The Sierra Club is joining activists from around the world to call on the World Bank to free us from fossil fuels and the landscapes of extraction, hidden conflict, and increasingly frequent natural disasters associated with their consumption.

Today, we join our international colleagues in a day of action that will flood the World Bank’s Facebook, Twitter, and Blog accounts with messages demanding a phase out of fossil fuel lending across the World Bank Group. We are demanding that the World Bank make good on its mandate to address poverty by embracing 21st century technologies and leave 19th century fuels in the ground.

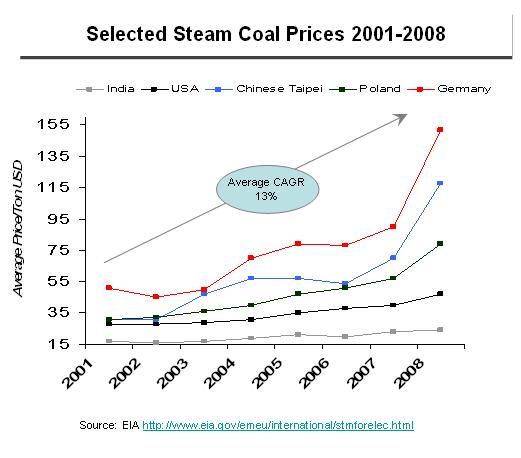

The world of energy has experience a sea change in recent years – fossil fuels are no longer cheap, and renewable energy is no longer expensive. In fact, the price of solar is dropping through the floor, and cheap wind power is replacing the need for costly new coal plants across the industrialized and developing world. Just look at the constant, and often dramatic, price increases in coal used to generate electricity across the world:

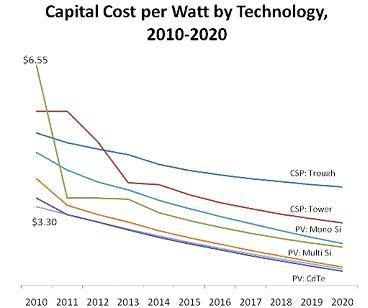

Now compare that to the future costs of renewable energy, particularly solar:

Source: Greentechmedia.com

These underlying economic fundamentals, innovation in business, and the creation of new financing opportunities are driving a revolution in rural electrification that, according to the International Energy Agency, will be largely powered by decentralized renewable energy.

Yet even as we stand on the cusp of this revolution, conventional ways of looking at energy poverty and rural electrification are allowing dinosaur industries to push their outdated technologies on dynamic emerging economies. These industries are casting a black fog over the next industrial revolution. For example, the U.S. coal industry has seen its domestic market share shrink drastically in recent years and is now seeking a new age of international coal trade in order to survive.

But coal is ill adapted to power the 21st century. As journalist Jeff Goodell put it in a recent interview, the coal industry is “perhaps the least entrepreneurial, most politically connected business in America.”

Kevin Parker, global head of asset management for Deutsche Bank, recently told the Washington Post that coal is “…a dead man walking. Banks won’t finance them. Insurance companies won’t insure them. The EPA is coming after them…and the economics to make it clean don’t work.”

It is hard to believe that an institution charged with alleviating global poverty would aid and abet an aging industry as it saddles dynamic emerging nations with its outdated wares. But with the disastrous $3.75 billion dollar loan for South Africa’s massive proposed Medupi coal plant fresh in our memories, and World Bank lending for coal reaching new record levels, the Bank has shown a willingness to tether the world to fossil fuels for years to come.

However, the World Bank now has the opportunity to turn skeptics into believers. It is drafting its energy sector strategy – a document that will chart the course of energy lending at the institution for the coming years. By phasing out fossil fuel lending across all agencies the Bank can send a strong signal that it is serious about cleaning up its act and moving its energy lending firmly into the 21st century.

There is strong support from world leaders for such a move, including a recent European Parliament resolution demonstrating a commitment to phase out fossil fuel lending at the World Bank Group. Following their lead will allow civil society to write a new chapter in both the Bank and the world’s history – one that promotes local energy economies and brings real development to those who need it – things that coal simply can’t deliver.

Take Action: Make sure the World Bank knows the world is watching.

To read a fact sheet on the World Bank’s coal lending and the energy strategy, go here (PDF).

Co-written by Justin Guay of the Sierra Club International Program.