The top execs at Monsanto Corp. must be running around HQ these days like director James Cameron post-Titanic, screaming “We’re king of the world!” It’s an understandable reaction. Between a likely Supreme Court win, the recently passed Monsanto Protection Act, and the company’s victory over a government antitrust investigation, the company has been on quite a winning streak.

Odd, then, to remember that less than three years ago, CNBC’s stock market “analyst” Jim Cramer declared that Monsanto’s was “the worst stock of 2010.” This came just before Forbes magazine all but withdrew its 2010 accolade that Monsanto was “company of the year.”

Monsanto had all the hallmarks of a troubled company. Its net income dropped nearly by half in 2010. By October, its stock dropped by almost that much. But those were just the most obvious indicators.

While it’s true that, even at the time, the company dominated the seed industry — 85 percent of all corn planted in the U.S. that year contained Monsanto’s patented genetically modified traits, as did 92 percent of soy — its products were taking a beating both in the fields and in the mainstream press. Word spread of the rise of superweeds that were immune to Monsanto’s pesticides, while farmers complained that Monsanto’s new SmartStax seeds were overpriced and no more effective than the old. At the same time, its flagship Roundup Ready product was about to go “off-patent,” and analysts were expecting a flood of “generic” (and much cheaper) pesticide-resistant seeds on the market.

As if that weren’t enough, Monsanto was locked in a multi-year legal battle with one of its top competitors — DuPont. It was a battle that some analysts thought could topple Monsanto from its perch atop the biotech seed pyramid. Anti-Monsanto activists even looked at DuPont as a potential ally, since it had filed an antitrust lawsuit against its sworn enemy as part of the fight. Then the government got into the act when it initiated its own antitrust investigation that threatened Monsanto’s core business. Oh, how the mighty had fallen!

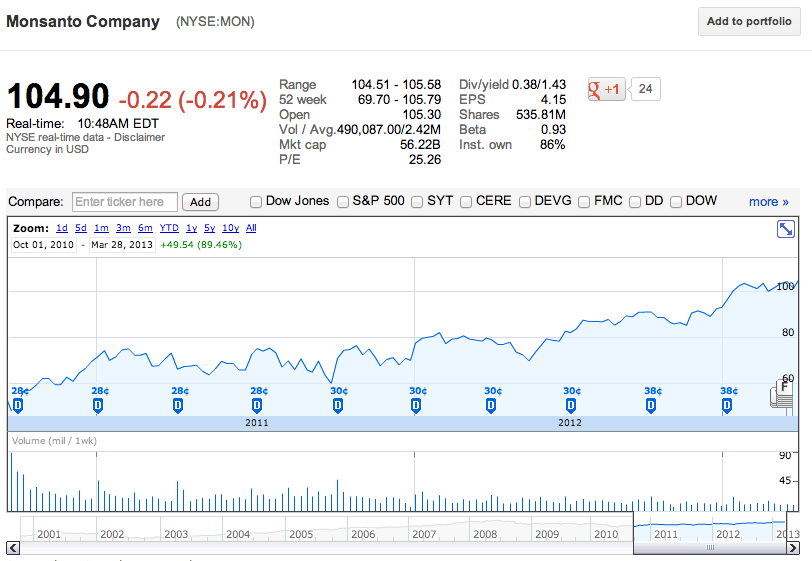

Fast forward to today. Monsanto Ascendant. Here’s a stock chart that runs from Oct. 8, 2010, to today.

Had you bought Monsanto stock the day you read about Monsanto’s troubles, you would have more than doubled your money — and tripled the return of the S&P 500 in the same period.

Well, the antitrust investigation disappeared in a puff of bureaucratic smoke — mostly because there’s nothing illegal about massive consolidation and control of an industry if the government can’t find compelling evidence that consumers were harmed. (For those that are interested in going deep into the antitrust superweeds, I explained how this came to be in a recent post.) Ergo, Monsanto isn’t about to be dismantled by the feds.

Meanwhile, the company’s sales recovered impressively. Its 2012 earnings statement shows that its net income doubled since 2010 and now exceeds $2 billion. Sales were driven by record high corn plantings in 2012 — thanks to sky-high demand from both corn ethanol and livestock feed. Never mind that the drought destroyed a good chunk of that year’s crop — no refunds!! (It’s worth noting that Monsanto claimed its seeds outperformed the average yield during the drought year. And with news that farmers will plant even more corn this year — the most since 1936 — Monsanto’s sales will continue to grow.)

As for the other threats to Monsanto’s business, according to this article from Harvest Public Media, it looks like Monsanto has successfully engineered its seeds so that the whole generic biotech seed market will wither and die before it’s fully flowered. This is helped in some part by a Monsanto-related patent case that’s currently before the U.S. Supreme Court. The Justices seem to be favoring the company over the farmer accused of violating the company’s patents by “illegally” saving seeds.

For its part, the U.S. Department of Agriculture seems happy to do Monsanto’s bidding. From giving approval to its GMO alfalfa seed — despite the fact that many organic farming advocates complained that it could put them out of business — to allowing farmers to plant Monsanto’s GMO sugar beets in violation of a court order, the agency seems to agree that what’s good for Monsanto is good for American farmers.

Then there’s the so-called “Monsanto Protection Act,” snuck into the recent federal government’s funding bill, that allows the USDA to override any judge who tells Monsanto it’s not allowed to spread its genetically modified seeds around. It may not have given the company protections that it doesn’t already enjoy from a compliant USDA — and Politico reports that Secretary of Agriculture Tom Vilsack thinks the provision might be unenforceable — but it certainly demonstrates the company’s continued power on Capitol Hill.

Surely if the regulatory and legal processes have failed, a little competition will keep this monster in check, right? What about that titanic struggle between the two biotech giants, Monsanto and DuPont? The one that could knock Monsanto off its perch? Yeah, well, the two companies just kissed and made up. Not only did they drop all the lawsuits, counter-suits, and patent claims, but they also entered into a broad licensing agreement that will allow Monsanto to use DuPont’s genetic modifications in its seeds and vice versa. One of the last stumbling blocks Monsanto faced is now gone.

The upshot is that its genetically modified seeds will gain the ability to withstand repeated exposure to a broader range of herbicides, increasing agricultural chemical use and encouraging farmers to continue planting vast acreages of corn.

Of course, Monsanto’s success is also predicated on a high price of corn — since that justifies the higher cost of the seed and the higher cost of using additional herbicides to combat superweeds. But if this year’s corn harvest comes in as a bumper crop, corn prices are likely to drop, possibly precipitously — there are even early indications that the boom may be ending and prices are returning to earth.

If the recent price drop continues, we’ll soon see if Monsanto’s resurgence is a permanent boom or just an extreme-climate-driven bump. Groups like Food Democracy Now! are hoping for the latter, and are currently pushing back at Monsanto’s powers with demonstrations and petitions. Whatever happens, the company has demonstrated an Energizer Bunny-like resilience. That may make investors happy. But it should make anyone interested in a sustainable agricultural system very, very sad.