.

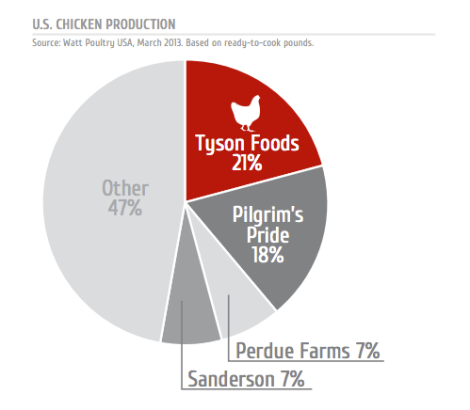

Christopher Leonard, author of The Meat Racket, has made a convincing case that Tyson was already big enough to manipulate prices (it produces one in every five pounds of meat in the U.S.), so I asked him about the implications of this acquisition.

Even if this deal doesn’t violate anti-trust law, there are problems with this kind of consolidation, he said. “When all the power is so centralized in these behemoths, they end up writing their own rules in Congress and fighting the reforms to protect consumers and farmers,” he said.

When the Obama administration sought to reform the animal farming industry, many farmers, some visibly frightened, risked their livelihoods by speaking publicly about abuses. But industry squelched that attempt.

Now, the industry lobbyists are working to reduce the number of inspectors in slaughterhouses, while speeding up the lines. There is some logic to this, Leonard said, because producers will compensate by conducting more testing for pathogens. But the chickens already move down the disassembly lines “obscenely fast, in my opinion,” Leonard said.

These companies also have the clout to fight environmental regulations. Tyson works to reduce its greenhouse gas emissions, but at the same time it pays farmers so little that they have little choice but to pollute.

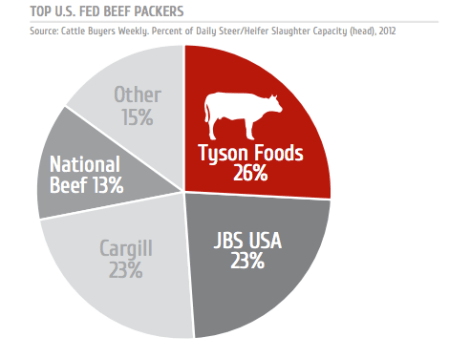

The deal does have a small silver lining: Tyson’s victory means that its competitor JBS — the largest meat producer in the world, which owns Pilgrim’s Pride — lost. “I like to keep my oligarchies all-American,” Leonard joked. (JBS is based in Brazil.) “But to be honest, what bothers me is the loss of local control. Local communities don’t keep the profits, and they lose control over their economies. And now that’s moved from the little chicken towns to an international scale.”

It’s not much of a silver lining. JBS may be the largest meat producer in the world, but Tyson is the second largest. If we want a change from this era of meat mergers, we’d need to pass tough anti-trust laws, Leonard said, as we did in 1921.