The “era of direct payments is over for farmers,” reports Bloomberg Businessweek. “Farm subsidies could finally be on the chopping block,” says this recent article in the Baltimore Sun. Meanwhile the president of the ultra-conservative American Farm Bureau Federation was even quoted recently saying, “the public will no longer support direct payments to farmers.”

On the surface, all this sounds promising to those in the food movement who see government subsidies for commodity farmers as a systematic way to keep industrial and highly processed food cheap and plentiful. But in truth, headlines like these (which have been especially plentiful since the Senate Ag Committee began convening hearings and holding public meetings a month ago in an effort to draft the 2012 Farm Bill) speak more to the shifting rhetoric behind farm subsidies than they do to any real change in the big picture of American farming.

As we’ve discussed here on Grist, “direct payments” to farmers (i.e. subsidies farmers have collected based on historical production, regardless of commodity prices) are indeed going away. But they’re being replaced by another subsidy — government-supported crop insurance. And while “crop insurance” certainly sounds innocent enough, the term is being stretched beyond its traditional meaning. Like the name implies, some crop insurance does cover disaster relief, but the latest form also “insures” (mostly large) farms against revenue loss [PDF]. In other words, even a 5-10 percent revenue loss (due to weather or not), will be made up for with taxpayer dollars. And for the most part, we’re not talking small family farms or farms that grow fruits and vegetables, either.

As the Environmental Working Group researchers wrote in a November 2011 report (linked above):

Over 80 percent of “crop” insurance policies now insure business income even if there is no yield loss caused by weather. This has doubled the cost to taxpayers and opened the door for large payments to producers who suffer only paper losses, and for windfall profits for insurance companies.

In other words, Big Ag has a backup plan, and it might even work out better for them than the current setup, because direct payments were tied to conservation efforts. (You only received a check if you could prove you were either practicing “on-farm conservation” or setting aside a portion of your land not to be farmed). Crop insurance, on the other hand, has no conservation strings attached.

On Friday, the Environmental Working Group pointed to another controversial downside to crop insurance: the enormous amount of taxpayer dollars going to the insurance companies that administer it.

According to this chart [PDF], we’ve paid $7.1 billion to a long list of insurance companies between 2007 and 2011. Furthermore, many of these companies are based outside the U.S, including the Switzerland-based ACE Limited (who received $1.5 billion), Australia-based QBE Insurance Group (which brought in $830 million), and Bermuda-based Endurance Specialty Holdings Limited ($450 million).

As Scott Faber, EWG’s vice president for government affairs, puts it: “More and more tax dollars are flowing to foreign insurance companies and away from farmers, working families, and the environment. These insurance subsidies are being provided with no strings attached to the largest and most profitable farm operators and foreign insurance companies.”

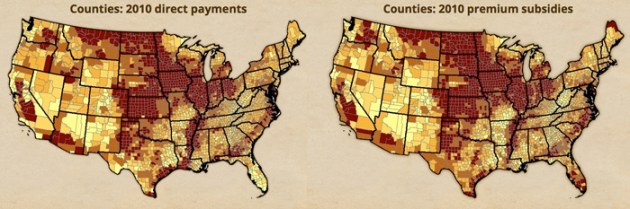

What I found most telling about EWG’s latest research isn’t the fact that so much of the money we’re spending to “help farmers” is leaving our shores. (How much of the money made by American companies actually stays here anymore anyway?) It was a set of maps that appeared in EWG’s media briefing on Friday. One shows the recipients of direct payments in 2010 (the darker the color, the more government money received) and the other shows the distribution of crop insurance payments in the same year.

Maps courtesy of The Environmental Working Group.

So there you have it, a visual reminder of what a difference this new focus on “crop insurance” over direct payments is likely to have.

Of course, there is still a great deal of speculation about whether this Congress will be able to agree on a bill before we move full swing into election season. Failure to pass the 2012 bill before the 2008 Farm Bill expires could cause the bill to revert to the 1949 version. But we’ll have more on that here on Grist next week, so stay tuned.