Life these days is expensive. The lingering effects of the pandemic, Russia’s invasion of Ukraine, higher fuel and energy prices, and extreme weather shocks throttling the supply chain have conspired to make many everyday necessities much less affordable. Rising food costs in particular have become a source of financial stress for millions of U.S. households. Though overall inflation has cooled from a record peak in 2022, food prices increased nearly a quarter over the last four years and are expected to continue to climb.

So far this year, Americans have faced a nationwide bird flu outbreak, propelling the cost of eggs to record levels, while rising temperatures and erratic rainfall across Western Africa are escalating chocolate prices to new highs. Years of drought in the U.S. have also contributed to historically low levels of cattle inventories, hiking up beef prices. The result is skyrocketing supermarket bills, tighter household budgets, and dwindling access to food.

President Donald Trump’s latest trade decisions aren’t likely to help the situation. Amid a flood of announcements about federal funding freezes, food program terminations, and mass government layoffs, the president has been issuing on-again, off-again sanctions aimed at the United States’ biggest trading partners. In the span of a single week, he enacted blanket tariffs against goods from Mexico, Canada, and China, exempted some products under the United States-Mexico-Canada trade agreement, and then doubled tariffs on China before threatening a new set of taxes on Canadian products. On Tuesday, he ordered his administration to double duties on Canadian steel and aluminum imports, which he subsequently walked back to 25 percent before those snapped into effect Wednesday morning, prompting immediate retaliation levies from Canada and the European Union.

The pendulum-like nature of Trump’s trade policies, economists told Grist, almost certainly means higher grocery store prices. It has already spooked financial markets and prompted major retailers like Target’s CEO Brian Cornell to warn that if some of the promised tariffs go into effect, customers could see sticker shock for fresh produce “within days.”

“When it comes to extreme weather shocks, which are destroying our supply chains, climate change is increasing prices and creating food inflation,” said Seungki Lee, an agricultural economist at Ohio State University. If policymakers don’t fully account for that by adjusting trade policies, he said, then to some degree, “we will see the compounding impacts of tariffs and climate change-related shocks on the supply chain.”

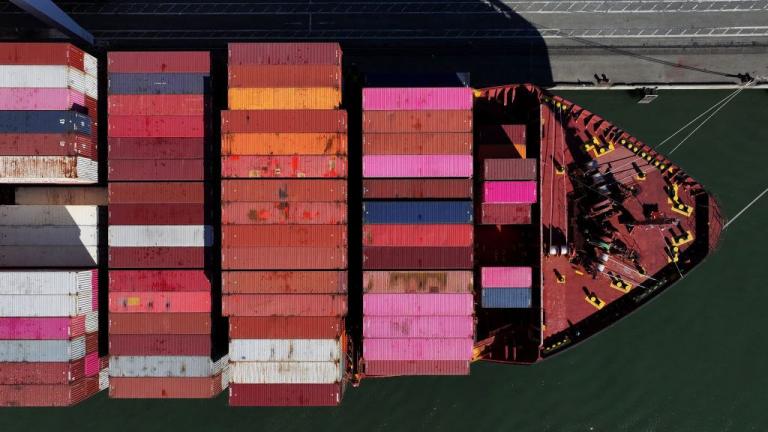

Tariffs, or taxes charged on goods imported from other countries, are typically a negotiation tactic waged by governments in a game of international trade, with consumers and producers caught in the crosshairs. When goods enter a country, tariffs are calculated as a percentage of their value and paid by the importer. The importer may then choose to pass on the cost to consumers, which, in the case of something like fresh fruit grown in Mexico, often ends up being everyday people. Given the extent of the United States’ dependence on Canada, Mexico, and China for agricultural trade, farmers, analysts, business leaders, policymakers, and the general public have all raised concerns over the effect of tariffs on grocery store prices and the possibility of trade wars slowing economic growth.

During the first Trump term, levies on China triggered retaliatory tariffs that decimated agricultural exports and commodity prices, costing the U.S. agricultural industry more than $27 billion, which the government then had to cover with subsidy payouts. To date, the U.S. has not fully recovered its loss in market share of soybean exports to China, its biggest agricultural export market. An analysis by the National Bureau of Economic Research, a nonprofit organization, found that the 2018 trade war with China was largely passed through as increases in U.S. prices, reducing consumers’ income by about $1.4 billion per month. Rural agricultural sectors in the Midwest and the mountain west were hit harder by China’s retaliatory tariffs than most others, the analysis found.

This time around, Trump appears to have doubled down on the tactic, though the demands and messaging of his tariff policy have remained wildly unpredictable, with economists dubbing the president an “agent of chaos and confusion.” All told, China, Canada, and Mexico supplied roughly 40 percent of the goods the U.S. imported last year. In 2023, Mexico alone was the source of about two-thirds of vegetables imported to the U.S., nearly half fruit and nut imports, and about 90 percent of avocados consumed nationwide.

Without factoring in any retaliatory tariffs, estimates suggest that the levies imposed by Trump last week could amount to an average tax increase of anywhere between $830 a year and $1,072 per U.S. household. “I’m a little nervous about the increase in tension,” said Lee. “It could lead to an immediate shock in supermarket prices.”

Canada and China have since responded with tariffs of their own. Canada’s tariffs imposed last week amounted to nearly $21 billion on U.S. goods, including orange juice, peanut butter, and coffee. China imposed 15 percent levies on wheat, corn, and chicken produced by U.S. farmers, in addition to 10 percent tariffs on products including soybeans, pork, beef, and fruit that went into effect on Monday. Meanwhile, Mexico planned to announce retaliatory tariffs but instead celebrated Trump’s decision to postpone. On Wednesday, in response to Trump’s steel and aluminum tariff hike, Canadian officials announced a second $20.7 billion wave of duties and the European Union declared it would begin retaliatory trade action next month for a range of U.S. industrial and farm goods that includes sugar, beef, eggs, poultry, peanut butter, and bourbon.

With Trump’s planned tariffs, Americans can expect to see fresh produce shipped from Mexico — such as tomatoes, strawberries, avocados, limes, mangos, and papayas, as well as types of tequila and beer — become more expensive. Other agricultural products sourced from Canada, including fertilizer, chocolate, canola oil, maple syrup, and pork are also likely to see cost hikes. New duties on potash, a key ingredient in fertilizer, and steel used in agricultural machinery coming from Canada could also indirectly elevate food prices. Many of these products, such as avocados, vegetable oils, cocoa, and mangoes, are already seeing surging price tags in part because of rising temperatures.

Though there’s no shortage of questions surrounding Trump’s tariff policy right now, James Sayre, an agricultural economist at the University of California, Davis, said that even this current state of international trade uncertainty will lead to a higher grocery cost burden for consumers.

“All of this uncertainty is really bad for businesses hoping to import, or establish new supply chains abroad, or for any large-scale investment,” said Sayre. “Just this degree of uncertainty will increase prices for consumers and reduce consumer choice at the supermarket … even more than tariffs themselves.”

All the while, climate change continues to fuel food inflation, leaving American consumers to foot the bill of a warming world and the cascading effects of an administration seemingly set on upending global trade relations.

“It is actually a little bit hard to anticipate what we can expect from the current administration when we are seeing the burden of food inflation by tariffs or trade, and also at the same time, we have climate-related shocks on the supply chain,” said Lee. “Hopefully we will not see an unexpected compounding effect by these two very different animals.”